As the week draws to a close, the cryptocurrency market has come under renewed selling pressure. The total market capitalization fell by 3%, with over $400 million in liquidations led by Bitcoin and Ethereum in the past 24 hours. Investor sentiment has weakened, and altcoins have experienced steeper declines than Bitcoin.

Fed’s Rate Cut Comments Shocked the Market

The main driver behind the November 3 sell-off was the latest round of comments from the U.S. Federal Reserve (Fed). Fed Chair Jerome Powell stated that following October’s 25 basis point rate cut, another cut in December was “not certain.” His cautious tone strengthened the U.S. dollar and increased pressure on risk assets.

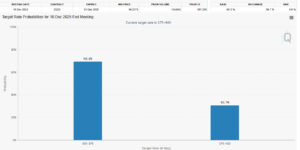

Additionally, U.S. Treasury Secretary Scott Bessent remarked that the tight monetary policy has already slowed the economy, leaving “little room for further cuts.” These remarks dampened risk appetite among investors. According to CME FedWatch Tool data, the probability of another rate cut in December fell from 90% to 69.3%, fueling concerns that the Fed may take a more hawkish stance than previously expected.

Massive Outflows from Bitcoin ETFs

Another factor weighing on the market was the continued capital outflow from U.S. spot Bitcoin ETFs. In just one week, the funds saw net outflows of $780 million, with the largest redemptions coming from BlackRock, ARK Invest, and Fidelity.

Experts note that this trend signals institutional investors are reducing risk exposure and rebalancing portfolios. This selling pressure has intensified Bitcoin’s decline, while ETF-related outflows have added extra volatility to the market.

Cascade Liquidations Deepened the Sell-Off

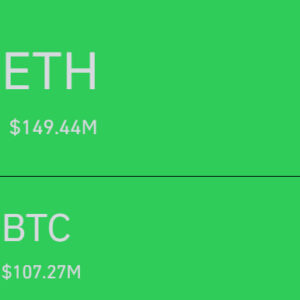

When Bitcoin fell below $107,500, a wave of forced liquidations in futures markets was triggered. Over the past 24 hours, $400 million worth of positions were liquidated, affecting more than 162,000 traders.

- Bitcoin: $107.27 million liquidated

- Ethereum: $149.44 million liquidated

Analysts warned that this liquidation chain accelerated the drop, and if BTC falls below $106,000, it could trigger another $6 billion in liquidations.

Altcoins Took a Heavier Hit

Altcoins were hit even harder than Bitcoin, with the top 50 tokens losing an average of 4%. Investors shifted capital toward Bitcoin and stablecoins as safe havens, pushing Bitcoin dominance up to 60.15%.

- Ethereum (ETH): Down 4.4% to $3,734

- BNB: Down 4.8% to $1,039

- XRP: Down 3.38% to $2.50

- Uniswap (UNI): Down 9%, the day’s weakest performer

- Dogecoin (DOGE): Down 6.9%

Market analysts noted that investors are seeking protection against short-term volatility, leading to a capital rotation into Bitcoin and stable assets.

Markets Remain in Cautious Mode

As of November 3, the crypto market downturn has been fueled by a mix of macroeconomic uncertainty and liquidity outflows. The Fed’s hawkish tone, a stronger dollar, and ETF redemptions have prompted investors to retreat from risk assets.

However, analysts emphasize that such corrections are a natural part of the broader bull cycle, and Bitcoin may find strong support around $106,000, potentially setting the stage for the next

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.