The end of the 41-day partial U.S. government shutdown is being viewed not only as a step toward restoring economic stability but also as the beginning of a new phase for the cryptocurrency market. Historical data shows that Bitcoin has often rallied sharply following the reopening of the U.S. government, and investors now wonder whether a similar rebound could occur this time.

Historical Perspective: Bitcoin Rallies After Shutdowns

Past U.S. government shutdowns have created short-term uncertainty in traditional markets but have often marked opportunity periods for Bitcoin:

- In February 2018, after the government reopened, Bitcoin’s price jumped around 96% within a short time as risk appetite returned and the crypto market rebounded.

- In January 2019, following the longest shutdown in U.S. history (35 days), Bitcoin surged 157% in the following months.

While it’s debated whether these rallies were caused directly by the reopening itself or by the fiscal stimulus and expansionary monetary policies that followed, the correlation remains striking. Analysts note that the fresh liquidity entering markets after a shutdown tends to boost investor confidence and accelerate the shift toward alternative assets such as Bitcoin.

Liquidity Inflows: The Strongest Catalyst for Bitcoin

The Senate’s vote of 60–40 to end the 41-day shutdown has strengthened the market’s belief that “liquidity is returning.” Liquidity is often described as the most powerful fuel for the crypto market, as new capital inflows typically trigger sharp price moves in major assets like Bitcoin and Ethereum.

Economist Peter Schiff commented on the reopening:

“The news of the shutdown’s end pushed stock futures, gold, silver, and Bitcoin higher simultaneously. This shows the market is preparing to flee a weakening dollar. Rising deficits and inflation fears will drive investors toward alternative assets.”

His remarks highlight that the reopening could spark not only a governmental recovery but also a renewed investor shift toward risk assets. Bitcoin’s ability to hold steady near $105,000 suggests that the market remains in a wait-and-see phase during this transition.

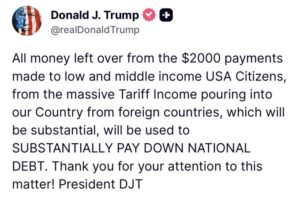

The “Tariff Dividend” Effect: Trump’s New Fiscal Stimulus

Just before the government’s reopening, President Donald Trump introduced a plan that could inject significant liquidity into the economy a proposed “tariff dividend” of $2,000 per U.S. citizen. Though not a direct cash payment, the plan could take forms such as tax reductions or a “no tax on tips” policy, ultimately increasing disposable income and pushing new money into circulation.

Such expansionary fiscal measures have historically fueled Bitcoin rallies most notably in 2020, when pandemic stimulus checks coincided with Bitcoin’s surge from $10,000 to $60,000. Trump’s plan has therefore sparked speculation among investors: “Is another wave of liquidity coming?”

Bitcoin’s Current Situation: Start of a Bull Run or Calm Before a Correction?

Bitcoin is currently trading around $104,500, with relatively muted volatility. On-chain data shows an increase in exchange inflows from short-term wallets, signaling a rise in profit-taking activity.

Analysts agree that Bitcoin stands at a critical crossroads:

- If the government reopening and fiscal stimulus measures are implemented quickly, Bitcoin could enter a new growth cycle.

- If political obstacles delay these plans, Bitcoin might experience a short-term correction, potentially falling below $101,000.

Macro indicators suggest that the 65-month liquidity cycle could peak in early 2026, implying that Bitcoin may currently be in the early accumulation phase of a major mid-term rally.

Can History Repeat Itself?

Bitcoin’s historical performance after previous U.S. government shutdowns gives investors hope:

- +96% in 2018

- +157% in 2019

Today’s setup appears strikingly similar:

The U.S. government is reopening

Fiscal stimulus expectations are rising

The dollar is weakening, and investors are rotating into alternative assets

History may not repeat exactly, but the macroeconomic conditions suggest that Bitcoin could once again be on the verge of a new bull cycle.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.