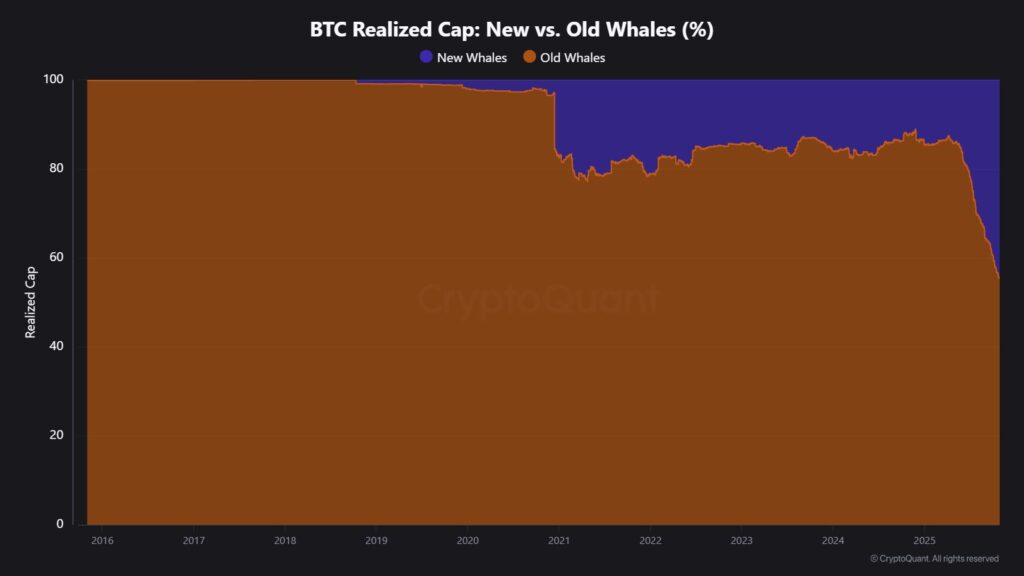

A new wave of Bitcoin whales is changing the market landscape. According to on-chain data, new Bitcoin whales now control 45% of the total Whale Realized Cap, marking a major generational shift among the largest holders.

At the end of October 2024, Bitcoin’s price dropped below $112,788, pushing these new holders into losses for the first time in a year. This transition raises questions about whether they can withstand market pressure as older whales offload holdings.

Whale Realized Cap Signals a Power Shift

The Realized Cap measures Bitcoin’s total value based on the last on-chain transaction price for each coin. The Whale Realized Cap reflects the capital invested by large holders owning over 1,000 BTC.

Data from CryptoQuant shows that new whales’ share of the realized cap has risen sharply. However, for the first time since October 2023, these new whales now have a negative Unrealized Profit Ratio — meaning their average entry price of $112,788 is higher than the current BTC price of $110,196.

Meanwhile, older whales who accumulated Bitcoin at lower prices remain profitable, giving them greater resilience during downtrends and potentially adding selling pressure if new whales panic.

Selling Pressure and Market Psychology

This ongoing distribution from old whales to new whales could intensify selling pressure if sentiment weakens further. Historically, such transitions — where experienced holders sell to newer investors — have preceded deeper market corrections.

Open Interest across futures markets has declined, signaling weaker trader confidence. Lower participation means reduced volatility in the short term but also indicates uncertainty among investors about BTC’s near-term direction.

If new whales start selling to cut losses, Bitcoin could face additional downside. Conversely, if they hold through current levels, the market might find stability soon.

What to Watch Next

Analysts highlight three key signals to monitor:

-

New whale behavior — large sell-offs could push BTC below $100,000.

-

Long-term holder activity — renewed accumulation could stabilize the market.

-

Futures Open Interest — a rebound could mark a short-term recovery trend.

The next few weeks will reveal whether this new generation of whales has the same conviction as their predecessors — a factor that could shape Bitcoin’s trajectory into 2025.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.