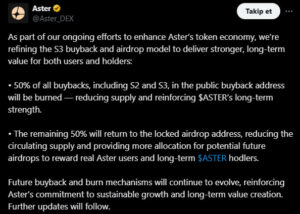

The blockchain project Aster has announced a new token buyback and burn plan aimed at creating a more sustainable token economy and increasing long-term investor value. The company emphasized that this strategy is designed to build a more stable price structure within the Aster ecosystem while establishing a deflationary model. According to the statement, Aster will permanently burn 50% of all repurchased tokens, a move expected to reduce total supply and support long-term value growth for the ASTER token.

A Supply-Reducing Model: “Half of All Buybacks Will Be Burned”

Aster’s new approach focuses on strengthening both community support and investor confidence. The project team announced that 50% of the tokens accumulated in public buyback addresses, including those from the S2 and S3 phases, will be burned.

This burn mechanism is designed to reduce circulating supply, increasing scarcity and potentially applying upward pressure on the token’s price. Such models are often referred to in the crypto market as “value protection policies”, signaling a commitment to long-term ecosystem sustainability.

The Remaining 50% Will Go to Long-Term Holders

Aside from the burned tokens, the remaining 50% will be transferred to a locked airdrop address. These tokens will not be released into circulation; instead, they will be distributed in the future as rewards for contributors to the Aster ecosystem and long-term investors.

This system is designed to both reduce circulating supply and establish a loyalty-based reward structure within the Aster community. By rewarding long-term holders, Aster aims to reinforce the project’s foundation with a committed and sustainable user base.

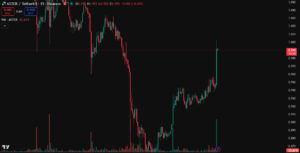

Price Activity Following the Announcement

After the announcement, the ASTER token experienced notable price volatility. Investors began taking positions in anticipation of reduced supply, leading to a sharp increase in trading volume. According to market data, Aster’s trading volume more than doubled within a few hours of the news.

Analysts note that although such supply-reducing measures can cause short-term volatility, they tend to support price stability and value appreciation over the medium to long term. Aster’s decision not only reduces token supply but also underscores its commitment to sustainable ecosystem growth. The combination of the burn and airdrop models signals the project’s transition toward a value-driven economic framework.

Sustainability and Long-Term Value Creation

Aster stated that its buyback and burn model will continue to evolve over time, contributing to the long-term sustainable growth of the ecosystem. The project team confirmed that it is already working on more flexible and dynamic burn policies for the future.

This strategy is seen as a major milestone in establishing a deflationary economic model while enhancing the project’s overall value. According to experts, Aster’s initiative has the potential to restore long-term investor confidence and strengthen its market position within the blockchain industry.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.