Big Tech giants rake in billions from every click, transaction, and social post we make, while we barely see a fraction of the value we create—if anything at all. What if we could directly profit from our own data, time, skills, and intelligence? That’s exactly where ConsumerFi (CFI) steps in: a Personal Intelligence Layer for apps and agents, powered by User-Owned Intelligence. The protocol turns your digital footprint into “Digital DNA”—a secure, private, fully user-controlled asset. This unlocks hyper-personalized decisions across DeFi, AI, prediction markets, gaming, and beyond, while ensuring you capture the rewards you deserve.

In this deep dive, we’ll explore how ConsumerFi works, its tokenomics, the powerhouse team behind it, and the partnerships fueling its growth. Ready to own your slice of the next trillion-dollar internet economy?

What is ConsumerFi (CFI)?

ConsumerFi is a decentralized information protocol that transforms scattered app data into User-Owned Intelligence. At its core lies the ConsumerGraph—a private data vault where users store their Digital DNA: financial history, social signals, expertise, and more, all fused into a single powerful reputation score. This portable, trust-based credit system follows you across the ecosystem.

Apps tap into this intelligence to deliver smarter, context-aware recommendations: better yields, tailored content feeds, automated trades… the list goes on. The best part? You stay in full control—grant access only when you want, revoke it anytime.

Value flows straight back to users:

- 50% of protocol revenue fuels $CFI buybacks and burns.

- Every time your intelligence is used, you earn $CFI.

- As more apps integrate, more value circles back to the community.

It’s a true user-centric flywheel: smarter agents → higher engagement → bigger collective rewards.

How Does CFI Work? Three Core Pillars

ConsumerFi operates through three tightly integrated components:

- Personal Data Vault (ConsumerGraph) A portable, key-secured profile that lives under your control. Apps request only the context they need, only for as long as you permit—and you can cut access instantly.

- Smart Recommendations Real-time intelligence compares options against your goals and surfaces the optimal move, whether it’s a swap, staking opportunity, or personalized content.

- In-App Execution Complete actions across blockchains with one tap, without ever surrendering custody or leaving the app.

Together, these give wallets, browsers, and dApps true personal AI and seamless on-chain experiences. The guiding principle is clear: platforms that own the user journey will dominate liquidity, engagement, and data gravity.

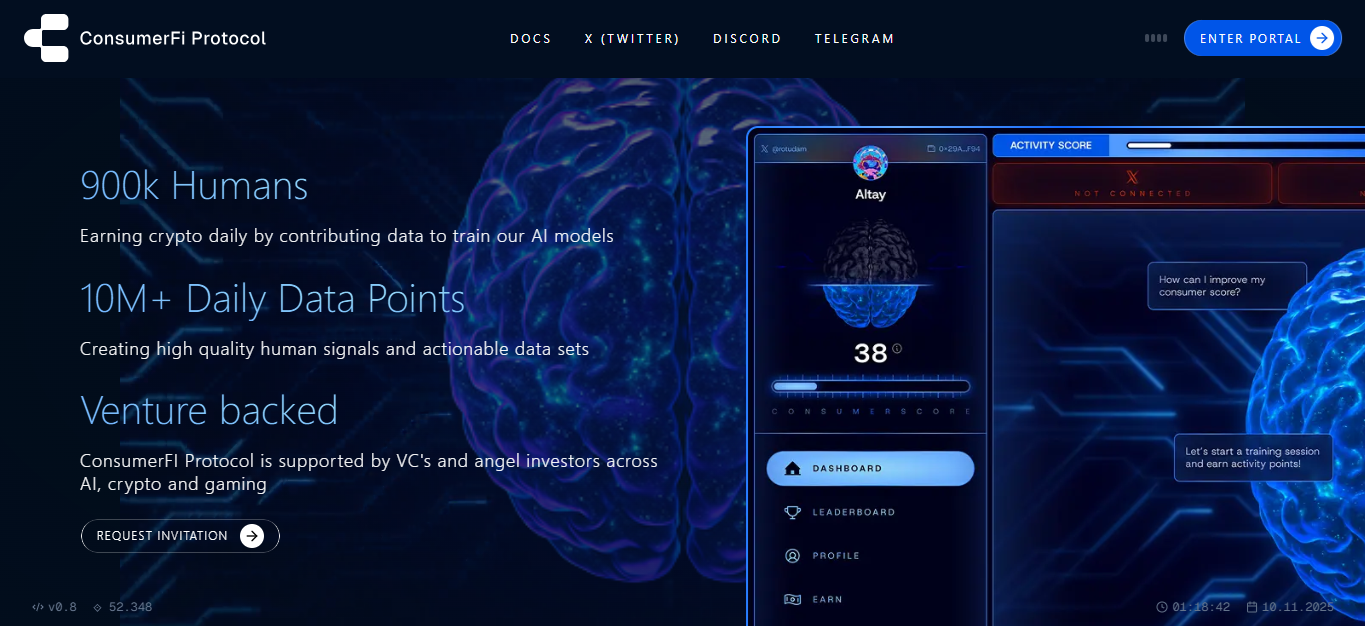

ConsumerFi Is Already Live—and Massive

This isn’t a project starting from scratch:

- 900K monthly active users

- 170M+ app downloads via existing SDKs

- 32B+ data points already generating intelligence

- 10M+ daily data points creating high-quality human signals

ConsumerFi runs one of crypto’s largest distribution and data networks. 900,000 people earn crypto daily by contributing data to train AI models.

