As the crypto market starts the week on a weak note, Bitcoin remains stuck around the $95,000 range. Although total market capitalization is moving sideways at around $3.20 trillion, global economic developments and regulatory uncertainty are reducing risk appetite. The market decline is being shaped not only by price action but also by macro pressures coming from the U.S. and Asia.

Macroeconomic Pressure: Fed Uncertainty and U.S. Data Are Stressing the Market

Following the end of the U.S. government shutdown, markets shifted their focus to inflation and employment indicators. However, announcements that some key economic reports will not be released increased uncertainty surrounding the Fed’s potential interest rate cuts. This has put pressure on risk assets and accelerated sell-offs in the crypto market.

Statements from Fed officials indicating that expectations for “early easing” should be reduced have made investors more cautious. The subsequent declines in the Nasdaq and S&P 500 pushed the selling pressure from tech stocks into crypto. With weakened expectations for rate cuts, liquidity tightens — a development that undermines the support Bitcoin needed to stay above $100,000.

Regulatory Uncertainty: Moves From Japan and the U.S. Are Taking Effect

Japan’s plan to classify digital assets under insider trading regulations has created new uncertainty. The framework is expected to cover 105 crypto assets, slowing institutional investor activity. In the U.S., oversight procedures targeting major crypto companies are expected to accelerate. These developments are placing pressure on ETF demand, making it harder for the market to gain strength.

MicroStrategy Discussions Weaken Market Sentiment

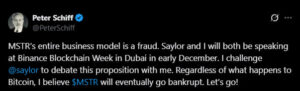

Comments from Peter Schiff — claiming that MicroStrategy operates with high-yield preferred shares, excessive debt, and an unsustainable financing model — also briefly damaged investor confidence. His “death spiral” warning raised doubts about the biggest corporate buyer of Bitcoin. While these discussions do not alter the long-term trend, they negatively impact sentiment in an already fragile market environment.

Market Outlook: TOTAL Holding at Critical Support

The total market cap (TOTAL) remains stable around $3.20 trillion. In recent days, it has fluctuated between $3.21 and $3.16 trillion, holding a strong support zone. Staying above $3.16 trillion prevents a deeper correction. But a close below this level could widen the decline toward $3.09 trillion. On the upside, breaking $3.21 trillion would strengthen the potential for recovery toward $3.26 trillion, and eventually $3.31 trillion.

Bitcoin: Critical Battle Around $95,000

Bitcoin is currently trading at $95,494, holding this range for several days and maintaining its psychological support zone. This level is the strongest buffer against further downside. But if BTC drops below $95,000, a sharp move toward $91,521 support could be triggered.

Breaking this support would turn weak investor sentiment into deeper selling pressure. For Bitcoin to ease the downward momentum, it first needs to reclaim $98,000. A sustained move above this level opens the door back to $100,000, invalidating the bearish outlook entirely.

Multiple Risks Behind the Continued Decline

The drivers of today’s decline can be summarized as follows:

- Weakening expectations for Fed rate cuts + strong U.S. economic data

- New crypto regulations emerging in Japan

- Sharp pullback in U.S. tech stocks

- Weakening ETF demand

- MicroStrategy-related concerns and corporate risk discussions

Even so, total market capitalization remains above critical support. Bitcoin’s short-term direction now depends heavily on its reaction within the $95,000–$100,000 range.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.