Hyperliquid’s native token HYPE briefly surged to $98 on the Ethereum Layer-2 futures exchange Lighter. However, the exchange later clarified that the spike was caused by bot activity and subsequently removed the data from its charts. The incident has sparked intense debate surrounding DeFi transparency and the principles of decentralization.

HYPE Price Spikes to $98 on Lighter

On the morning of October 27, an unexpected event on the Lighter exchange caught the crypto community’s attention. The HYPE token skyrocketed from $48 to $98 within minutes, effectively doubling in value. The sharp movement appeared on charts as a long green candle and quickly went viral across social media.

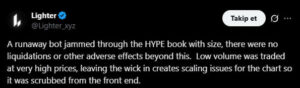

However, the Lighter team clarified that the sudden surge was not a genuine market movement, but rather the result of a malfunctioning trading bot. The team confirmed the issue, stating:

“A rogue bot misinterpreted the size of the HYPE order book.”

This explanation confirmed that the dramatic price spike was caused by an automated trading error, not organic market demand.

Removal of the Wick Sparks Backlash

The Lighter team removed the $98 “wick” from its user interface charts. While some users viewed this as a reasonable visual correction, others criticized it as “historical censorship.”

Another wave of criticism within the community described the move as an attempt to “erase history.” The account Hyperliquid Daily commented:

“Removing the wick from the front end means acting as if it never happened. That undermines the platform’s data integrity.”

HYPE Price Stabilizes Again

Following the incident, the HYPE price returned to around $47.8. The current Lighter charts no longer show the $98 wick, now reflecting a more stable market trend.

However, community debate continues. Some investors believe this event has damaged trust in Lighter, while others see it as a potential turning point toward a stronger transparency policy.

Assessment

The sudden price spike in Hyperliquid’s HYPE token was more than just a technical glitch — it underscored how fragile the balance between transparency, trust, and decentralization remains within the DeFi sector. Although the Lighter team described its response as a “user-friendly adjustment,” much of the community viewed the move as data manipulation. For many, the removal of historical price information raised concerns about data integrity and censorship within decentralized platforms.

In the coming days, it will become clearer how this incident affects Lighter’s long-term credibility and how it resonates across the broader DeFi market, which continues to grapple with the tension between usability and full transparency.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.