Venus Protocol is a decentralized lending and stablecoin platform that launched on BNB Chain in 2020. By combining Maker’s collateral-backed stablecoin model with Compound’s algorithmic money markets, Venus introduced an accessible and efficient DeFi structure. Thanks to this hybrid design, it quickly became one of the most widely used applications in the Web3 ecosystem.

What Is Venus BUSD (vBUSD)?

Venus BUSD (vBUSD) is the interest-bearing token of the Venus Protocol, operating on Binance Smart Chain (BSC). When users deposit BUSD into Venus, they receive vBUSD in return—this token represents the liquidity they have supplied to the protocol. As interest accrues in the market, the value of vBUSD increases, allowing users to withdraw more BUSD than they initially deposited.

Because the system is fully operated through smart contracts, users can earn yield without relying on any centralized authority. Venus also enables borrowing against deposited collateral, making vBUSD both a yield-generating asset and a liquidity tool within the Venus ecosystem.

How Does Venus Protocol Work?

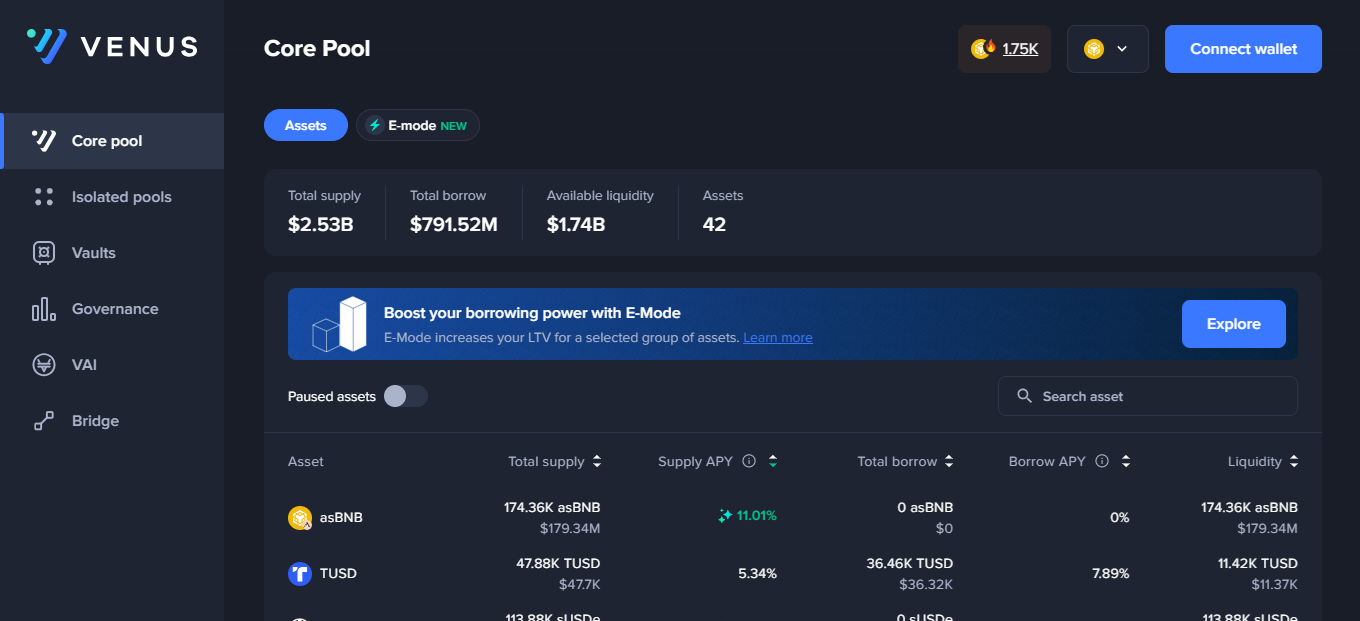

Venus operates as a decentralized marketplace for lending and borrowing on BNB Chain.

Users can:

-

Deposit assets to earn interest

-

Use those assets as collateral to borrow other tokens

All deposited funds remain in smart contracts, and users receive vTokens representing their positions. These vTokens can be redeemed at any time. While the platform is permissionless, it is not risk-free; smart contract vulnerabilities and liquidation risks exist, although the code is open-source and audited.

