A major development has emerged in Argentina’s ongoing LIBRA memecoin scandal, which has sent shockwaves through the country’s crypto community. Federal Judge Marcelo Giorgi has ordered the freezing of all assets linked to the LIBRA project, targeting U.S. businessman Hayden Davis and two crypto intermediaries. The ruling escalates the investigation into allegations of fraud involving Argentine President Javier Milei’s name.

LIBRA Assets Officially Frozen

Judge Giorgi’s order includes a “prohibición de innovación” — a legal measure preventing the transfer or alteration of digital assets connected to LIBRA. The freeze applies to Hayden Davis (U.S.), Orlando Mellino (Argentina), and Favio Rodriguez (Colombia), all allegedly involved in the movement of project funds. Prosecutor Eduardo Taino requested the measure based on reports from Argentina’s financial oversight agencies, which estimate that investors may have lost between $100 million and $120 million.

Judge Giorgi stated:

“This decision was made to prevent the suspects from transferring or concealing funds before the trial concludes.”

The ruling was also communicated to all crypto exchanges operating in Argentina, and the National Securities Commission (CNV) has begun freezing LIBRA-related accounts in coordination with the court.

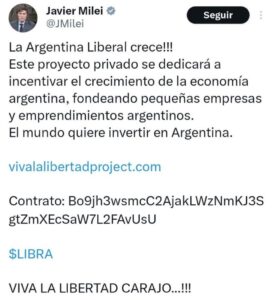

A Scandal Sparked by a Selfie

The investigation began after President Javier Milei posted a selfie with Hayden Davis, referring to him as his “blockchain advisor.” Just 42 minutes after the post, a $507,500 transaction was made through Bitget Exchange.

Blockchain analytics firms TRM Labs and Chainalysis later linked this transfer to withdrawals from LIBRA liquidity pools across Bitget, Gate.io, and Circle. Reports suggest that around $90 million was funneled through consolidation wallets tied to the project. According to Reuters, “the on-chain behavior indicates that these addresses are connected to LIBRA’s internal operations.”

Argentina’s Crypto Community Shaken

The LIBRA incident is now being described as one of the largest crypto fraud cases in Argentina’s history. Experts warn that the association of political figures with crypto projects has severely damaged investor confidence.

Driven by President Milei’s social media influence, LIBRA gained rapid attention by exploiting meme culture — only to collapse within hours. The resulting hundreds of millions in losses have placed Argentina’s financial regulators on high alert.

Political Fallout Intensifies

Launched on the Solana network in February, LIBRA briefly surged after Milei’s post — before crashing almost immediately. Milei later deleted the post, claiming:

“I was not informed of the project’s details. Once I learned more, I chose not to continue supporting it.”

However, leaked messages have further fueled controversy. In one alleged exchange, Davis wrote, “I’m sending money to his sister — she’s doing everything I sign off on. Crazy.” These messages strengthened accusations that Milei’s name was exploited to attract investors.

A Turning Point in Argentina’s Crypto History

The LIBRA memecoin scandal highlights the dangers of unregulated markets and the risks posed when political figures intersect with crypto promotions. Judge Giorgi’s decision marks one of the first large-scale judicial interventions in Argentina’s digital asset space.

New developments in the case are expected to unfold in the coming weeks, as regulators, courts, and the crypto community grapple with the fallout of Argentina’s largest crypto fraud case to date.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.