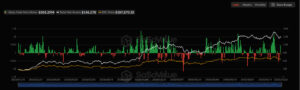

Despite increased volatility and global macroeconomic uncertainty in recent weeks, major funds’ interest in digital assets remains strong. Data released on October 22, 2025, revealed significant capital movements in U.S. spot Bitcoin and Ethereum ETFs.

While some investors took profits in the short term, institutional capital largely maintained long-term positions. During this period, Bitcoin ETFs recorded general outflows, but BlackRock’s ETF products stood out with strong inflows across both Bitcoin and Ethereum, diverging positively from the broader market trend.

Million-Dollar Outflows from Bitcoin ETFs

According to October 22 data, U.S. spot Bitcoin ETFs saw a net outflow of $101.29 million, reflecting cautious investor sentiment and profit-taking amid volatility. However, BlackRock’s IBIT fund recorded a net inflow of $73.63 million on the same day moving counter to the overall trend. IBIT has now achieved three consecutive weeks of positive inflows, maintaining its position as the only major fund expanding its market share.

BlackRock’s Impact on Ethereum ETFs Despite Outflows

A similar pattern was observed in Ethereum ETFs. On October 22, spot Ethereum ETFs recorded a total net outflow of $18.77 million. However, BlackRock’s ETHA fund stood out as a remarkable exception, posting a net inflow of $111 million on the same day.

This performance made ETHA the ETF with the highest daily inflow across all crypto funds. According to analysts, the surge reflects BlackRock’s strong institutional client network and the growing interest in Ethereum’s tokenization and staking potential, both of which continue to drive long-term confidence in the asset.

BlackRock Aims for the Top in the ETF Race

Recent data shows that BlackRock’s ETF products have been delivering strong performance across the market. Both IBIT (Bitcoin ETF) and ETHA (Ethereum ETF) are among the few funds recording positive inflows on both fronts.

This trend reinforces BlackRock’s leadership in the crypto ETF space, strengthening its reputation as a trusted institution among large-scale investors.

Market Sentiment Turns Cautious But BlackRock Stands Firm

The October 22, 2025 ETF data reveals a cautious stance among investors in the crypto market. Despite the overall net outflows across funds, BlackRock’s IBIT and ETHA stood out with consistent inflows, signaling institutional confidence.

According to analysts, this demonstrates that investors still view Bitcoin and Ethereum as long-term institutional-grade assets, even amid short-term volatility.

The direction of future fund flows will likely become one of the key indicators of market sentiment in the coming days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.