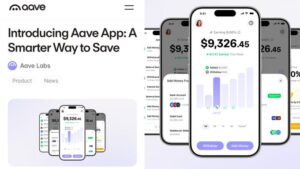

AAVE, one of the most established projects in the DeFi sector, is taking a major step that will bring traditional finance and decentralized finance closer together. The company is preparing to launch a new financial application on the Apple Store that aims to offer consumers attractive, high-yield opportunities. This move is considered one of the most significant steps in AAVE’s strategy to reach the masses.

A Gateway From AAVE to Traditional Users

Until now, AAVE has mostly served crypto-native users. However, the new Apple Store application will give AAVE the chance to engage with a much broader global audience and make DeFi products more accessible for mobile users. The main goals of the app can be summarized as follows:

- Offering users higher yields compared to traditional savings accounts

- Presenting DeFi yield models through a simple and user-friendly interface

- Providing an easy entry point for users who are unfamiliar with crypto

- Expanding the reach of the AAVE protocol on a global scale

It is stated that the application will present AAVE’s liquidity pools to end-users in a simplified and easy-to-understand format.

What Is Aave (AAVE)?

Aave is a decentralized DeFi protocol that allows users to lend their crypto assets and earn interest, borrow against collateral, and execute various investment strategies. The protocol was originally launched as ETHLend in 2017 and used a peer-to-peer (P2P) model. In 2018, it rebranded to Aave and evolved into a much more efficient, pool-based liquidity model. “Aave” means ghost in Finnish.

Initially operating only on Ethereum, Aave is now available on multiple networks including Polygon, Avalanche, Fantom, Arbitrum and Optimism. One of Aave’s standout features is its liquidity pool mechanism: lenders deposit assets into pools, and borrowers can instantly draw loans from these pools.

A Strategic Transformation: DeFi Goes Mainstream

According to analysts, this initiative shows that AAVE aims not only to serve crypto enthusiasts but also to reach the wider consumer base accustomed to traditional banking apps. This could create two major advantages for the protocol:

- A potential increase in AAVE’s total liquidity

- The opportunity to attract traditional investors into the DeFi universe

This move is also seen as a strong step toward the long-awaited “mainstream adoption” goal within the DeFi sector.

A New Bridge Between DeFi and Mobile Finance

AAVE’s decision to launch a high-yield financial app on the Apple Store could mark a major breakthrough for the DeFi ecosystem. It represents the beginning of a new era for both institutional and retail users. This initiative has the potential to accelerate DeFi adoption, attract fresh liquidity to the AAVE ecosystem, and spark new competition in the mobile finance space.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.