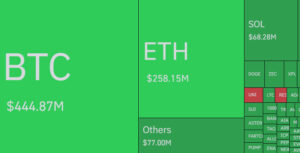

The crypto markets faced sharp turbulence today. Bitcoin’s price dropped rapidly from $99,000 to $97,000, triggering intense selling pressure and resulting in the liquidation of roughly $440 million worth of long positions. This sharp move once again demonstrated how vulnerable the market remains in the face of high leverage.

Million-Dollar Long Liquidations: Market Shocked

The rapid decline across the crypto markets led to an increase in forced closures on major exchanges where leveraged trading is active. Long positions opened with bullish expectations were left defenseless against the sudden pullback.

Key factors that triggered the liquidations:

- The steep and rapid drop in Bitcoin’s price

- Highly leveraged positions hitting liquidation thresholds

- Overall market weakness and the fast spread of selling pressure

During this process, liquidation heatmaps clearly showed waves of forced exits across platforms.

Bitcoin Drops From $99,000 to $97,000

Bitcoin’s fall from $99,000 to $97,000 within just a few minutes instantly suppressed market risk appetite and caused investor sentiment to deteriorate rapidly. The sudden drop broke key technical support levels to the downside, triggering algorithmic selling and further intensifying selling pressure. The steep short-term decline caused leveraged positions to be liquidated in a cascading manner, once again exposing how fragile the market’s overall liquidity structure is.

This abrupt movement mirrors the occasional large-scale liquidation waves seen in the past and clearly reflects the market’s sensitivity to high leverage. For investors, the biggest risk of such rapid pullbacks is that automatic liquidations kick in before they can manually intervene, forcing positions to close involuntarily.

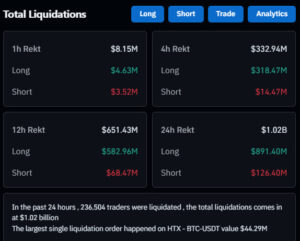

$1 Billion Liquidated in 24 Hours: 236,504 Investors Affected

Daily data paints an even more dramatic picture:

- Total liquidations reached $1 billion

- 236,504 investors lost their positions

- A single liquidation over $44 million occurred on HTX in the BTC-USDT pair

These numbers clearly show how intense the selling pressure has been across the market.

Excessive Leverage Makes Markets Fragile

The large liquidations of the past hours once again proved how sensitive the crypto markets are to high leverage. Bitcoin’s drop to $97,000 severely impacted both leveraged positions and overall market psychology. In the short term, volatility is expected to continue; however, the market’s reaction to these sharp movements will determine direction in the near future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.