In the third quarter of 2025, Coinbase purchased 2,772 Bitcoin (BTC), bringing its total holdings to 14,548 BTC. At current market prices, the company’s Bitcoin holdings are valued at approximately $300.7 million. This consistent and disciplined accumulation strategy highlights Coinbase’s strong long-term confidence in Bitcoin, despite ongoing short-term market volatility.

Brian Armstrong: “Coinbase Has Long-Term Confidence in Bitcoin”

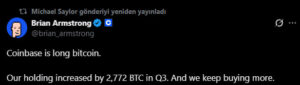

Coinbase CEO Brian Armstrong shared the company’s position on the social media platform X (formerly Twitter), stating:

“Coinbase is investing in Bitcoin for the long term. Our Bitcoin holdings increased by 2,772 BTC in the third quarter and we’re continuing to buy.”

This announcement highlights that Coinbase is no longer just a trading platform — it has become an active Bitcoin accumulator. The company’s approach is being interpreted as a corporate-level digital reserve strategy, especially at a time when Federal Reserve interest rate policies continue to create uncertainty in traditional markets.

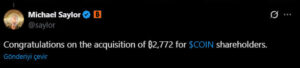

MicroStrategy founder and Bitcoin advocate Michael Saylor responded to Coinbase’s disclosure on X, stating:

“Congratulations to Coinbase shareholders for acquiring an additional 2,772 Bitcoin.”

Saylor’s comment sparked widespread discussion across the crypto community. Many analysts view this exchange as symbolic of a broader institutional evolution — Coinbase is now seen not just as a crypto exchange, but as a long-term Bitcoin investor and strategic holder.

Steady Accumulation Strategy: Dollar-Cost Averaging (DCA)

In recent months, Coinbase has adopted a dollar-cost averaging (DCA) strategy, consistently purchasing Bitcoin on a weekly basis. This approach aims to reduce the impact of price volatility while building a stable, long-term accumulation plan.

According to analysts, Coinbase’s method reflects a “digital HODL policy” within the institutional investment landscape. This marks a shift away from a purely fee-based revenue model toward a strategy focused on long-term financial resilience backed by crypto reserves.

Quarterly Results Exceed Expectations

During the same quarter, Coinbase reported $1.87 billion in revenue, surpassing market expectations of $1.8 billion. The company’s net income also strengthened, driven by increased staking revenue and a surge in institutional trading volumes.

Another major contributor to this growth was the expansion of Coinbase Prime, one of the firm’s flagship institutional platforms. Coinbase Prime has become increasingly popular among funds and banks, offering secure digital asset custody and execution services, further reinforcing Coinbase’s position as a leader in institutional crypto finance.

What Does Coinbase’s Bitcoin Strategy Mean?

According to analysts, Coinbase’s third-quarter Bitcoin purchases are a clear signal of the company’s long-term financial reserve strategy.

This move not only reaffirms confidence in the crypto market, but also solidifies Coinbase’s position as a leading financial institution within the broader blockchain ecosystem.

Glassnode data shows that Coinbase’s Bitcoin holdings now exceed those of many institutional funds and hedge firms. This development positions Coinbase not merely as a crypto exchange, but as a strategic financial entity holding significant Bitcoin reserves effectively bridging the gap between traditional finance and the digital asset economy.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.