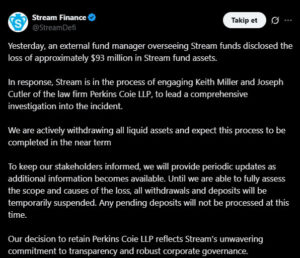

Stream Finance, a major player in the DeFi sector, has suspended all deposits and withdrawals after an external fund manager overseeing its assets reported a loss of approximately $93 million. The company announced that it has partnered with international law firm Perkins Coie LLP to ensure the safety of user funds and investigate the cause of the incident.

$93 Million Loss Sends Shockwaves Through DeFi

In an official statement released Monday night, Stream Finance confirmed that an external manager responsible for fund oversight had identified a $93 million loss, marking one of the largest financial incidents in the protocol’s history.

The company stated:

“We have initiated a comprehensive review to fully assess the cause and scope of the loss. During this process, all deposit and withdrawal functions have been temporarily suspended. The recovery of existing liquid assets is ongoing, and we will continue to keep our users regularly informed.”

The announcement triggered concern and uncertainty among users, sparking discussions about the project’s future and possible recovery scenarios.

Perkins Coie Leads Legal and Audit Investigation

Stream Finance has appointed Keith Miller and Joseph Cutler from Perkins Coie LLP to lead the investigation. Both lawyers are well-known for their work with fintech and blockchain companies, particularly in the fields of regulation, compliance, and cybersecurity.

The company emphasized that the investigation would be conducted transparently and that findings would be shared regularly with the community. In addition, Stream Finance plans to restructure its internal systems and review its risk management frameworks.

xUSD Loses Its Peg Amid Panic Selling

Following the announcement, blockchain security firm PeckShield reported that Stream Finance’s stablecoin, Staked Stream USD (xUSD), had lost its peg. According to CoinGecko data, xUSD plunged from $0.90 to $0.30, losing nearly 68% of its value within 24 hours, and is currently trading slightly above $0.40.

This sharp decline triggered panic among users and raised concerns over potential collateral risks in related liquidity pools. Analysts warned that such events could lead to cascading liquidations across the DeFi ecosystem.

A New Warning Sign for DeFi

Originally designed to enhance capital efficiency and deliver high-yield strategies for users, Stream Finance’s crisis has reignited the debate over trust in external fund managers within decentralized finance.

Experts believe this incident could prompt stricter auditing, tighter risk controls, and mandatory independent reporting across DeFi protocols. The community is now closely watching how Stream Finance manages the crisis and rebuilds user confidence. A detailed situation report from the company, expected in the coming days, will likely play a critical role in shaping market sentiment across the broader DeFi landscape.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.