Tokenlon is a decentralized exchange (DEX) and payment-settlement protocol built on the Ethereum blockchain. Its goal is to enable users to trade tokens securely, quickly, and at fair prices — without intermediaries. The LON token serves as a utility token within this ecosystem, providing fee discounts, governance rights, and incentive mechanisms.

Founders / Team Information

Tokenlon was developed by the team behind imToken Wallet. The project’s founder, Bin He (who is also the founder of imToken), played a key role in its creation.

According to the official Litepaper V1.0, the core team members are: Ben He, Kai Chen, and Lucas Huang. Tokenlon was incubated by the imToken team in April 2018 and launched as an independent decentralized exchange in July 2019.

Investors and Key Partnerships

The Tokenlon ecosystem has grown through strategic collaborations and early investment support.

Institutional Investors: Lightspeed, SoftBank China, and BlueRun Ventures.

Technology Partners:

-

imToken: The core incubator and wallet ecosystem that launched Tokenlon.

-

0x DEX Protocol: Tokenlon 4.0 is built on an improved off-chain RFQ (Request for Quotation) model based on the 0x architecture.

-

Kyber Network: A key DeFi protocol that supported Tokenlon’s early development.

Project Vision

Tokenlon aims to deliver the best execution price, low slippage, and minimal transaction fees in decentralized trading. It aggregates various liquidity sources — from AMM pools to professional market-maker offers — to provide seamless trading and payment settlements without intermediaries. Its vision extends beyond trading to becoming a universal settlement layer for decentralized payments.

How It Works (Core Architecture)

Tokenlon operates through a three-layered architecture:

• Market Liquidity Layer: Aggregates off-chain RFQ market makers and on-chain AMM protocols such as Uniswap and Curve. It ensures users get the best exchange rates and mitigates counterparty risk.

• Settlement Layer: Executes trades on-chain via smart contracts and digital signatures. Atomic settlement ensures that transactions either complete fully or revert, keeping assets safe in users’ wallets.

• Application Layer: Provides APIs and SDKs, allowing developers to integrate Tokenlon’s features into other applications and platforms.

Key Features

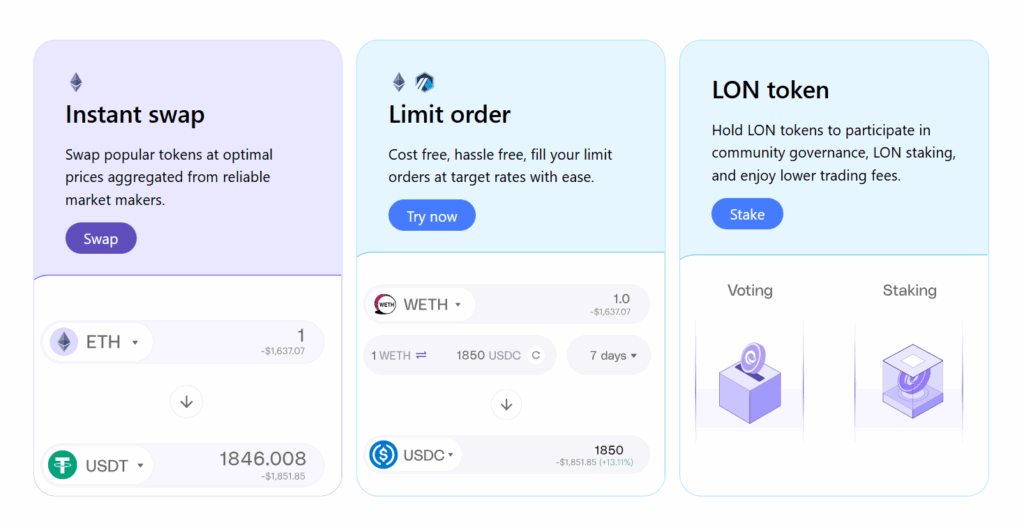

- Gasless Trading: Users can swap tokens even without ETH in their wallets, removing gas fee concerns.

- Optimal Trade Price: Combines quotes from PMMs and AMMs to offer the most favorable trading rates.

- Best-in-Class Security: Smart contracts are regularly audited by independent security firms.

- High Success Rate: Tokenlon 4.0 boasts a 99%+ on-chain settlement success rate.

- Trade Rewards: Each successful trade earns users LON tokens as a reward.

Governance and the Role of LON

Tokenlon’s long-term goal is to evolve into a community-governed DAO (Decentralized Autonomous Organization).

LON Holder Rights: Token holders can propose and vote on TIPs (Tokenlon Improvement Proposals) affecting key protocol parameters such as fees and buyback mechanisms.

Early Governance: Before on-chain governance deployment, the community participated via Snapshot’s off-chain voting system.

