The Japanese government is preparing a massive 17 trillion yen (approximately 110 billion USD) stimulus package to stop the economic contraction and revive growth. While global markets closely monitor this development, analysts are debating what it could mean for Bitcoin and the broader crypto market. Rising global liquidity typically boosts flows into risk assets, leading many to believe Bitcoin could benefit significantly.

First Economic Contraction After Three Quarters: Why Is Japan Taking This Step?

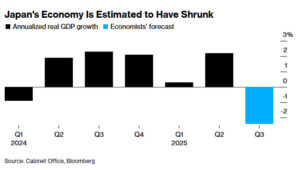

Japan’s economy contracted by 1.8% annually in Q3, ending its six-quarter streak of growth. Although economists expected a deeper contraction of -2.4%, the slowdown was enough to push the government toward stronger fiscal support.

Yoshimasa Maruyama (Chief Economist, SMBC Nikko Securities) stated:

“The GDP figures show a temporary loss of momentum. We expect the Japanese economy to return to a moderate recovery trend.”

The government prioritizes protecting consumers from rising prices and supporting strategic sectors.

Fiscal Stimulus While the Central Bank Signals Rate Hikes

Interestingly, Japan is experiencing a divergence in policy. While the government prepares massive fiscal stimulus, the Bank of Japan (BOJ) is hinting at a possible rate hike.

- BOJ kept interest rates at 5%

- BOJ Governor Kazuo Ueda suggested a potential rate hike in December

This mismatch could create volatility in the yen. Analysts believe stimulus will increase liquidity, while rate hike signals may weaken the yen further.

Liquidity Surge: What Does It Mean for Bitcoin?

Japan’s multi-trillion yen stimulus may weaken the yen and push investors into higher-return assets. Historically, when the yen weakens:

- Japanese investors seek alternative stores of value

- Global liquidity rises

- Bitcoin often reacts strongly

A macro analyst summarized:

“When Japan opens the fiscal taps, capital flows outward, global liquidity rises, and Bitcoin reacts first. If this package is approved, it could become one of Bitcoin’s strongest macro tailwinds going into 2026.”

Bitcoin has historically performed well during currency devaluation cycles.

Signs of Global Liquidity Expansion: U.S. and China Join In

Japan’s actions align with global liquidity expansion trends:

- S. government shutdown ended

- Treasury General Account holds $960B

- Around $300B may flow out in coming weeks

- Fed is nearing a pause in QT (quantitative tightening)

- China’s central bank injected over 1 trillion yen in recent liquidity operations

These signals suggest the global tightening cycle of 2021–2023 is reversing.

Bitcoin: Bear Trap or Major Opportunity?

Despite recent weakness (BTC trading around $95,300), some analysts see a potential bear trap:

- Liquidity expansion favors Bitcoin

- Macro conditions are slowly shifting positive

- Current price compression may precede a strong trend shift

Analyst Bull Theory explained:

“This doesn’t mean instant bull market, but expanding liquidity increases the chance that BTC’s current weakness is a bear trap.”

Japan’s Stimulus Could Become a Major Macro Catalyst for Bitcoin

The massive stimulus package combined with global liquidity easing could provide a powerful macro boost for Bitcoin. A weaker yen, rising global liquidity, and increased demand for inflation-resistant assets all support Bitcoin’s long-term appeal. The coming weeks will show how the Japanese economy responds and how much of this giant stimulus flows into global markets including Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.