JUST is a popular decentralized finance (DeFi) ecosystem built on the TRON blockchain. The platform primarily revolves around JustStable, a decentralized stablecoin lending system. JST tokens entered circulation in May 2020, and the platform officially launched in August 2020 through an Initial Exchange Offering (IEO) on the Poloniex LaunchBase platform.

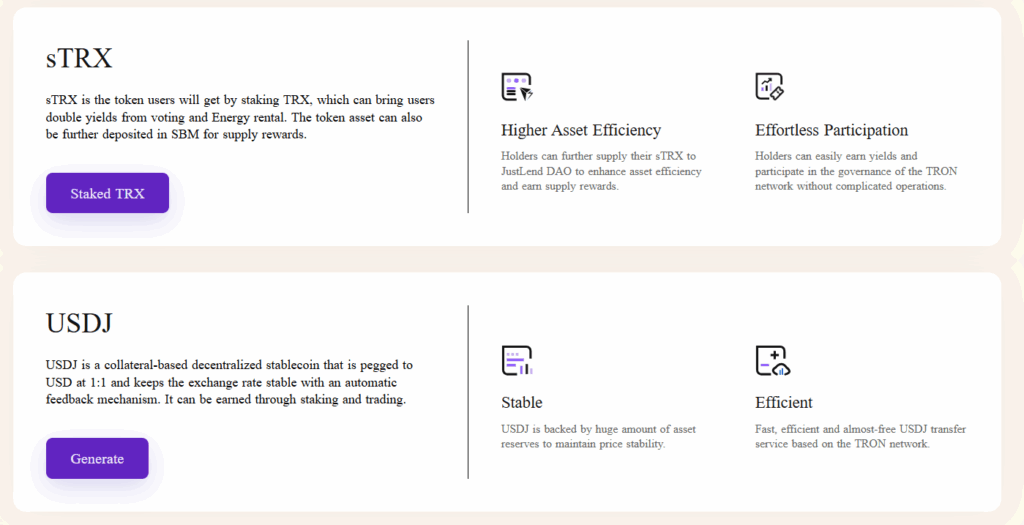

JUST is a two-token ecosystem: USDJ and JST. USDJ is a stablecoin pegged to the US Dollar (USD). JST serves multiple functions on the platform, including paying interest, participating in governance, setting parameters such as interest rates and minimum collateral ratios, and supporting the platform’s sustainability.

Users who want to mint USDJ deposit supported collateral tokens such as TRON (TRX), convert them into PTRX, and lock them as a Collateralized Debt Position (CDP). Depending on the amount of collateral, users can mint USDJ and later repay it to retrieve their collateral.

The JUST ecosystem aims to be a fair and borderless DeFi hub accessible to TRON users. The platform is managed by the JUST Foundation, which includes professionals from companies like Alibaba, Tencent, and IBM.

Team Information and Founders

The JUST team is partially public. Key members include:

-

Terance F: Blockchain expert, former Barclays and IBM employee

-

Elvis Zhang: Senior developer and experienced blockchain researcher

-

C Wu: Wallet and exchange specialist

-

GL Kong: Experienced blockchain engineer and early crypto adopter

The platform was announced by TRON CEO Justin Sun and has received technical and financial support from the TRON team.

Project Concept

JUST aims to build a full DeFi ecosystem on TRON rather than focusing on a single product. The platform offers multiple products covering various DeFi use cases:

-

JustStable: Multi-collateral decentralized stablecoin platform

-

JustLend: TRON-based money market protocol where users can provide liquidity or take low-interest crypto loans

-

JustSwap: Automated Market Maker (AMM) for TRC-20 tokens and permissionless liquidity pools

-

JustLink: The first decentralized oracle system on TRON, securely supplying smart contracts with real-world data

-

Cross-chain tokens: Tokenized versions of BTC, ETH, LTC, and other blockchain assets on TRON

Investors and Partnerships

Following the IEO, the platform has strategic investors and partners:

