Artificial intelligence is exploding with productivity gains, yet its real-world footprint remains stubbornly narrow—mostly search and content generation. Think back to the internet in the early 1990s: massive hype, but no practical e-commerce rails to unlock scale. Today’s AI faces a parallel bottleneck: large language models (LLMs) can’t move value, lack true decision autonomy, and are opaque enough to be shut out of traditional finance. Wayfinder (PROMPT) smashes that ceiling. It equips user-owned, fully autonomous AI agents—called shells—to roam blockchain ecosystems securely, control dedicated Web3 wallets, and execute transactions independently. At its core is a living, community-grown network of wayfinding paths that turn the sprawling maze of smart contracts into navigable “smart maps.” Shells remember their journeys, learn from every interaction, and share collective intelligence, fueling nonstop evolution.

In this guide we’ll unpack Wayfinder’s big-picture vision, dive into its architecture, explore real-world use cases from gaming to DeFi, and break down its unique human + AI governance model. Buckle up—AI agents are about to conquer the blockchain.

What is Wayfinder (PROMPT)?

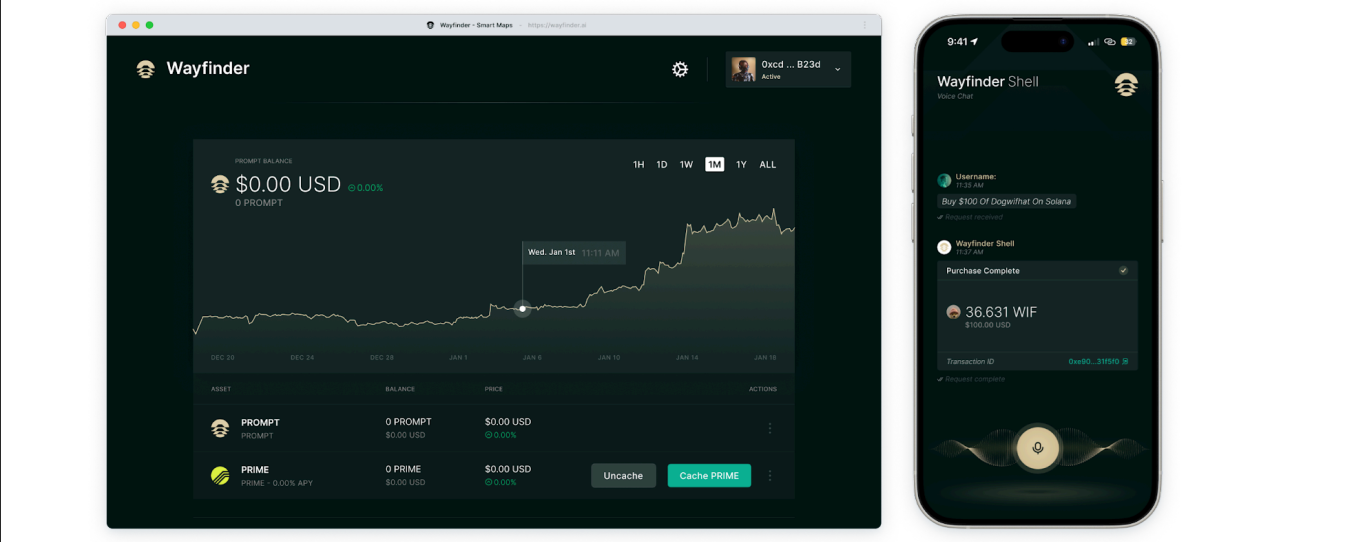

Wayfinder is infrastructure that plugs AI agents into native digital economies. Born as the backbone for Colony, Parallel Studios’ AI-driven survival simulation, it’s now a universal toolkit for developers and everyday users alike. Shells leverage wayfinding paths to locate smart contracts, swap tokens, bridge assets, mint NFTs—all autonomously. Thanks to LLM-powered interfaces, anyone can issue plain-English commands (“Move my USDC from Ethereum to Solana and grab the best DEX rate”) without writing a line of code.

Wayfinder makes cross-chain ops feel like a single click. Bridges, wallets, and protocol quirks vanish under the hood; the shell handles the rest. This slashes Web3’s technical friction and accelerates mass adoption. In gaming, it lets agents mine resources, trade, and strategize inside Colony—and the same tech will soon power sports, finance, and NFT ecosystems. As an extension of the Echelon Prime network, PRIME holders and partners shape early governance.

Core Challenges & Wayfinder Fixes

AI Roadblocks on Blockchain

- Zero Context: Swapping one token requires hunting addresses, parsing contracts, and comparing DEX liquidity—manual, slow, and wasteful.

- Latency Nightmares: Chain speeds can’t keep up with AI’s need for near-real-time decisions.

- Tooling Drought: Blockchain data is expensive or locked behind custom builds.

Wayfinder’s Playbook

Wayfinder indexes contracts into wayfinding paths and stitches them into a graph-based map. Shells query this map semantically, weigh trade-offs (low fees vs. proven reliability), and act. LLM front-ends translate vague instructions into precise execution.

Security First: Shells own their wallets but every transaction needs owner sign-off. Verification Agents stress-test new paths; bad routes trigger stake slashes.

Architecture: Omni-Chain, High-Speed Rails

Built on Solana for velocity yet chain-agnostic, Wayfinder starts with heavyweights—Ethereum, Solana, Base, Cosmos—and expands via community votes.

