In the Solana ecosystem, Ore (ORE) redefines the concept of a digital store of value as a token born through mining, fully on-chain, and operating with zero trust assumptions. Combining Bitcoin’s “digital gold” philosophy with Solana’s lightning-fast transaction capacity and low-cost infrastructure, project offers an inflation-free economy with a fixed supply of 5 million tokens. There is no pre-mining, team allocation, VC lockup, or hidden distribution—every ORE is generated transparently through miners’ GPU power.

Project is designed as Solana’s first and only true native store of value. While bridged tokens like USDT and WBTC carry third-party risks, Ore is fully Solana-native, eliminating bridge hacks, oracle manipulations, or centralized custody risks entirely.

What is Ore?

The project creates a digital gold standard using Solana’s fast, low-cost, and highly scalable infrastructure. Total supply is capped at 5,000,000 ORE; new tokens are produced exclusively through mining. The project is built on the principle of “mining = value creation”—a hybrid approach merging Proof of Work (PoW) fair distribution with Solana’s Proof of History (PoH) speed. It also aims to be the cornerstone of decentralized finance. With hundreds of DeFi protocols, NFT marketplaces, and gaming ecosystems on Solana, a native store of value was missing. Ore fills this gap. Mining with SOL, staking with ORE, deflation through burning—all operate within a single smart contract.

The project redefines fair launch. Zero team allocation, zero VC lockup, zero pre-mining—the first ORE goes to the first miner. This is an ecosystem growing through the collective effort of the Solana community.

How Does the System Work?

The project is an SPL standard token. Its smart contract is written in Rust, fully auditable, and immutable (non-upgradable). The protocol uses verifiable random function (VRF)—Solana’s on-chain randomness ensures unpredictable and tamper-proof winning block selection.

The mining grid is 5×5—total 25 blocks. Each miner stakes SOL to claim space in one or more blocks. At the end of each round:

- 1 winning block is selected

- All SOL from the 24 losing blocks is distributed proportionally to miners on the winning block

- +1 ORE reward:

- 50% chance shared among all winning miners

- 50% chance one random miner takes it all

This system is a lottery + PoW hybrid. Higher stake = higher win probability, but fully random—no miner has guaranteed rewards.

Motherlode Mechanism

Each round, +0.2 ORE is added to the motherlode pool.

- 1 in 625 chance it triggers → pool distributed proportionally to winning block miners

- If not triggered, it accumulates → potentially millions of ORE in jackpots

- Example: No trigger for 1,000 rounds → 200 ORE accumulated → 200 ORE distributed in one round

Motherlode rewards long-term miners. The growing pool drives mining participation and fuels the protocol’s viral growth.

Refining Mechanism

10% of mining rewards is deducted as a refining fee. This fee:

- Is distributed proportionally to miners who delay claiming their rewards

- The longer you wait, the more tokens you get

- Short-term dumping is penalized

- Long-term holders are rewarded

Example:

- 100 ORE mining reward

- Claim immediately → receive 90 ORE

- Wait 30 days → receive 95–110 ORE (depending on refining pool)

This shifts token distribution toward long-term holders—creating deflationary pressure + holder incentives.

Key Features

- True Solana-Native Store of Value

- No bridges → zero risk

- Mining with SOL → native liquidity

- 5M fixed supply → inflation-free

- SPL standard → works in all Solana wallets

- Fair Launch

- Zero pre-mining

- Zero team allocation

- Zero VC lockup

- First token → first miner

- All code open-source

- Deflationary Burning & Buyback

- 100% of transaction fees burned

- Protocol revenue (10% SOL) → $ORE buyback

- 90% burned (remintable, but circulation drops)

- 10% to stakers

- Staking & Yield (Revenue Share)

- Stake $ORE → receive $stORE

- Buybacks from protocol revenue → added to $stORE pool

- $stORE / $ORE ratio continuously increases

- No lockup → instant unstake

- Stakers “double-dip”: benefit from buyback and revenue share

- Motherlode Jackpot

- +0.2 ORE accumulates per round

- 1/625 trigger → massive payout

- Can grow to millions of ORE

- Explodes mining participation

Ore Tokenomics

Total Supply: 5,000,000 ORE (fixed) Circulating Supply: Increases via mining (0 at TGE)

Emission:

- +1 ORE per minute (mining)

- +0.2 ORE per round (motherlode pool)

Revenue & Burning:

- Protocol revenue (10% SOL) → $ORE buyback

- 90% burned (remintable)

- 10% to stakers

Fees:

- Refining: 10% (to patient miners)

- Admin: 1% SOL (development)

