As the Federal Reserve’s (Fed) December meeting draws closer, expectations for a potential rate cut are becoming increasingly polarized within the institution. Remarks from Fed officials Lorie Logan and Stephen Miran have revealed a clear split, adding uncertainty to the policy outlook and prompting markets to reassess the likelihood of a shift in interest rates.

FED Lorie Logan: “Conditions Do Not Support a Cut in December”

Lorie Logan, known for her hawkish stance, made it clear that she does not support a rate cut at the upcoming meeting. Logan had already opposed a reduction in October, citing persistent inflation risks, and her latest comments reaffirm that stance.

According to Logan, recent data does not provide convincing evidence that inflation is easing fast enough. She emphasized that price pressures remain above target and that the downward trajectory is not yet strong or sustained.

Logan stated:

“When I look toward the December meeting, I would need to see strong evidence that inflation is falling faster than expected or that the labor market is cooling more significantly than the gradual slowdown we have observed. Without that, it is difficult to support another rate cut.”

FED Stephen Miran: “Recent Data Supports a More Dovish Approach”

In contrast, Fed official Stephen Miran argues that the economic indicators since September have shifted in favor of easing monetary policy. Miran believes the data now presents a compelling case for a more accommodative stance.

He pointed out that inflation has performed better than anticipated and that the labor market has weakened in a noticeable way. For Miran, these factors suggest that a tighter policy posture is no longer necessary.

“All the data we have received supports a more dovish view. Under these conditions, we should be moving toward easing rather than the opposite,” he said.

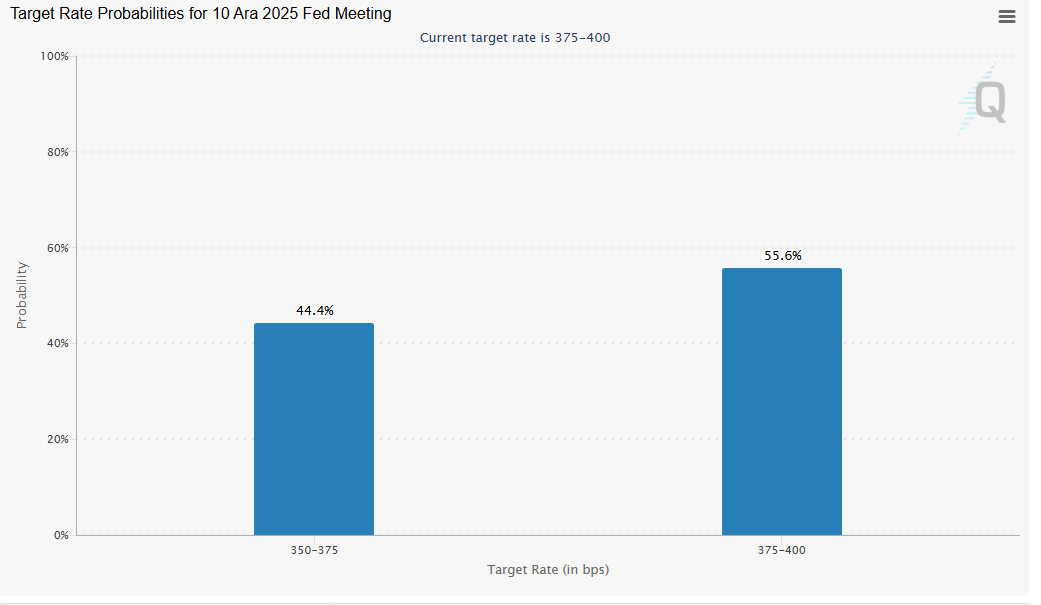

CME FedWatch Data: Market Expectations Tilt Slightly Toward a Hold

The latest CME FedWatch Tool projections illustrate how traders are pricing in the upcoming decision. With 25 days remaining until the December 10 FOMC meeting, probabilities stand as follows:

-

350–375 bps: 44.4%

-

375–400 bps (no change): 55.6%

-

400–425 bps: 0%

These figures indicate that markets currently see a hold as the most likely outcome.

As the meeting approaches, the divergence between Logan and Miran will continue to shape market sentiment, signaling that the Fed’s internal debate may be far from settled.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.