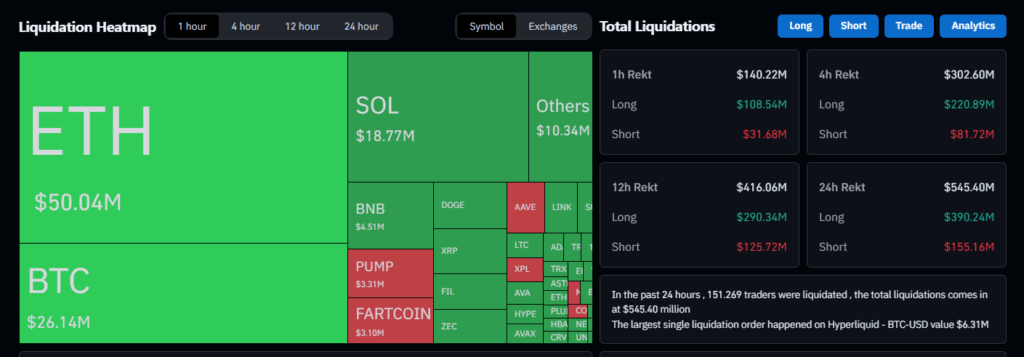

The crypto market experienced a massive wave of liquidations over the past 24 hours. According to CoinGlass data, a total of $545.4 million worth of long and short positions were liquidated. During this period, 151,269 traders were affected.

The largest single liquidation occurred on the Hyperliquid exchange in the BTC-USD pair, amounting to $6.31 million. This data highlights once again the risks associated with high-leverage trading in the Bitcoin market.

Ethereum and Bitcoin Lead Liquidations

Ethereum (ETH) positions saw $50.04 million in liquidations, while Bitcoin (BTC) positions accounted for $26.14 million. These two major cryptocurrencies made up the bulk of total liquidations. Additionally, Solana (SOL) recorded $18.77 million, and BNB had $4.51 million in liquidations, drawing attention in the market.

Crypto liquidation data shows that the market is vulnerable to sudden price movements. Leveraged trades in the altcoin market, in particular, have contributed significantly to these liquidations.

Long Positions Under Pressure

The liquidation ratio in long positions reached 73%. In the last four hours, $302.61 million was liquidated, with $220.89 million coming from long positions and $81.72 million from short positions. This indicates that price corrections are primarily targeting leveraged long positions.

A “long squeeze” effect has been observed among investors, and some market analysts suggest this may result in a short-term consolidation in Bitcoin prices.

Hyperliquid and Bybit Top Exchanges in Liquidations

The largest liquidation volumes among exchanges were observed on Hyperliquid:

-

Hyperliquid: $128.68M → 54.7% short-heavy

-

Bybit: $59.43M → 97.1% long-heavy

-

Binance: $56.13M → 92.6% long-heavy

-

Gate.io: $23.97M → 97.1% long-heavy

-

OKX: $23.02M → 86.9% long-heavy

The short-heavy position on Hyperliquid suggests that traders on this platform use different leverage strategies, while the long-heavy positions on Bybit and Binance indicate a market sentiment primarily driven by bullish expectations.

What Do Crypto Liquidation Data Mean?

According to CoinGlass liquidation maps, this recent massive wave of liquidations shows that the market is being cleared of excessive leverage. Such movements usually signal that the market is seeking balance after short-term corrections.

Experts note that crypto liquidation data is an important indicator for investors, reflecting the market’s “cleanup” phase. However, as long as leveraged trading continues, the risk of liquidation remains.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.