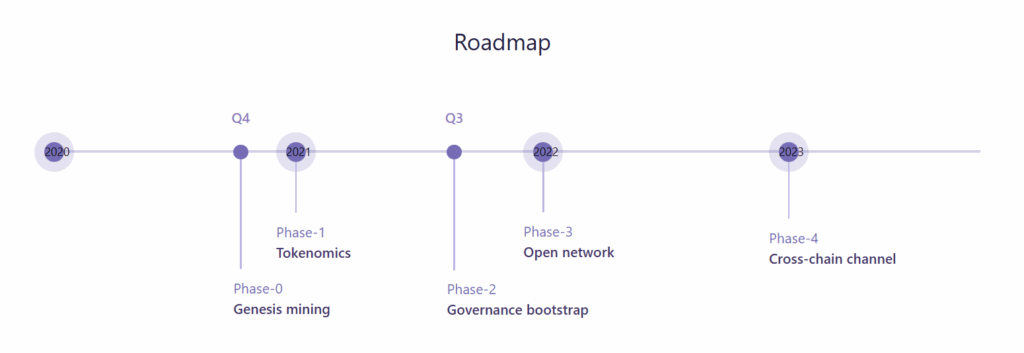

Roadmap

- 2020: Phase-0 (Genesis Mining) launched, followed by Phase-1 (Tokenomics).

- 2021: Key milestone year — Tokenlon 5.0, liquidity incentives, buyback, and staking mechanisms introduced.

- 2021–2022: Governance bootstrap began; protocol parameters gradually opened to the community.

- 2022: “Open Network” phase — expanding into a multi-relayer liquidity network.

- 2023 and beyond: Cross-chain settlement channels and atomic cross-chain swaps initiated.

Token Utilities

- Fee Discounts: Standard trading fee is 0.30%. LON holders receive tiered fee discounts based on token holdings.

- Governance: Token holders can participate in DAO governance and vote on proposals.

- Incentives: Trade mining, liquidity rewards, and staking programs are powered by LON.

- Ecosystem Growth: Aligns interests of users, liquidity providers, and developers to foster long-term network sustainability.

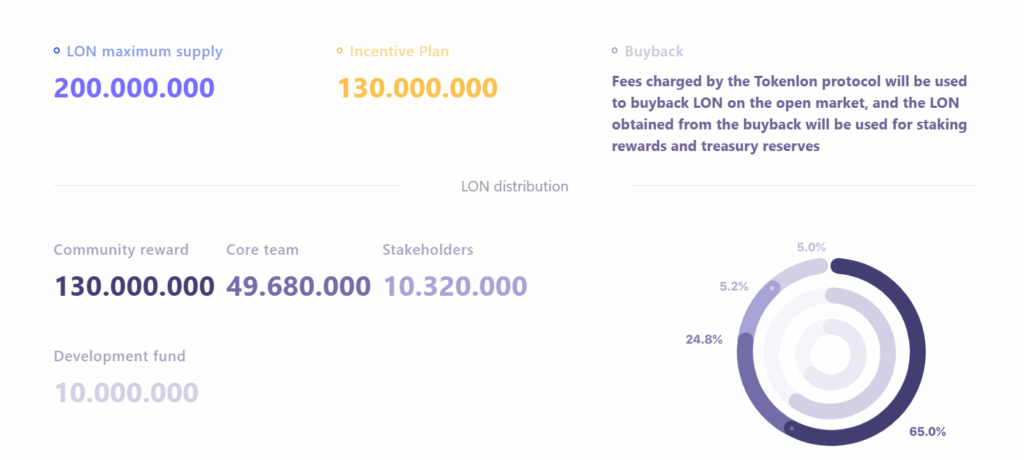

Token Information and Distribution

- Max Supply: 200,000,000 LON

- Total Supply: 140,450,000 LON

- Circulating Supply: 124,460,000 LON

Distribution:

-

Community Incentives (LIP): 130,000,000 LON (65%) — distributed in two phases.

-

Core Team: 49,680,000 LON (24.8%) — two-year linear vesting.

-

Stakeholders: 10,320,000 LON (5.2%) — two-year linear vesting.

-

Development Fund: 10,000,000 LON (5%) — two-year linear vesting.

Ecosystem Participants

- Users: Traders and referrers using the protocol.

- Liquidity Providers: AMMs, professional market makers, and brokers.

- Developers: Core team, community contributors, relay operators, and integrators.

- Governance Members: TIP proposers, reviewers, and LON token voters.

Core Features

-

Integrated wallet trading via imToken

-

Aggregated liquidity and best price execution

-

LON-powered fee discounts and governance

-

Liquidity and staking incentives for users

-

Gradual transition to community-led governance

-

Cross-chain support for future settlement expansion

-

User-friendly interface with professional liquidity access

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.