Why is Ethereum dropping? ETH has fallen about 12% over the past week, trading near $3,400 at press time. Analysts point to strong liquidity clusters between $3,200 and $3,350, suggesting the asset may revisit that zone before attempting a move toward $3,500.

Macro Headwinds and Global Risk Aversion

Ethereum’s recent weakness is largely driven by poor global macro data. Consumer-oriented companies have posted disappointing quarterly earnings, while renewed concerns over inflated AI valuations have reduced risk appetite. Meanwhile, the ongoing U.S. government shutdown continues to weigh on market sentiment.

A University of Michigan survey revealed that consumer confidence expectations hit their lowest level since 1978, signaling broader economic anxiety. As investors turn risk-averse, both equity and crypto markets remain under pressure.

DeFi Slowdown and On-Chain Metrics Decline

Ethereum’s on-chain data also indicates a slowdown across the network. Total Value Locked (TVL) has dropped to $74.25 billion — the lowest level since July — down 24% in 30 days. One major trigger was a $120 million exploit targeting the leading DeFi platform Balancer v2.

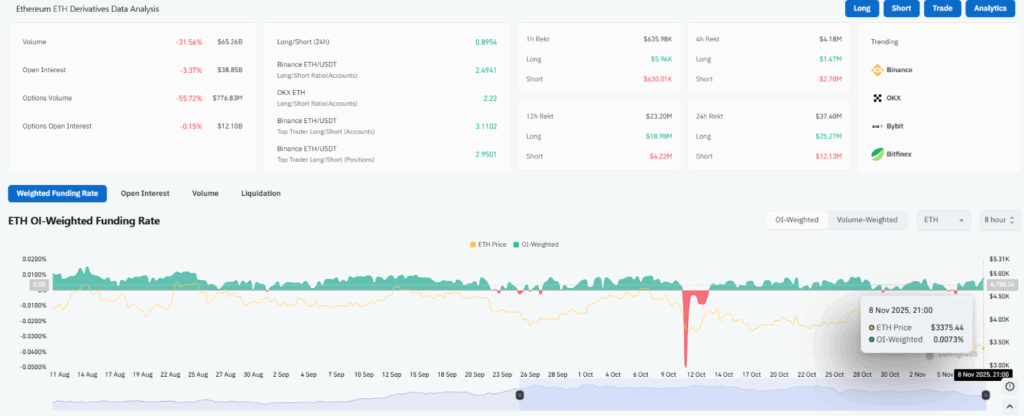

Trading activity has weakened as well. According to CoinGlass, Ethereum’s trading volume fell 31.6% to $65.3 billion, while open interest declined 3.4% to $38.85 billion. Ethereum DApps generated $80.7 million in October, down 18% from September, reflecting lower staking yields and slower network performance.

ETF Outflows and Liquidity Zones Limit Upside Potential

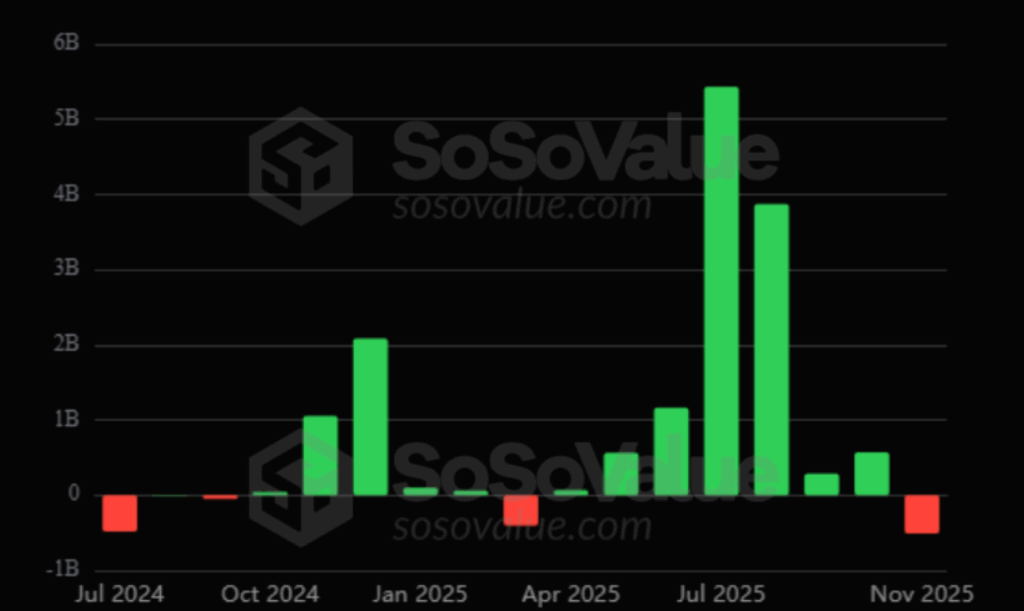

Investor appetite for U.S. spot Ethereum ETFs remains limited. Spot ETH products recorded about $507.83 million in net outflows in November, with no major corporate treasuries adding new ETH holdings. This highlights weak institutional demand despite structured product availability.

Derivatives data also signals caution. With mounting macroeconomic obstacles, a near-term breakout above $3,900 appears unlikely. However, the $3,200–$3,350 range presents a strong liquidity cluster that could form a temporary support base before any rebound.

Fusaka Upgrade Could Be a Potential Catalyst

The upcoming Fusaka Upgrade, scheduled for early December, may provide a positive catalyst for Ethereum. It aims to enhance network scalability and security, potentially improving overall performance and user experience.

Going forward, ETH’s recovery depends on stronger macroeconomic conditions, renewed ETF inflows, and sustained on-chain growth. Without these, consolidation or further downside remains possible.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.