Famed investor Michael Burry, best known for predicting the 2008 global financial crisis, has issued a new warning—this time targeting big tech companies. The “Big Short” legend claims that major technology firms are artificially inflating their profits through accounting practices and hinted that “details will come on November 25.”

Burry: “Profits Are Being Artificially Boosted Through Depreciation Tricks”

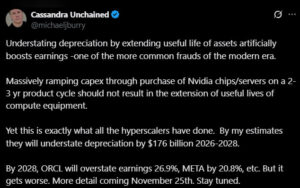

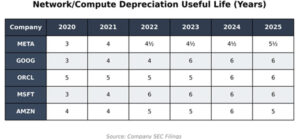

Burry, who famously earned $800 million by shorting the housing market before the 2008 crash, posted on X (formerly Twitter) that tech giants are manipulating their balance sheets. According to him, companies such as Amazon, Google, Microsoft, and Oracle are overstating the lifespan of their servers and hardware to minimize depreciation expenses, making their profit margins appear stronger than they really are.

“Extending the useful life of assets to lower depreciation artificially inflates profits,” Burry wrote. “It’s one of the most common frauds of the modern age.” He added that this issue is especially prevalent in cloud infrastructure powered by Nvidia chips, where hardware with a 2–3 year product cycle is being listed on financial statements as having a lifespan of 5–7 years.

“$176 Billion in Expenses Being Hidden,” Claims Burry

According to Burry, major tech firms are underreporting around $176 billion in depreciation expenses for the 2026–2028 period, misleading investors with inflated profit figures.

He outlined potential impacts on corporate earnings:

- Oracle’s profit margins may be overstated by 26.9%.

- Meta (Facebook) could be reporting profits 8% higher than reality.

Burry warned that this accounting manipulation could have significant long-term effects on tech stock valuations, calling it “a hidden weakness” behind the current tech boom.

.

“More Details Coming on November 25”

Burry ended his post by stating, “More details will come on November 25.” Analysts speculate that he may release a detailed research report or reveal a new investment strategy on that date. His hedge fund, Scion Capital Management, continues to hold short positions against major AI stocks despite their recent rally.

Of his $1.4 billion portfolio:

- 66% is short on Palantir (PLTR)

- 14% is short on Nvidia (NVDA)

This positioning signals Burry’s conviction that the AI-driven tech rally is overextended and that valuations of big tech firms are significantly inflated. Financial analysts view his statements as an early warning against a potential post-2021 tech bubble, similar to his prescient call before the 2008 crisis. Once again, Burry appears to be positioning himself against the crowd, hinting at an approaching market correction led by overvalued technology giants.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.