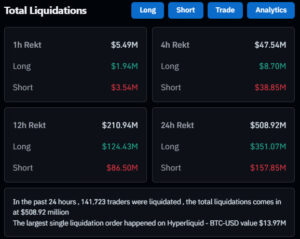

The crypto markets have been shaken once again. In the past 24 hours, a total of $351 million in long positions have been forcibly liquidated. This unexpected wave was driven by the recent surge in volatility across digital asset markets and the aggressive use of leverage.

Sudden price swings triggered automatic liquidations, particularly among high-risk traders chasing short-term profits. According to experts, this event once again highlights that leveraged trading remains one of the weakest points in the crypto market. The rise in liquidation volume is also seen as part of the market’s natural process of flushing out overheated positions and restoring balance.

Leveraged Trading Leads to Heavy Losses

Most of the liquidations over the past 24 hours affected highly leveraged traders. After sharp price corrections, automatic liquidation mechanisms were triggered, closing a significant portion of long positions opened with profit expectations. This once again demonstrates how aggressive trading strategies can lead to massive losses in a short period of time.

According to experts, the spike in liquidation volume is a natural outcome of rising leverage levels in futures markets. When traders fail to meet margin requirements, positions are automatically closed a process that acts as a “balancing mechanism” for the system during periods of high volatility.

Bitcoin and Ethereum Under Pressure

Following the liquidation wave, Bitcoin (BTC) fell by 3.5% intraday, dropping to around $107,800. Ethereum (ETH) also faced selling pressure, retreating from above $3,950 to around $3,870.

Experts suggest that these declines stem from short-term corrections caused by the unwinding of highly leveraged positions. However, technical indicators show that as long as Bitcoin remains above the $100,000 threshold, its structural trend remains positive.

Volatility Persists, Leveraged Positions at Risk

The $351 million liquidation of long positions within 24 hours once again highlighted how sensitive the crypto market is to short-term volatility. Many investors, aiming for high profits through leveraged trading, faced sudden liquidation waves as the market direction shifted unexpectedly.

According to experts, similar liquidation events may continue in the coming days. Traders are advised to reduce leverage ratios, act cautiously, and implement protective strategies during volatile market conditions to manage risk more effectively.