Bitcoin (BTC)’s brief slide below the $100,000 mark rattled sentiment but ultimately reinforced the level as a strong psychological and technical floor. The rapid rebound shows that the recent volatility was less about structural weakness and more about a temporary liquidity squeeze. Many analysts argue that the ongoing U.S. government shutdown has played a major role in pressuring prices, rather than signaling a cycle peak.

PlanB: Mid-Cycle Pause, Not the Final Top

PlanB, the analyst known for the Stock-to-Flow (S2F) model, views the recent correction as a natural breather within a larger bull cycle. He highlights that Bitcoin has remained above $100,000 for six consecutive months — a sign that the market has transitioned from treating this level as resistance to regarding it as a firm support zone.

Momentum indicators support this idea. With the RSI hovering near 66, Bitcoin is far from the euphoric 80+ readings typically seen at major market tops. Based on his model projections, PlanB suggests that the next major upward phase could lift prices into the $250,000–$500,000 range, assuming Bitcoin continues to diverge from its realized price — a common feature of strong bull markets.

Arthur Hayes: Liquidity Tightness Before a Coming “Stealth QE”

Arthur Hayes attributes Bitcoin’s short-term weakness to contracting U.S. dollar liquidity. Since the summer’s debt ceiling resolution, the Treasury General Account (TGA) has expanded, pulling significant liquidity out of financial markets.

However, Hayes expects this trend to reverse once the government reopens and begins deploying funds more aggressively. This would reduce the TGA balance and inject liquidity back into the system. He argues that the Federal Reserve’s involvement — particularly through the Standing Repo Facility — will amount to balance-sheet expansion without being formally labeled quantitative easing. According to Hayes, this discreet liquidity boost could be the next catalyst for Bitcoin.

Raoul Pal: A Major Upswing in Global Liquidity Is Near

Macro strategist Raoul Pal points to the long-term uptrend in his Global Macro Investor (GMI) Liquidity Index as evidence that the broader liquidity cycle remains intact. In his view, markets are currently in a “Window of Pain,” marked by tight conditions that challenge investor conviction.

Pal expects a decisive turnaround as U.S. Treasury spending injects an estimated $250–350 billion into markets, quantitative tightening winds down, and interest rate cuts begin. He notes that when global liquidity rises — across the U.S., China, Japan, and elsewhere — risk assets tend to move higher in unison.

Large Holders Accumulate as Retail Sentiment Weakens

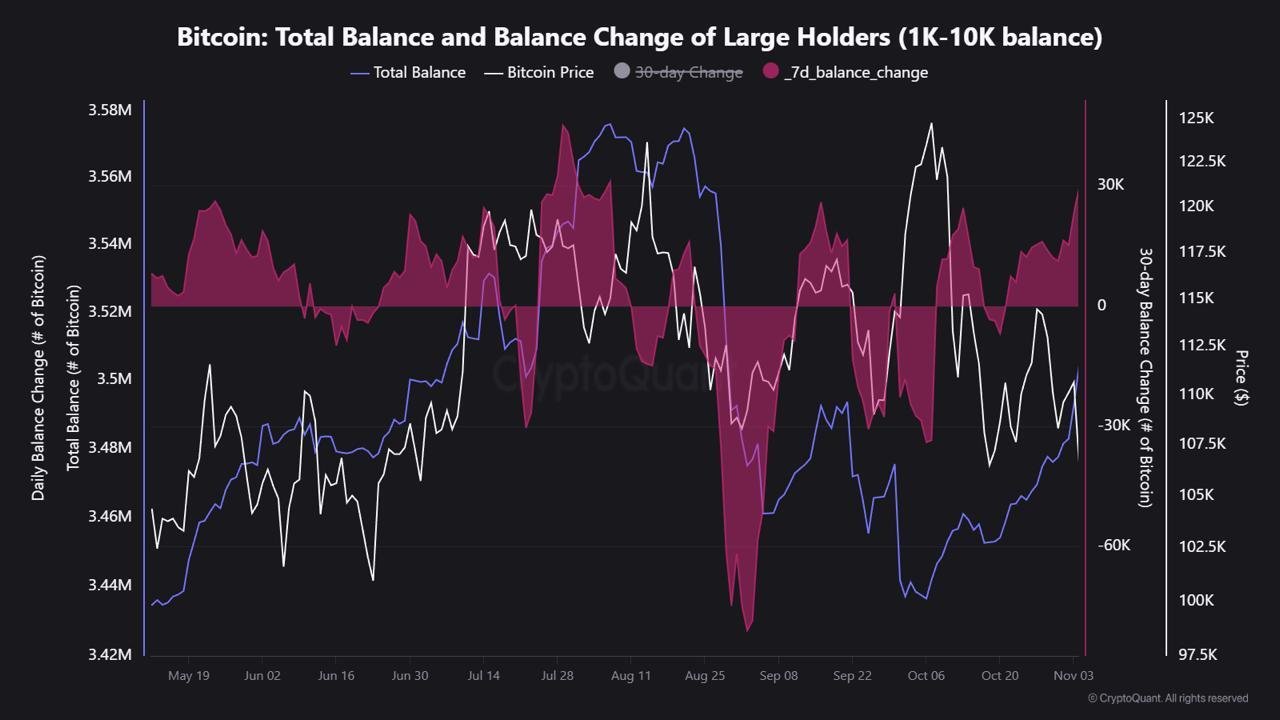

On-chain data from CryptoQuant shows that major Bitcoin holders — addresses with between 1,000 and 10,000 BTC — accumulated roughly 29,600 BTC in the past week, an amount valued at about $3 billion. Their combined holdings have climbed to 3.504 million BTC, marking the first significant accumulation wave since September.

What makes this trend more notable is that it occurred during a period of sharp sentiment deterioration among retail investors and $2 billion in ETF outflows. Analysts interpret this divergence as evidence that institutional players are strengthening the support zone around $100,000, positioning for the next macro-driven expansion.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.