- Deposit: 0.00001 SOL

- Auto-miner: 0.000005 SOL/round

Allocation:

- Mining: 100%

- Team/VC: 0%

Earnings Optimization

- Motherlode hunting: Higher stake → higher jackpot chance

- Refining: Claiming immediately → 10% loss

- Staking: $ORE → $stORE → royalty + value growth

- Pool mining: Spread risk, share rewards

Staking & Yield

- Stake $ORE → receive $stORE

- Protocol revenue → $ORE buyback → added to $stORE pool

- $stORE / $ORE ratio continuously rises

- Unstake freely → instant exit

- Stakers “double-dip”:

- Buyback → boosts $ORE price

- Royalty → increases $stORE value

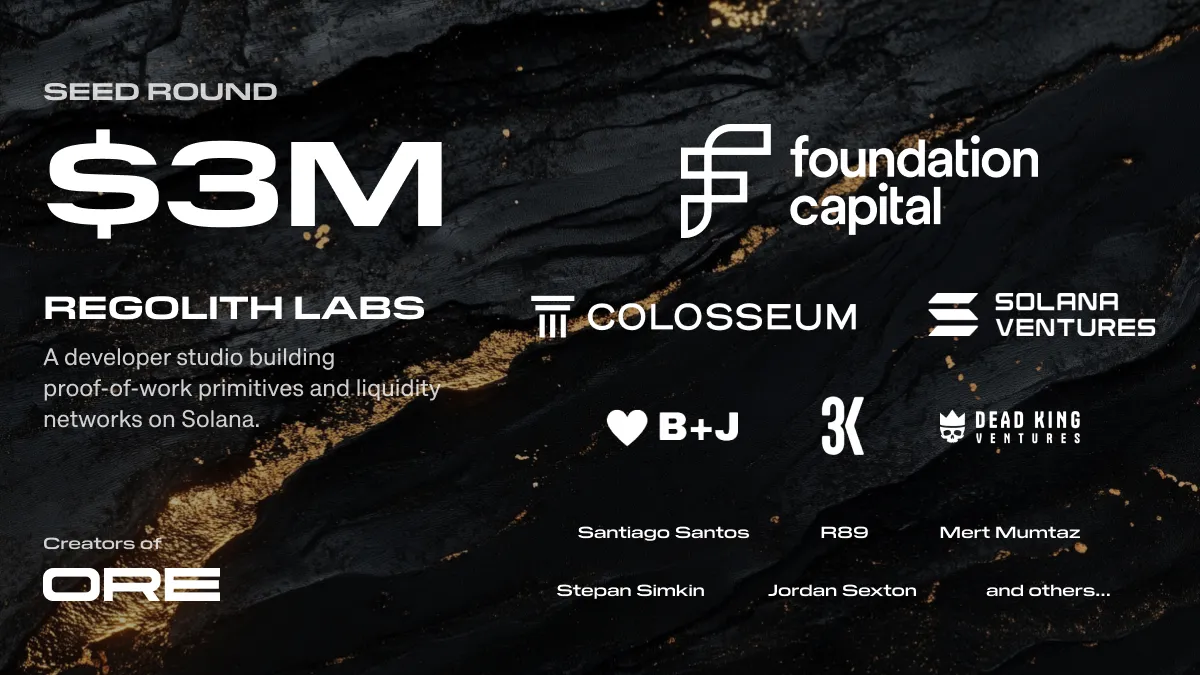

Investors

Raised: $3M (Seed – September 13, 2024)

- Santiago Roel Santos (Angel)

- Solana Ventures

- Foundation Capital

- Colosseum

- Third Kind VC

- BJ Studios, Dead King Society

Roadmap

Q4 2025:

- $ORE TGE (official listing)

- Mining v2 (higher jackpots, dynamic grid)

- Mobile miner (iOS/Android)

Q1-Q2 2026:

- Ore DEX (native AMM, $ORE/SOL pool)

- Ore Lending (Aave-like)

- Cross-chain bridges (Ethereum, Base)

Q3 2026+:

- Ore Pay (SOL payments, $ORE reserves)

- Ore NFT marketplace (blind bidding)

- Institutional staking (custody solutions)

Team

The project is led by Hardhat Chad with a minimalist team. Chad, a legendary miner in the Solana community, built Ore single-handedly from scratch. The team is committed to decentralized mining and fair distribution. Development, operations, and maintenance are funded through protocol revenue (1% SOL).

Ore is Solana’s digital gold. Born through mining, grows with staking, becomes scarcer with burning. $ORE holders invest in Solana’s future. Miners, stakers, and holders—all are part of the same ecosystem.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.