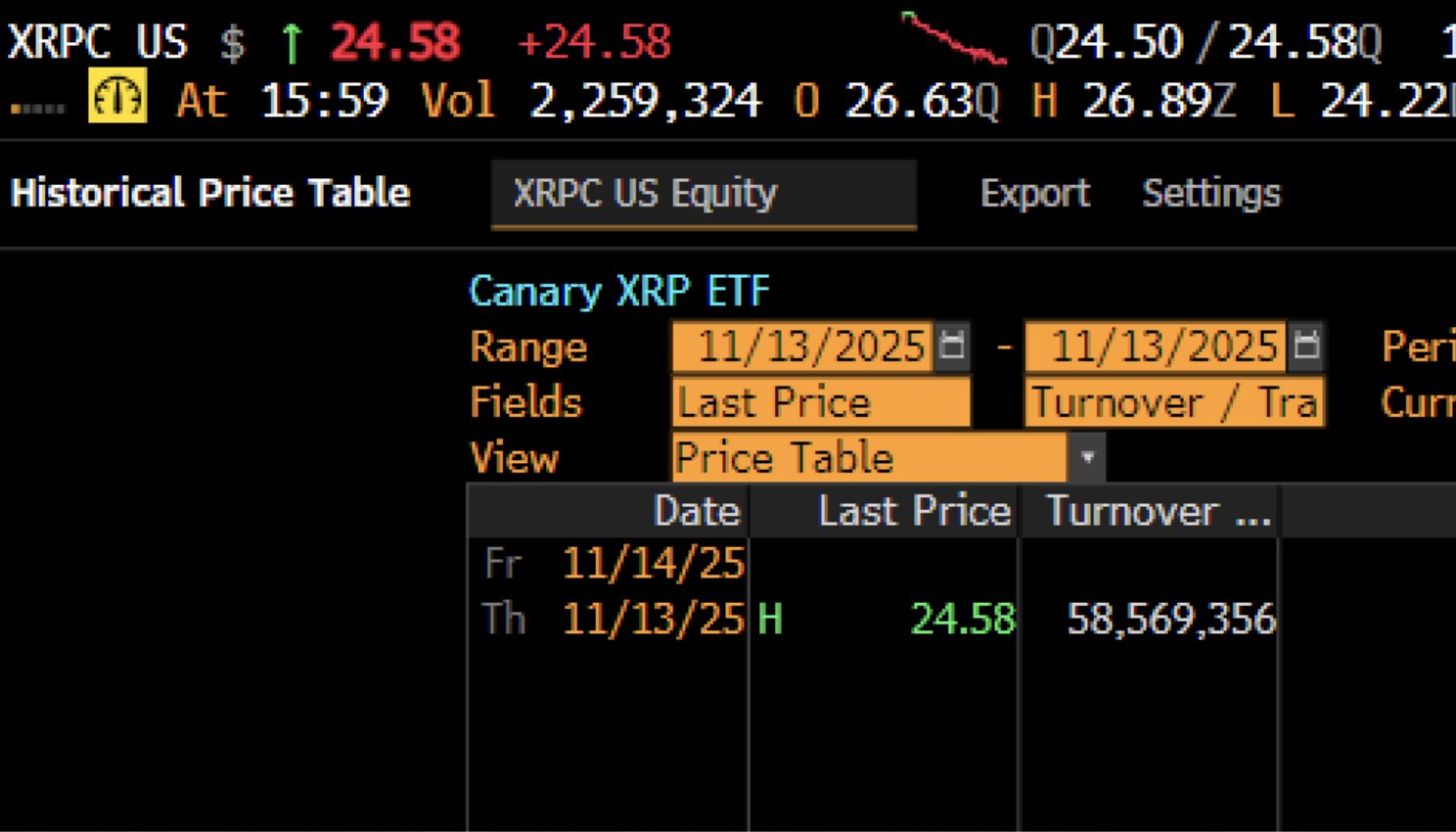

The year 2025 has opened with remarkable momentum for crypto-linked exchange-traded funds, and leading the charge is the newly launched spot XRP ETF from Canary Capital. The fund, trading under the ticker XRPC, made a historic debut as the first U.S.-listed spot ETF focused on XRP. On its first day, XRPC generated $58 million in trading activity, marking the strongest opening among more than 900 funds introduced so far this year. Bloomberg ETF analyst Eric Balchunas highlighted the launch as one of the standout ETF debuts of 2025.

Bitwise’s Solana ETF Close Behind

XRPC’s impressive entrance narrowly outperformed Bitwise’s Solana-focused ETF, BSOL, which recorded $57 million in first-day volume. The tight competition between these two products underscores the growing rivalry among leading altcoin-based ETFs. Their early success positions XRP and Solana as the two dominant players in the digital asset ETF landscape heading into 2025.

Notably, the third-ranked fund of the year trailed these leaders by roughly $20 million in opening-day activity. This gap signals a heightened appetite for large-cap altcoins, particularly XRP and Solana, among both retail and institutional participants.

Institutional Demand for Altcoins Gains Strength

The strong debut of the XRPC ETF highlights an important trend: institutional capital is increasingly expanding beyond bitcoin and ether to include other major digital assets. While XRP’s spot price did not immediately react with a major surge, the fund’s volume clearly reflects rising demand for regulated, accessible investment vehicles tied to alternative blockchain networks.

The spot ETF format enables a broader pool of investors to gain exposure to assets like XRP, which has long been integrated into real-world payment systems. This easier access could amplify interest in the XRP Ledger’s scalability and cross-border settlement capabilities.

Can XRPC Maintain Its Momentum?

Despite the record-setting launch, questions remain about whether XRPC can sustain this pace in the coming weeks. Market observers are watching closely to see if opening-day enthusiasm translates into consistent inflows and long-term investor engagement.

The long-debated value proposition of XRP—centered on high-throughput transactions and practical payment utility—may play a decisive role in shaping the ETF’s performance over time. As institutions continue to evaluate blockchain-based settlement solutions, these fundamentals could support ongoing demand.

Looking ahead, the evolving competition between XRP- and Solana-focused ETFs is set to become one of the defining storylines of 2025. Their performance will offer valuable insights into how quickly institutional adoption of alternative digital assets is accelerating.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.