As of November 3, the crypto market experienced a major sell-off amid global financial weakness. The total cryptocurrency market capitalization dropped by $150 billion, falling to $3.35 trillion, marking one of the sharpest corrections in recent months.

Bitcoin fell below $100,000, hitting an intraday low of $98,944. According to analysts, the main reasons behind the decline include the downturn in the U.S. stock market, the potential for a prolonged U.S. government shutdown, and a broader risk-off sentiment driving investors away from volatile assets. The overall market is currently gripped by panic and strong selling pressure.

Bitcoin Loses Key Support: Drops Below $100,000

Bitcoin (BTC) dropped below $100,000 for the first time in three months, falling to $98,944 and losing 7% in value over the past 24 hours. Although it later attempted to stabilize around $101,477, investor sentiment remains fragile. The widespread sell-off in crypto also triggered steep losses for Ethereum (ETH). ETH’s price plunged 14% in 24 hours to $3,089, hitting its lowest level in four months.

Analysts attribute Ethereum’s sharp decline primarily to heavy U.S. investor selling and tightening liquidity. According to CryptoQuant analyst Maartunn, the Coinbase premium turned negative, a clear indicator of U.S.-based selling pressure. As ETH retests key support levels, analysts warn that a dip below $3,000 could create a new lower support range between $2,900–$3,200.

Altcoins Also Plunge: Solana, Dogecoin, and BNB Lose Value

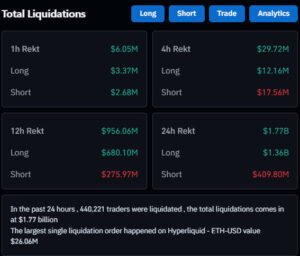

The heavy selling in Bitcoin and Ethereum spilled over into the altcoin market. Solana (SOL), Dogecoin (DOGE), and BNB all dropped around 9% in the last 24 hours. This wave of volatility triggered mass liquidations of leveraged positions across exchanges.

Over the last 24 hours, a total of $1.77 billion in liquidations occurred $1.36 billion of which came from long positions. This indicates that most traders were betting on price increases but were caught off guard by the sudden selling pressure. The drop in liquidity further fueled sell orders, amplifying volatility in the altcoin market.

Sharp Decline in Global Market Cap

According to CoinMarketCap data, the total crypto market cap was around $3.4 trillion on October 6, fell to $3.2 trillion by October 10–12, and after a brief recovery, resumed its downward trend starting November 1. As of November 5, it stands at $3.35 trillion, with a daily trading volume of $280.73 billion.

The Fear and Greed Index currently sits at 27 (“Fear”), showing that investors remain cautious. The Altcoin Season Index at 25/100 indicates Bitcoin’s dominance over altcoins, while the CoinMarketCap 20 Index at 210.95 reflects a synchronized downtrend across major cryptocurrencies.

Analysis

This sharp decline in the crypto market stems from both global economic uncertainty and shaken investor sentiment. Bitcoin’s fall below $100,000 represents a strong psychological break for the market. The sell-offs in Ethereum and other major cryptocurrencies accelerated panic-driven selling.

Experts suggest that while this downturn may serve as a re-accumulation opportunity for long-term investors, risk appetite remains low in the short term — meaning volatility could stay elevated in the crypto market for a while longer.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.