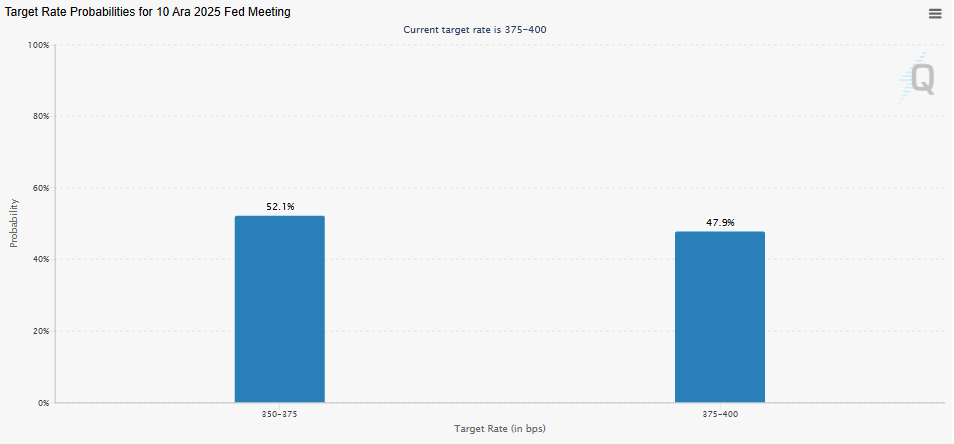

As December approaches, market attention is firmly centered on whether the Federal Reserve will deliver a rate cut at its final meeting of the year. According to the latest readings from the CME Group’s FedWatch Tool, expectations remain volatile but are currently pointing to a renewed — though fragile — probability of a rate reduction. After falling below the 50% threshold yesterday, rate-cut odds have once again risen above that level.

CME Data: Where Do Rate Expectations Stand?

The FedWatch Tool shows a divided market outlook ahead of the December 10 FOMC meeting:

-

350–375 bps: 52.1%

-

375–400 bps (current level): 47.9%

The narrow gap between the two outcomes highlights persistent uncertainty. While the market is leaning slightly toward a rate cut, confidence remains weak and highly sensitive to incoming data.

Mixed Signals From Federal Reserve Officials

Comments from Fed policymakers offer little clarity regarding the December decision. Their statements reflect both caution and concern, making it difficult for markets to form a definitive expectation.

Fed official Hammack outlined several risks and pressures shaping the outlook:

-

The unemployment rate is near its maximum sustainable level.

-

Inflationary pressures remain elevated.

-

Monetary policy may need to stay “restrictive” for longer.

-

Inflation is still high and appears to be firming rather than easing.

-

Softening labor market conditions are complicating the Fed’s employment mandate.

These remarks imply that the Fed may not be in a rush to pivot toward easing.

Similarly, Neel Kashkari maintains a cautious stance, emphasizing that inflation remains around 3%. He noted that he has “no strong inclination” toward a December rate cut at this stage.

Data Gaps Add to Market Uncertainty

The 43-day U.S. government shutdown created additional complications for economic forecasting. The disruption prevented the release of complete labor-market data for October.

White House officials acknowledged that the true unemployment rate for the month may remain unknowable.

Senior Adviser Hassett explained that only part of the employment report could be produced, meaning the unemployment component would not be fully captured. Although the government reopened on October 13, the missing dataset adds another layer of ambiguity to the Fed’s assessment process.

A Fragile Outlook Ahead of the December Meeting

While market pricing has shifted back toward favoring a December rate cut, the direction remains far from certain. High inflation, uneven labor-market indicators and cautious commentary from Fed officials all challenge the likelihood of a decisive policy shift.

As a result, the December meeting is shaping up to be one of the most pivotal of the year — a moment when clearer data and a more unified stance from policymakers will be essential for establishing the next phase of monetary policy.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.