On-chain data reveals that major crypto whales have been highly active over the past several hours. Large-scale transfers and leveraged positions across centralized exchanges and HyperLiquid have caught the attention of market participants. These movements across multiple assets in the past 24 hours suggest that institutional investors and whales are once again repositioning themselves in the market.

Contradictory Whale Positions in ZEC Trades

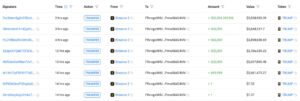

According to on-chain data, a newly identified wallet deposited 6.27 million USDC into the HyperLiquid exchange and opened a long position on ZEC (Zcash) at around $504, indicating bullish sentiment.

In contrast, another major investor deposited 1.15 million USDC to open a 10x leveraged short position on ZEC. The position’s current value stands at $5.20 million, with a liquidation price of $1,358, and an unrealized loss of $218,730. These opposing trades highlight ongoing uncertainty among whales regarding ZEC’s price direction and reveal that different strategic approaches are being deployed in the market.

Million-Dollar Whale Movement in TRUMP Token

Within the last 14 hours, another newly created address withdrew 3 million TRUMP tokens worth approximately $23.01 million from exchanges. Given the recent surge in volatility among Trump ecosystem tokens, this move drew significant attention. Some analysts speculate that this transaction could be linked to a potential new listing, staking initiative, or treasury restructuring within the ecosystem.

Bitcoin Whale Deposits 500 BTC to Kraken

Another notable transaction came from a known whale, Owen Gunden, who recently deposited 500 BTC (roughly $51.68 million) into Kraken. Such large exchange inflows are often interpreted as potential sell signals, though analysts note that this could also be related to inter-exchange arbitrage or derivatives collateral management.

Whale Activity Brings Both Uncertainty and Opportunity

The recent spike in large-scale whale transactions suggests renewed activity among major players and indicates that heightened market volatility may persist.

The opposing strategies observed in ZEC, TRUMP, and BTC trades reflect differing market outlooks, while the substantial Bitcoin and stablecoin flows demonstrate that whales are actively positioning themselves to navigate upcoming market shifts.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.