Trump Media & Technology Group (DJT) has officially added Bitcoin to its corporate treasury, marking a major step into the digital asset market. As of September 2025, the company reportedly holds $1.3 billion worth of Bitcoin, signaling a strategic shift toward using digital assets for growth, liquidity management, and financial flexibility.

Bitcoin Becomes the Core of Trump Media’s Treasury Strategy

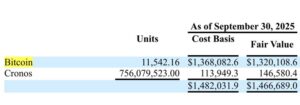

According to Arkham Intelligence, Trump Media has made Bitcoin a central part of its long-term financial planning. The company held 11,542 BTC in Q3 2025, some of which is used as collateral for convertible bonds.

This move positions Bitcoin not merely as an investment but as an active component of the firm’s balance sheet strategy. With recent purchases, Trump Media has increased its Bitcoin holdings, placing it among the largest institutional holders of the asset.

Aggressive Accumulation Between July and September

SEC filings show that Trump Media made large Bitcoin purchases between July 1 and July 21, when BTC traded near $115,000. The company’s total cost basis was $1.37 billion, with a fair market value of $1.32 billion at quarter’s end.

Additionally, Trump Media holds 756 million Cronos (CRO) tokens valued at around $146 million, bringing its total digital asset portfolio above $1.47 billion. However, a 17% decline in Bitcoin prices since then may expose the firm to unrealized losses in the fourth quarter.

Financial Performance: Strong Assets, Ongoing Losses

The company’s Q3 financial report revealed total assets of $3.26 billion, largely driven by crypto holdings. However, revenues totaled only $972,900, while the net loss reached $54.8 million.

Roughly $20 million of this loss was attributed to legal costs related to its merger with Digital World Acquisition Corp. Additionally, a $48 million drop in Bitcoin’s valuation was partly offset by a $33 million gain from Cronos holdings, leaving a net $15 million loss in digital assets for the quarter.

Stock Price Under Pressure

Trump Media’s stock (DJT) closed at $13.10 on Friday, near yearly lows. Analysts attribute the decline to the company’s heavy exposure to volatile crypto assets and its limited revenue from media operations.

However, some market observers note that if Bitcoin resumes its upward trajectory, Trump Media could see massive balance sheet gains, placing it in the same league as MicroStrategy in terms of institutional Bitcoin exposure.

Trump’s Changing View on Crypto

Donald Trump, who in 2019 called Bitcoin “highly volatile and made of thin air,” has since dramatically shifted his stance. In a 2024 Nashville speech, he described crypto innovators as “the Edisons and Carnegies of a new era.”

The Trump family’s total digital asset portfolio—both directly and indirectly managed—now exceeds $13 billion, including:

- World Liberty Fi – $5.76 billion

- Official Trump Meme – $6.30 billion

- Melania Meme Collection – $19.65 million

- Trump Trading Cards (NFTs) – $29,720

- Donald Trump (personal holdings) – $861,000

This shift underscores how Trump’s team now views crypto not only as an investment, but also as a political and economic tool.

Industry and Political Impact

Trump Media’s Bitcoin accumulation represents one of the largest corporate crypto adoptions in the U.S., highlighting how mainstream companies are integrating digital assets into their balance sheets.

The move also coincides with Trump’s crypto-friendly campaign efforts, which leverage blockchain-based fundraising models—a sign that digital assets are becoming a core force in U.S. politics and economics. With $1.3 billion in Bitcoin, Trump Media now stands alongside MicroStrategy, Tesla, and Block in institutional exposure.

While short-term volatility may weigh on its performance, the move positions the company as a next-generation, crypto-oriented financial powerhouse in the long run.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.