As of October 29, both Bitcoin and Ethereum spot ETFs experienced a quiet trading day. Affected by overall market volatility, ETF investors remained cautious throughout the day, showing hesitation to open new positions.

Analysts note that low trading volumes and limited market movements are linked to short-term profit-taking and broader macroeconomic uncertainty. In particular, expectations around U.S. interest rate policy and the strengthening U.S. dollar index are seen as key factors weighing on risk appetite within the ETF market.

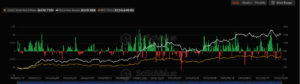

Sharp Net Outflows from Spot Bitcoin ETFs

During a period of heightened volatility in the crypto markets, spot Bitcoin ETFs saw net outflows totaling $470.71 million, signaling a decline in investor sentiment.

All 12 U.S.-listed spot Bitcoin ETFs recorded net outflows on the same day, marking one of the broadest withdrawal events since July 2024.

Analysts attribute this downturn to factors such as uncertainty surrounding the Federal Reserve’s interest rate policy, the strengthening U.S. dollar, and short-term profit-taking in crypto assets all contributing to the current pressure on digital asset markets.

Quiet Day in the Ethereum ETF Market

The situation was similar on the Ethereum side. As of October 29, spot Ethereum ETFs reported a total of $81.44 million in net outflows. Analysts note that investors have shown an increasing tendency to withdraw funds, largely due to Ethereum’s weak price performance in recent weeks.

However, BlackRock’s ETHA fund stood out as the only product with a positive inflow on the day, recording a small net gain. This suggests that some institutional investors continue to maintain long-term strategic positions in the Ethereum ecosystem, despite short-term market weakness.

Market Reaction: Bitcoin and Ethereum Prices Under Pressure

As overall trading volumes weaken, investors have shifted their focus back to U.S. macroeconomic data and ETF fund flow reports. According to analysts, while the recent outflows may create short-term pressure, the overall trend in the ETF market remains strong with over $14 billion in net inflows recorded into spot Bitcoin ETFs since the beginning of the year.

As of October 29, the latest outflows reflect a temporary decline in investor risk appetite. However, both Bitcoin and Ethereum ETFs still maintain a net positive inflow balance for the year. Experts emphasize that these fund outflows are unlikely to alter the long-term investment trend, viewing them instead as a natural phase of market consolidation following months of strong institutional participation.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.