One of the biggest names in the crypto mining industry, Marathon Digital, known for its consistent Bitcoin accumulation, has now made headlines with a move in the opposite direction selling. On-chain data shows that the company transferred over $200 million worth of Bitcoin to various platforms, sparking speculation that it may be preparing for a potential sale.

Marathon Digital Transfers $236 Million in Bitcoin

According to recent data, Marathon Digital the mining firm holding over 50,000 BTC, the largest amount in the sector transferred around $236 million worth of Bitcoin in recent days. The company reportedly sent 2,348 BTC to multiple platforms, drawing investors’ attention. Analysts note that transfers of this magnitude are typically made in preparation for sales. With market volatility rising as 2025 approaches, this move has raised the question: “Is Marathon starting to sell?”

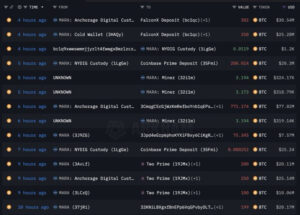

The on-chain analytics platform Lookonchain revealed Marathon’s transfer addresses and destinations. The Bitcoins were sent to FalconX, 2Prime, Galaxy Digital, and Coinbase Prime, all of which are institutional service providers commonly used for trading or liquidity operations. This has strengthened suspicions that the transfers could be directly linked to sales. Marathon has not yet issued an official statement on the matter.

Miners Struggling After the Halving

The 2024 Bitcoin halving event cut mining rewards in half, severely impacting industry revenues. Although Bitcoin’s price increases provided temporary relief, rising electricity and data center costs have limited profitability.

Many mining companies have begun adopting new strategies to stabilize income. Some have started leasing their data centers to AI firms to offset energy costs. Marathon Digital, however, chose to remain fully focused on Bitcoin mining. Yet these latest transfers have raised doubts about whether that strategy remains sustainable.

Is a Mining Sell-Off Beginning?

Marathon’s move could influence other mining firms as well. Recently, France-based Sequans announced the sale of 970 BTC to pay off debt. Experts warn that shrinking mining revenues and increasing operational costs could lead to more such sales in the near future a development that could exert short-term downward pressure on Bitcoin’s price.

Marathon Digital’s $236 million Bitcoin transfer may signal the beginning of a new wave of miner sell-offs. Many view this step as a strategic decision aimed at mitigating the post-halving revenue squeeze and maintaining financial stability in an increasingly competitive mining environment.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.