Key Innovations in Venus Protocol V4

Risk Management

-

Isolated Pools: Each pool has independent risk parameters, preventing issues in one pool from affecting others.

-

Advanced parameter controls: Collateral factors, liquidation thresholds, and borrow rates are managed more precisely.

-

Risk Fund: Each isolated pool maintains a fund dedicated to covering bad debt.

Decentralization Enhancements

-

A new governance framework featuring:

-

Faster VIP (Venus Improvement Proposal) execution

-

Role-based permissions

-

More granular pause mechanisms

-

Improved User Experience

-

A redesigned UI

-

More efficient reward distribution

-

Support for isolated lending markets

-

Upcoming features: fixed-rate borrowing and Venus Prime SBT program

Resilient Price Oracle

V4 introduces a new multi-source oracle system.

It:

-

Aggregates data from multiple price feeds

-

Reduces susceptibility to market manipulation

-

Allows per-token oracle activation or deactivation

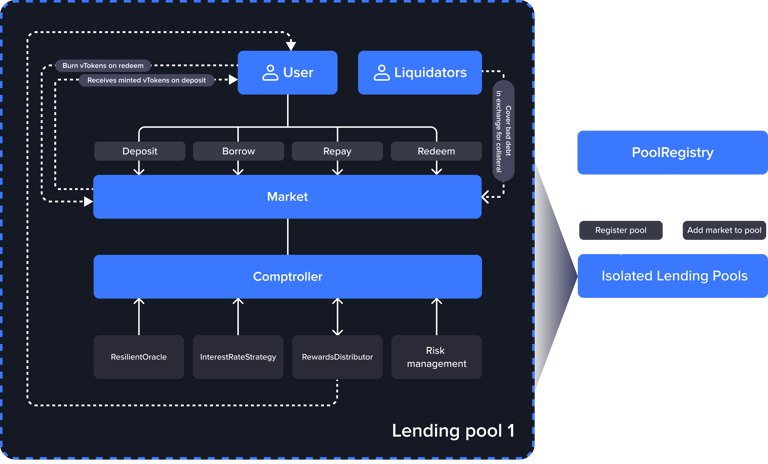

Isolated Pools

Isolated pools operate independently with their own risk settings.

Advantages include:

-

Containing risk within each pool

-

Allowing users to choose risk profiles

-

Customizable reward structures for each market

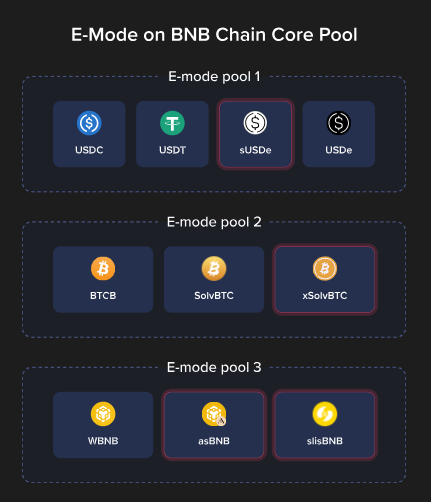

E-Mode (Efficiency Mode)

A new optimization system for the BNB Chain Core Pool.

Goals:

-

Improve capital efficiency for stablecoins and ETH-correlated assets

-

Provide higher collateral factors and liquidation thresholds

-

Offer lower liquidation penalties

Users remain in the core pool by default but can opt into an E-Mode pool for better capital efficiency.

Venus Reward Distributor

The upgraded reward mechanism enables Venus to:

-

Distribute rewards per market

-

Support multiple reward tokens simultaneously

-

Reward both suppliers and borrowers

Users can claim rewards from any market with a single transaction.

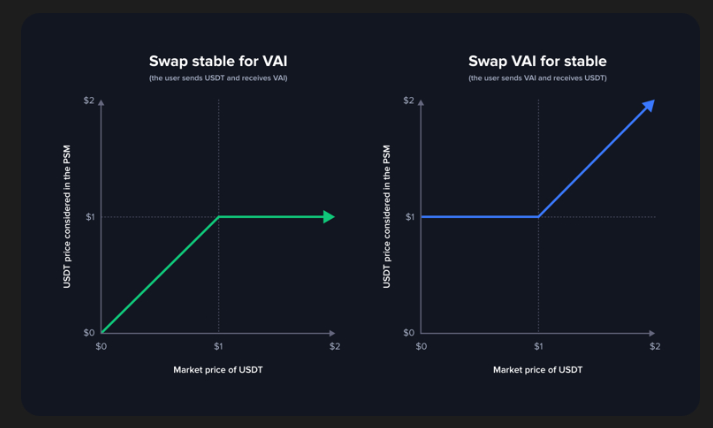

Peg Stability Module (PSM)

The PSM is designed to maintain VAI’s peg to 1 USD, similar to MakerDAO’s DAI-PSM.

