Fund flows remain at the center of attention in the crypto markets. In recent days, the divergence between Ethereum and Bitcoin spot ETFs has begun to reshape investor behavior. According to analysts, the market has entered a period of notable divergence, with risk-averse investors shifting toward Bitcoin in the short term.

Three Consecutive Days of Outflows from Ethereum Spot ETFs

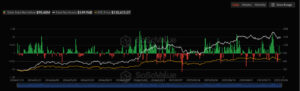

As of October 24, 2025, Ethereum ETFs recorded a total net outflow of $93.6 million, marking the third consecutive day of withdrawals one of the strongest waves of selling observed in recent weeks. Market experts attribute this trend to several factors. The recent volatility in Ethereum’s price has led short-term investors to reduce their exposure, while ongoing regulatory uncertainty in the U.S. and tight monetary policies from central banks have accelerated the flight from riskier assets.

However, analysts suggest this trend may be temporary, and capital inflows could resume depending on the broader market recovery and improved investor sentiment toward Ethereum.

Strong Inflow Wave into Bitcoin Spot ETFs

In contrast to the outflows seen in Ethereum funds, Bitcoin ETFs recorded strong net inflows on the same day. On October 24, Bitcoin ETFs saw a total inflow of $90.6 million, with no outflows reported across twelve different funds.

This trend highlights that investors continue to view Bitcoin as a safer and more stable asset during periods of short-term uncertainty. According to analysts, institutional investors in particular are showing a growing tendency to increase Bitcoin’s weight in their long-term portfolios, reinforcing its role as the preferred store of value in the current market environment.

Expert Market Assessment

Crypto analysts interpret the divergent fund movements between Ethereum and Bitcoin ETFs as part of a natural market rotation process. While risk-averse investors are shifting toward Bitcoin, more aggressive traders are exiting Ethereum positions in the short term to capitalize on new opportunities.

From a macroeconomic perspective, ongoing interest rate policy uncertainties and factors like the U.S. election cycle are contributing to imbalances in crypto fund flows. Despite these fluctuations, the overall market trend remains upward, indicating sustained long-term growth potential for digital assets.

Overall Outlook

Data from October 24, 2025, reveals a clear directional shift in crypto fund flows:

- Ethereum Spot ETFs: $93.6 million in net outflows

- Bitcoin Spot ETFs: $90.6 million in net inflows

This pattern shows that investors are seeking short-term safety in Bitcoin, while profit-taking and risk reduction strategies dominate the Ethereum side.

Experts believe that the direction of fund flows in the coming weeks will play a crucial role in determining the broader crypto market trend. If Bitcoin inflows continue at this pace, analysts anticipate a new ETF-driven bullish wave could emerge before the end of 2025.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.