Key Building Blocks

- Wayfinding Paths – Step-by-step blueprints to any contract (DEX routing, bridging, etc.).

- Ecosystem Graph – Nodes for protocols, contracts, standards (ERC-20, SPL), assets, functions, APIs, and multi-step routines. Stored off-chain for speed; periodic on-chain snapshots for transparency.

- Shells – Unlimited AI agents minted with PROMPT, tapping a shared knowledge vault.

- Verification Agents – Automated + human auditors that green-light paths.

Tech Highlights

- Tailored LLMs – Open-source, fine-tuned for EVM calls; smaller, cheaper, faster than closed giants.

- No-Code GUI – Craft prompts, manage memory, upload files. Plug-ins for Langchain, Llama Index via API key.

- Memory Engine – Conversation logs, short-term tool traces, long-term context. Pin, delete, or expand (paid).

Shells run on explicit intent: no rogue portfolio management or unbounded transfers. In games, they automate grind (mine → sell) but strategy stays with the owner.

Real-World Use Cases

- Colony Survival Sim Parallel Studios’ strategic sandbox. Wayfinder lets agents gather resources, trade, and evolve tactics autonomously while enforcing provable scarcity for generated assets.

- NFT Minting Sidekick Artists drop auction-ready collections; casual users gift personal NFTs. Upload media → optimal chain selection → mint → distribute.

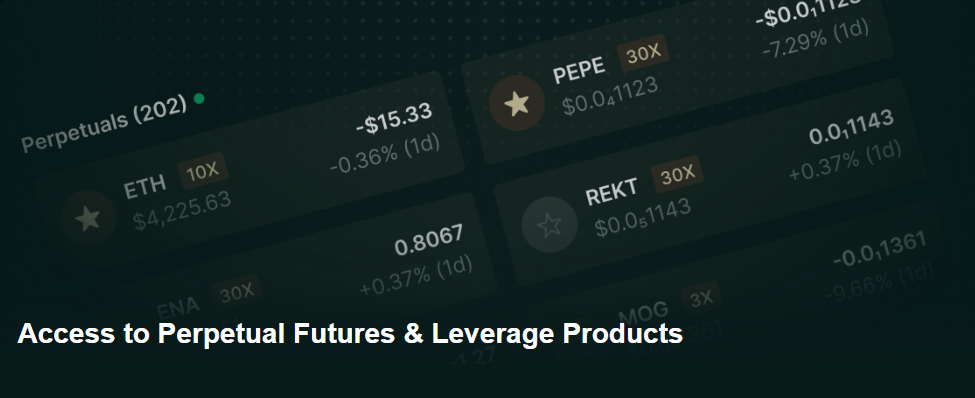

- Smart Trading Bot DCA schedules, VWAP chasing, arbitrage plays—tuned to your risk profile, always owner-approved.

- Web3 Customer Support Pro Feed it company docs; it fields queries with on-chain context baked in.

Future Horizons: Yield farming automation, in-game economy balancing, DeFi signal bots.

The Smart Map: Wayfinder Graph

A node-and-edge web where:

- Protocols bundle apps & assets.

- Contracts are unique-address logic.

- Standards define ERC-20, ERC-721, SPL behaviors.

- Assets carry ticker, address, metadata.

- Functions are callable code snippets.

- Routines chain functions into workflows.

Shells run semantic searches, rank paths by success rate or cost, and pick the winner. RAG pipelines enrich prompts; collective memory turns one shell’s win into everyone’s shortcut.

Path Lifecycle

- Launch Kit: Community scrapes top dApps, LLMs structure data.

- Crowdsourced Growth: Stake tokens to propose; Verification Agents vet; approved paths join the public library and split fees.

- Private Paths: License-only or premium pricing, unverified but isolated.

Bounty Board: Undiscovered routes auto-post rewards; manual bounties welcome.

Security & Risk Shields

- Stake Slashing – Faulty paths burn developer collateral.

- Verification Agents – Run micro-transactions, hunt bugs, claim bounties.

- Path Metadata – Creator rep, volume, success ratio, recent activity.

- Last-Mile Safety – Rent a Verification Agent to test-drive any path with pocket change.

- Compliance Layer – Geo-fencing, sanctioned-address blacklists, third-party audits.

Risk Vectors & Counters

- Translation glitches → Pre-execution confidence scores + owner review.

- Malicious routes → Stake exposure + low-activity warnings.

PROMPT Tokenomics

Max Supply: 1 billion (community-ratified).

Allocation Breakdown

- Private Sale Investors: 13.33%

- Team/Advisors/Contractors: 19.37%

- Public (miners, ICO, etc.): 28.71%

- Masternodes/Staking: 5.00%

- Treasury: 6.48%

- Exchange Hot Wallet: 1.00%

- Liquidity Provision: 3.00%

- Marketing/Ops: 5.28%

- Ecosystem Incentives: 6.54%

- Airdrops/Rewards: 11.29%

Governance: Humans + AI in Harmony

- Token Holders steer direction, staking rules, reward pools.

- Shell Voting capped at ~20% aggregate weight; agents can propose too.

- AI Constitution sets hard behavioral rails and emergency halt triggers.

Echelon Prime community bootstraps the first governance phase.

Team & Contributors

Wayfinder is forged by Kalos, Missionpoole, Occam, and the Parallel crew, deeply integrated with Echelon Prime and driven by open, community-first development.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.