Alchemix is a decentralized finance (DeFi) platform operating on the Ethereum blockchain. Its primary goal is to allow users to borrow against their collateral while simultaneously earning yield on that collateral through an innovative financial model. The platform is particularly notable for its self-repaying, interest-free, and non-liquidating loans.

Additionally, Alchemix supports synthetic asset generation and integrates with DeFi protocols, enabling users to access the future yield of their collateral immediately.

Team Information

The core Alchemix team consists of developers experienced in DeFi and Ethereum. Among the founders, Tobie Langel is recognized as the key figure shaping the project’s technical vision.

Team members specialize in DeFi protocols, yield farming strategies, and Ethereum development. Although official documents provide limited details about the team, Alchemix maintains a community-focused approach.

Investors and Key Partnerships

Alchemix launched without a pre-sale or external funding. However, the project relies on integration with key DeFi protocols for functionality:

-

Yearn Finance: Alchemix uses Yearn’s yVaults for collateral yield generation.

-

DEXs / DEX Aggregators: alAssets can be swapped for other tokens on decentralized exchanges like Uniswap and Sushiswap.

Project Concept

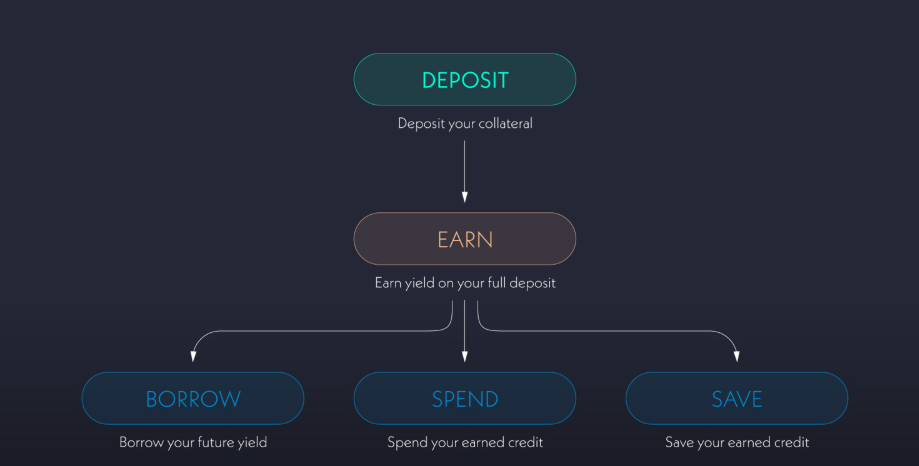

Alchemix allows users to deposit collateral and mint alAssets (synthetic debt tokens). These tokens represent future yield, automatically paying down users’ debt. This allows borrowing without losing collateral or paying interest.

How the Project Works

-

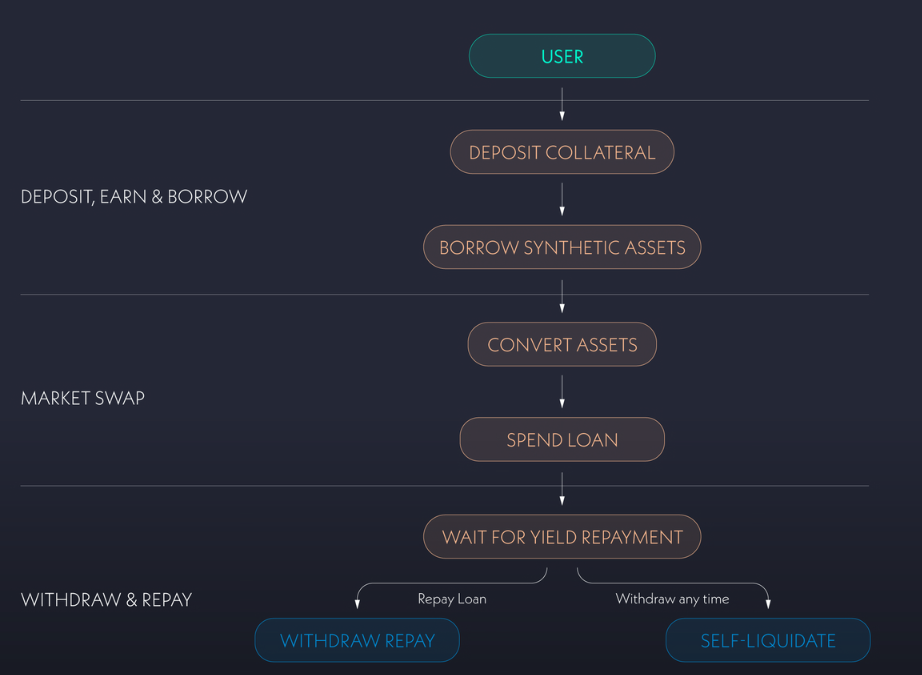

Deposit, Earn & Borrow: Users deposit collateral (e.g., DAI, ETH, or yield tokens). The platform generates yield from the collateral, which automatically reduces debt.