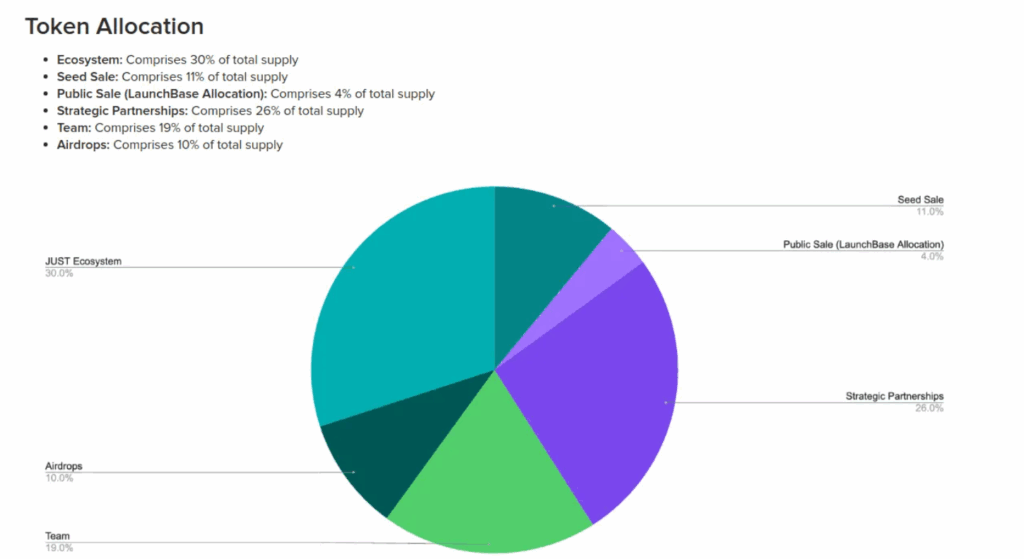

-

Seed Sale: 11%

-

Public Sale (LaunchBase): 4%

-

Strategic Partnerships: 26%

-

Team: 19%

-

Airdrop (for TRX holders): 10%

-

Ecosystem: 30%

The JUST team also collaborates with experts from Alibaba, Tencent, and IBM.

-

JUST Foundation: Includes professionals from leading tech companies and global investment banks.

-

Poloniex: The IEO was conducted on Poloniex LaunchBase.

How the Project Works (USDJ Creation and Stability Mechanism)

-

Deposit Collateral: Users deposit TRX as collateral.

-

Convert to PTRX & Create CDP: TRX is converted into PTRX and locked to create a Collateralized Debt Position (CDP).

-

Mint USDJ: Users can mint USDJ based on the amount of collateral.

-

Retrieve Collateral: Users repay the borrowed USDJ plus accrued stability fees to unlock their collateral.

-

Price Stability Mechanism (Target Rate Feedback Mechanism):

-

If USDJ price is above $1: The system encourages minting more USDJ to increase supply and bring the price down to $1.

-

If USDJ price is below $1: Minting USDJ becomes more expensive, encouraging holding, reducing supply, and raising the price back to $1.

-

Governance

The JUST ecosystem is governed by JST token holders, who can:

-

Select trusted price data providers

-

Set risk management parameters

-

Approve system upgrades

-

Decide on new feature implementation

This governance ensures the platform adapts to market changes while maintaining stability.

Roadmap

JUST follows a community-driven development path. It starts with basic governance and gradually introduces more sophisticated and continuous governance mechanisms. The main goal is to establish USDJ as a core component of the TRON DeFi ecosystem.

Future plans include security improvements, expanding use cases, and strengthening USDJ’s position in the cryptocurrency market.

Token Use Cases

JST tokens are used for:

-

Governance: Voting on protocol parameters and system upgrades

-

Fee Payment: Stability fees on borrowed USDJ are paid in JST

-

Deflationary Mechanism: JST tokens used for stability fees are burned, reducing supply over time

-

Incentives: Users earn JST by depositing collateral, lending, providing liquidity, or participating in special campaigns

Token Information and Distribution

-

Max Supply: 9.9 billion JST

-

Circulating Supply: 9.9 billion JST

Team tokens were fully vested by April 2022. Distribution includes Seed Sale, Public Sale, Strategic Partnerships, Team, Airdrop, and Ecosystem allocations.

Ecosystem and Features

The JUST ecosystem, as of January 2021, consists of five key products:

-

JustStable: Multi-collateral decentralized stablecoin platform for USDJ

-

JustLend: TRON-powered money market protocol for liquidity provision and low-interest loans

-

JustSwap: AMM platform for TRC-20 tokens and permissionless liquidity pools

-

JustLink: TRON’s first decentralized oracle system

-

Cross-chain Tokens: Tokenized BTC, ETH, LTC, and other blockchain assets usable within the JUST ecosystem

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.