The cryptocurrency market is preparing for a busy schedule during the week of November 10–13, with both global economic data and major altcoin events on the horizon. Following recent declines in Bitcoin, the market is seeking direction and the upcoming economic reports and project updates could have a direct impact on investor sentiment.

According to analysts, this week’s U.S. inflation (CPI) data, jobless claims, and stablecoin regulations may increase market volatility. In addition, several major projects have important meetings, summits, and ETF decision dates scheduled, all of which are expected to play a key role in shaping weekly price movements.

November 10 – Monday

- United Kingdom: The public consultation period for the stablecoin regulatory framework begins. This initiative is part of the UK’s broader effort to align its digital asset regulations with those of the United States.

November 11 – Tuesday

- SOL: The Solana x402 Hackathon concludes. The results of this developer-focused event will be crucial for the emergence of new DeFi and GameFi projects within the Solana ecosystem.

- LDO: Lido DAO token holders’ update meeting will take place. Key topics include staking rewards and governance strategies.

- HBAR: Deadline for SEC’s approval of the Hedera Spot ETF application. If approved, this could spark strong institutional interest in HBAR.

November 12 – Wednesday

- ADA: The Cardano Summit will be held. Announcements are expected regarding new partnerships and Cardano’s 2026 roadmap.

- VELODROME: Velodrome Finance will host its community event, focusing on new liquidity pool strategies across Optimism-based DeFi protocols.

- FLM, KDA, PERP: Binance will delist these three tokens. Users are advised to close open positions before the deadline.

- DOT: Deadline for SEC approval of the Polkadot Spot ETF application. A positive outcome could trigger a short-term price rally in DOT.

November 13 – Thursday

PUFFER: Investor token unlocks will begin, which may cause short-term volatility due to an increase in circulating supply. XRP: Deadline for SEC’s decision on the Spot ETF approval. If approved, the entire crypto market could experience a strong rebound.

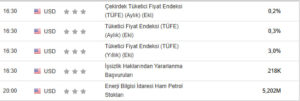

Key U.S. Economic Data (16:30 TSI):

- Core CPI (MoM): Previous 0.2%

- CPI (MoM): Previous 0.3%

- CPI (YoY): Previous 3%

- Initial Jobless Claims: Previous 218K

These figures are critical for shaping expectations about the Federal Reserve’s rate-cut timeline. A decline in inflation could trigger short-term relief across crypto markets.

Overall Assessment

In the upcoming week, both macroeconomic indicators and altcoin-specific developments will play decisive roles in shaping the overall direction of the crypto market. Particularly, the U.S. inflation (CPI) data, jobless claims, and interest rate expectations will have a direct influence on investor sentiment and risk appetite. These reports are also key signals for understanding the Federal Reserve’s monetary policy stance.

Meanwhile, anticipated SEC ETF decisions could lead to short-term price movements across individual projects. An approved spot ETF might trigger institutional inflows, potentially revitalizing overall market momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.