-

Minting alAssets: Users mint alAssets against their deposited collateral (e.g., deposit DAI to mint alUSD).

-

Yield Management & Debt Repayment: Generated yield is applied to repay debt automatically. Users may also withdraw collateral to manually repay debt.

-

Flexible Usage: alAssets can be used on DEXs or other DeFi protocols.

Governance

Alchemix is governed by ALCX token holders, who vote on protocol changes and upgrades. This ensures a fully decentralized, community-driven governance structure.

Roadmap

Key objectives include:

-

Expanding L2 and Ethereum integrations

-

Developing AI-powered blockchain exploration tools

-

Enhancing user experience and data visualization

-

Supporting new collateral types and alAsset creation strategies

Token Utility

The ALCX token is used for both governance and incentives:

-

Voting on protocol proposals

-

Rewards for liquidity providers

-

Participation in staking and liquidity pools

Token Information

-

Token Name: ALCX

-

Token Standard: ERC-20

-

Total Supply: 2.61M ALCX

-

Max Supply: Not specified

-

Circulating Supply: 2.5M ALCX

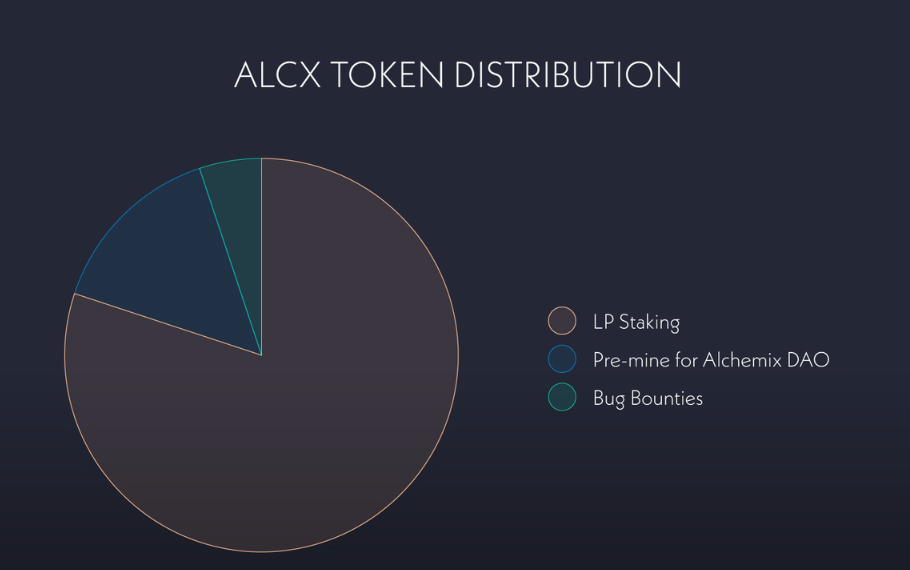

Token Distribution

-

LP Staking: 80% to liquidity providers and stakers (64% of total supply after 3 years)

-

Alchemix DAO Pre-mine: 15% for protocol treasury

-

Bug Bounties: 5% for security incentives

-

Founders, Developers & Contributors: 16% private staking pool for project contributors

Ecosystem

Alchemix ecosystem includes:

-

Alchemists: Smart contracts managing user accounts and collateral.

-

alAssets: Synthetic debt tokens (e.g., alUSD, alETH).

-

Transmuter: Manages yield and fee distribution.

-

Yield Strategies: Ensure collateral generates returns through DeFi protocols.

Key Features

-

Self-repaying, interest-free loans

-

Flexible borrowing and repayment against collateral

-

No risk of forced liquidation (managed via self-liquidation)

-

Access to multiple yield strategies for collateral growth

-

Decentralized governance and community-oriented protocol

-

Integration with various tokens and stablecoins

Official Links & Social Media

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.