A significant development has occurred in the crypto markets. Fidelity Investments, one of the world’s largest asset managers, is now allowing its U.S. brokerage customers to purchase Solana (SOL) tokens. The company’s digital assets division, Fidelity Digital Assets, has officially launched custody and trading support for Solana with this move. This decision demonstrates that Fidelity, which manages over $4 trillion in assets, is further advancing institutional adoption of the blockchain ecosystem.

Fidelity Digital Assets Makes a Move on Solana

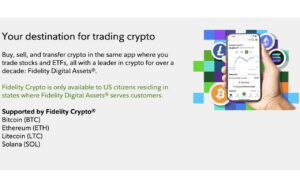

Fidelity Digital Assets has expanded its digital asset offerings beyond Bitcoin (BTC) and Ethereum (ETH) by announcing support for Solana. Under the new support, Fidelity’s U.S. brokerage customers will now be able to directly buy and sell SOL and utilize custody services.

This integration highlights the growing interest of the traditional finance (TradFi) world in high-performance blockchains like Solana.

Institutional Adoption Strengthens

The market reacted positively following Fidelity’s announcement. The price of SOL surged nearly 5% in a short period, climbing to around $190. This movement reflects investors’ expectations of increased institutional access. Analysts anticipate a rise in demand for Solana in the short term and expect this development to intensify the Ethereum-Solana competition in the long run.

Fidelity’s move enables institutional investors to securely access the Solana ecosystem. This allows major funds, asset managers, and financial institutions to directly participate in DeFi, staking, and NFT projects on the Solana network. According to experts, this development will boost liquidity on the Solana network, supporting both price stability and ecosystem growth.

Regulatory Framework and Outlook

Although Fidelity’s step is significant for crypto adoption, regulatory uncertainties with the U.S. Securities and Exchange Commission (SEC) persist. Experts note that future approval processes for Solana ETFs or other institutional products may be influenced by this decision. Nevertheless, the overall picture indicates that the trend of institutionalization in crypto assets is accelerating. Fidelity’s decision is viewed as a strategic step that advances both investor confidence and institutional adoption.

Fidelity’s support for Solana trading strengthens the bridge between institutional capital and the DeFi ecosystem in the blockchain world. This move demonstrates that Solana is not only a technology platform but also a reliable investment vehicle at the institutional level. While short-term price impacts are being observed, in the long term, this development is regarded as the beginning of Solana’s broader institutional adoption process.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.