Who Is It For? Three Key Roles

- Consumers Turn everyday actions into on-chain rewards. Complete surveys, gamified tasks, or train your own AI assistant to handle taxes or automate trades.

- Creators Build and scale AI-powered minds. Feed your physical and digital content—including social accounts—into your personal AI to amplify your knowledge.

- Micro Workers The future agentic workforce. Get paid to label text, images, and audio that train tomorrow’s AI agents.

Why It Matters: Humanity at an AI Crossroads

“AI is likely to be either the best or worst thing ever to happen to humanity.” – Elon Musk

Today, AI corporations harvest our knowledge, voices, and creativity without consent. ConsumerFi flips the script: AI works for you, instructed by you. Your digital activity fuels a community-built collective intelligence, creating a flywheel of smarter agents, greater usage, and larger rewards.

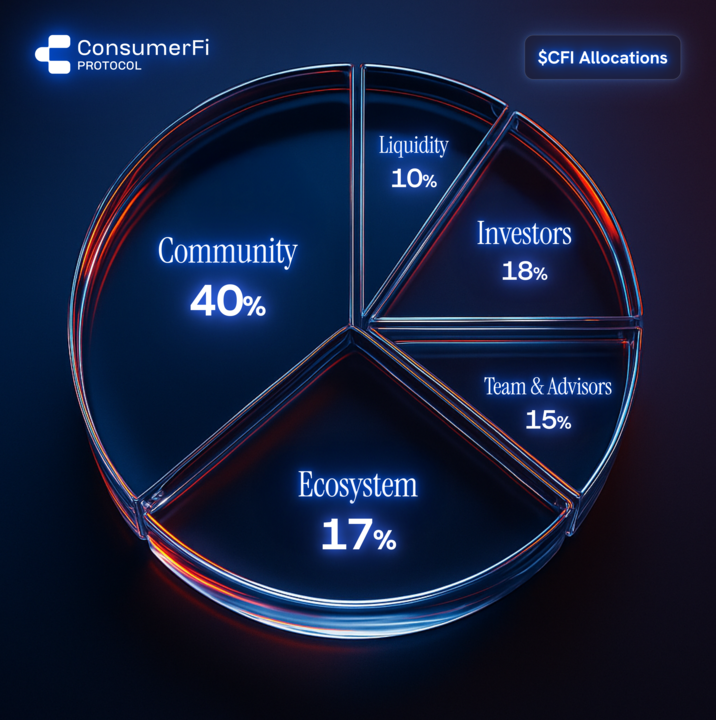

CFI Tokenomics: Fair and Transparent

- Total supply: 1 billion $CFI

- Allocation:

- 40% Community

- 17% Ecosystem

- 18% Investors

- 15% Team & Advisors

- 10% Liquidity

An additional 10% of total supply is reserved for early supporters and partners. Active communities backing ConsumerFi will be rewarded through targeted $CFI campaigns. Half of all protocol revenue drives buyback & burn, directly supporting token value.

ConsumerFi Partnerships

The launch honors early builders and welcomes the next wave. Current partners include DeBlock, Ethos, Myriad, NEAR, PlayEmber, and WallChain. The protocol is backed by top VCs and angels across AI, crypto, and gaming.

ConsumerFi (CFI) Team

A battle-tested crew that has scaled consumer apps to billions of downloads:

- Hugo Furneaux – Leads app development & user acquisition. Founder of PlayEmber (150M+ downloads), pioneer in web3 gaming models.

- David Leer – Heads product. 5+ years as a Web3 founder; built NEAR’s first DEX aggregator; expert in token economics, GraphRAG memory, and aggregation algorithms. Previously managed $63M scope on $500M projects.

- Jon Hook – Drives strategy, growth & BD. Co-founded a mobile ad network acquired by Phunware (NASDAQ); generated 3B+ downloads as CEO of BoomBit, CRO at Homa Games, VP at AdColony; led global ads for Audi, Nike, Paramount at MediaCom/Dentsu.

- Benny Brown – Community & marketing lead. Decade-long NFT builder; founded Bodega Dynamic NFT launchpad on NEAR.

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.