The decentralized cryptocurrency exchange dYdX has announced plans to officially enter the U.S. market by the end of 2025 and launch its spot trading products. This development marks the first strategic move by one of the largest derivatives platforms in the DeFi world to step into the U.S. regulatory environment.

Entry into the U.S. Market: Part of a Strategic Roadmap

According to a report by Reuters, dYdX CEO Eddie Zhang stated that the company’s U.S. expansion plan holds a key position in its long-term vision. Zhang said, “We plan to launch spot trading services in the U.S. by the end of this year, including major crypto assets such as Solana (SOL). The U.S. market will be a crucial turning point that defines our direction.”

According to the CEO, this move will be an important step toward accelerating dYdX’s global expansion strategy and reaching a more institutional user base. The exchange aims to adapt its decentralized trading infrastructure to the U.S. regulatory framework, bringing DeFi-based trading into alignment with the existing legal system.

Major Fee Reductions Coming

Alongside its U.S. launch, dYdX has announced a significant reduction in trading fees. CEO Eddie Zhang stated that the platform plans to cut fees nearly in half, lowering them to a range of 0.5%–0.65% in the new phase.

This move is part of dYdX’s strategy to offer competitive pricing for both retail and institutional investors, positioning itself more strongly against major U.S.-based competitors such as Coinbase, Kraken, and Binance.US.

“For our U.S. launch, we will offer more attractive trading conditions for our users. This is not just a new market entry — it’s a milestone for the maturation of the global DeFi economy.”

— Eddie Zhang, CEO of dYdX

Perpetual Futures Excluded for Now

Due to strict regulations in the United States, dYdX will not initially offer perpetual futures products. Zhang noted that if regulatory agencies establish clearer rules in the future, the exchange plans to introduce these products to the U.S. market as well. In the meantime, dYdX will focus on spot trading, liquidity depth, and user experience.

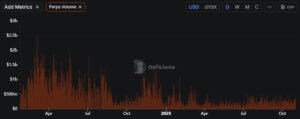

Since its launch in 2019, dYdX has surpassed $1.5 trillion in total trading volume. According to DeFiLlama, the platform processed $8 billion in perpetual contract volume over the past 30 days, making it one of the largest decentralized derivatives exchanges in the world. Experts agree that entering the U.S. market will enhance dYdX’s brand recognition and pave the way for greater institutional participation in the DeFi ecosystem.

Overall Assessment: dYdX Opens the Door to DeFi in the U.S.

dYdX’s decision to enter the U.S. market is seen as the beginning of a new era for decentralized exchanges. With the introduction of its spot trading services, the exchange aims to establish a structure that appeals to both retail and institutional investors.

Once the compliance process with U.S. regulations is completed, dYdX is expected to strengthen the bridge between DeFi and traditional finance. This move is being regarded as a historic milestone for the maturation of the decentralized finance sector in the final quarter of 2025.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.