Through the PSM:

-

Users can swap VAI ↔ USDT at a 1:1 rate

-

Fees (feeIn / feeOut) are determined by governance

-

Excess VAI is burned and fees are sent to the treasury

Conversions use oracle price data, ensuring accurate exchange rates.

Venus (vBUSD) Tokenomics

XVS Token (Governance + Staking)

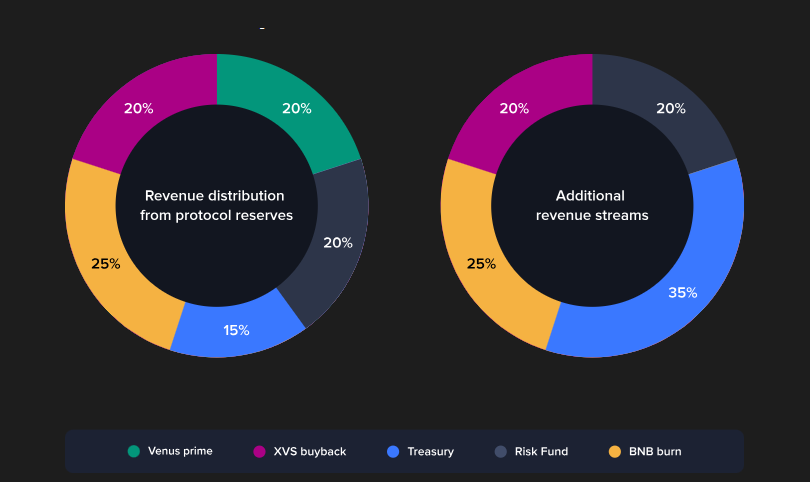

Protocol Revenue Allocation (PROTOCOL_RESERVES):

-

Treasury: 15%

-

XVS Vault: 20%

-

Venus Prime: 20%

-

Risk Fund: 20%

-

BNB Burn: 25%

Additional Revenue (e.g., liquidations):

-

Treasury: 35%

-

XVS Vault: 20%

-

Risk Fund: 20%

-

BNB Burn: 25%

Base XVS Vault Rewards: 308.7 XVS per day (reset every 6 months)

Token Converter

A fully on-chain automated conversion system that:

-

Works autonomously

-

Continuously channels protocol revenue into selected tokens

-

Creates natural arbitrage opportunities

-

Operates transparently on-chain

What Is Venus Prime?

Venus Prime is a new incentive model for users who stake XVS.

Features:

-

Rewards come entirely from protocol revenue

-

Stakers receive a Soulbound Token (SBT) that boosts reward rates

Prime Token Types

Revocable Prime Token

-

Requires staking at least 1000 XVS for 90 days

-

Minted after 90 days

-

Burned if the staked balance drops below 1000

-

Max supply: 500 (BNB Chain)

Irrevocable (OG) Prime Token

-

Will be introduced in the second phase

Reward Calculation Formula

Rewards are determined using a simplified Cobb–Douglas function that considers:

-

User’s staked XVS

-

Borrowing/lending activity

-

Market multipliers

-

Protocol-wide performance metrics

Venus BUSD (vBUSD) Team

The driving force behind Venus BUSD is Joselito Lizarondo, a well-known entrepreneur in the crypto and DeFi ecosystem. Joselito entered the industry through Bitcoin mining and OTC trading before founding Swipe in 2018—a platform that enabled real-time crypto-to-fiat spending via Visa cards and quickly scaled globally, eventually leading to its acquisition by Binance in 2020.

During this period, he also launched Venus Protocol, which became one of the core lending infrastructures on BNB Chain. With extensive experience building both centralized and decentralized systems, Joselito continues to advise various projects and advocates for a future shaped by open finance and user-centric technologies.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.