aPriori is an intelligent coordination layer designed to create an efficient and coordinated ecosystem on high-performance blockchains. The project brings together validators, traders, and data flows to provide speed, liquidity, and efficiency comparable to traditional exchanges in the DeFi space. At its core, aPriori integrates four main pillars that combine smart trade execution, MEV optimization, and robust staking infrastructure:

Order Flow Segmentation Engine: An AI-powered system that classifies trades in real-time and collects data to optimize routing efficiency.

Swapr: An AI-based DEX aggregator that routes “clean” trades to liquidity pools while redirecting toxic flows to other venues.

MEV Infrastructure: A specialized MEV auction system that increases user fees and validator rewards.

aprMON (Liquid Staking Token): A liquid staking token that combines staking and MEV revenue.

Together, these components create a high-efficiency flywheel within the aPriori ecosystem.

Team and Founders

The founding team of aPriori consists of experienced professionals in crypto and finance:

-

Olivia Z. – Co-Founder: Previously a senior software engineer at Coinbase, Olivia graduated from Dartmouth College with degrees in Computer Science and Economics.

-

Ray S. – Co-Founder: Contributed to Pyth Network and has worked at Jump Trading, Jump Crypto, and Flow Traders.

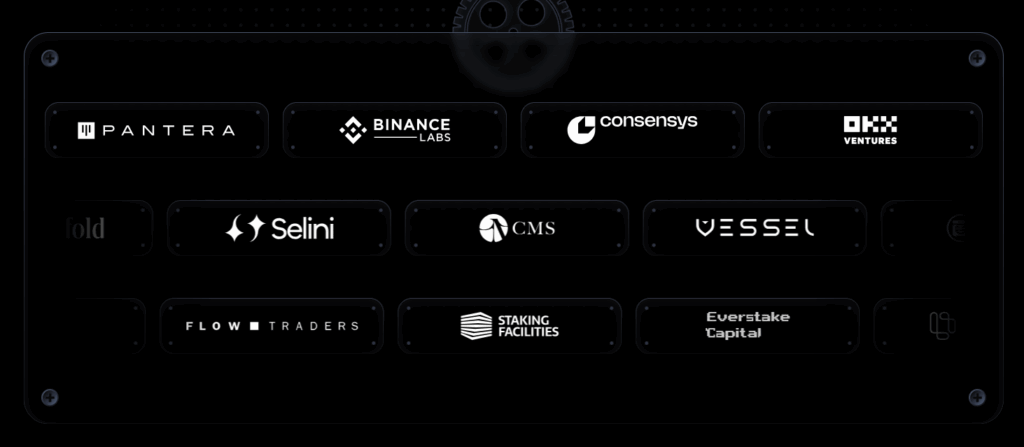

Investors and Partnerships

aPriori has successfully attracted strong institutional support in the DeFi space, raising approximately $30 million across various funding rounds.

Key Investors and Partners:

-

Pantera Capital

-

HashKey Capital

-

P. Ventures

-

OKX Ventures

-

CMS Holdings

-

IMC Trading

-

Consensys

-

Autodesk, NewSpring Capital, PBJ Capital, Oyster Angel Fund, Sigma Partners, Sigma Prime Ventures, Gutbrain Ventures, GEM, Gate Labs, Ambush Capital, Big Brain Collective

Project Concept and Working Principle

The main goal of aPriori is to coordinate fragmented trades on high-speed blockchains to enhance efficiency. To achieve this:

-

It segments and routes transaction flows using AI.

-

Optimizes liquidity via Swapr and ensures fair pricing.

-

Captures MEV opportunities to increase rewards for users and validators.

-

Provides liquid staking via aprMON, giving users access to staking rewards and other DeFi opportunities.

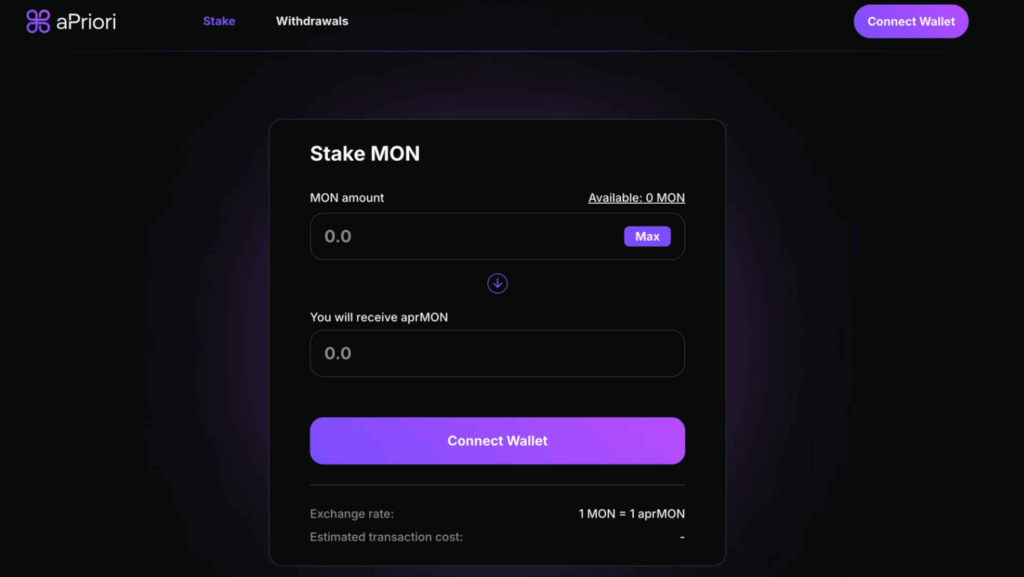

Staking and aprMON Token Structure

aprMON uses a reward-bearing token model:

-

The number of tokens remains fixed; staking rewards increase the token’s value over time.

-

Users can earn staking rewards while using aprMON for DeFi liquidity.

-

Liquid staking removes the complexity of running a validator or delegating.

Governance

$APR token holders will participate in protocol governance as the ecosystem grows, enabling engagement in validator coordination, liquidity management, and the data economy.

Roadmap

Completed – Q1 to Q3 2025:

-

LST infrastructure deployed on Monad Testnet

-

Partnerships within the Monad ecosystem

-

Swapr introduction and Order Flow Segmentation Engine launch

-

$APR token distribution event

Q4 2025 – Mainnet Activation:

-

LST and MEV infrastructure deployment

-

Swapr mainnet launch

-

Liquidity incentive programs and validator alignment

Q1 2026 – Ecosystem Expansion:

-

Monad DeFi integrations

-

Performance dashboards and ecosystem growth programs

Q2–Q4 2026 – Governance and Network Evolution:

-

Governance v1 enables $APR holders to participate in protocol governance

-

Swapr v2 with AI-powered predictive routing

-

Tokenized data marketplace activation

Token Information and Use Cases

-

Token: $APR

-

Total Supply: 1,000,000,000 APR

-

Max Supply: 1,000,000,000 APR

-

Circulating Supply: 185,000,000 APR

-

Use Cases: Validator and staker coordination, liquidity incentives, governance, and DeFi ecosystem integration

-

Token Model: Reward-bearing (compatible with aprMON)

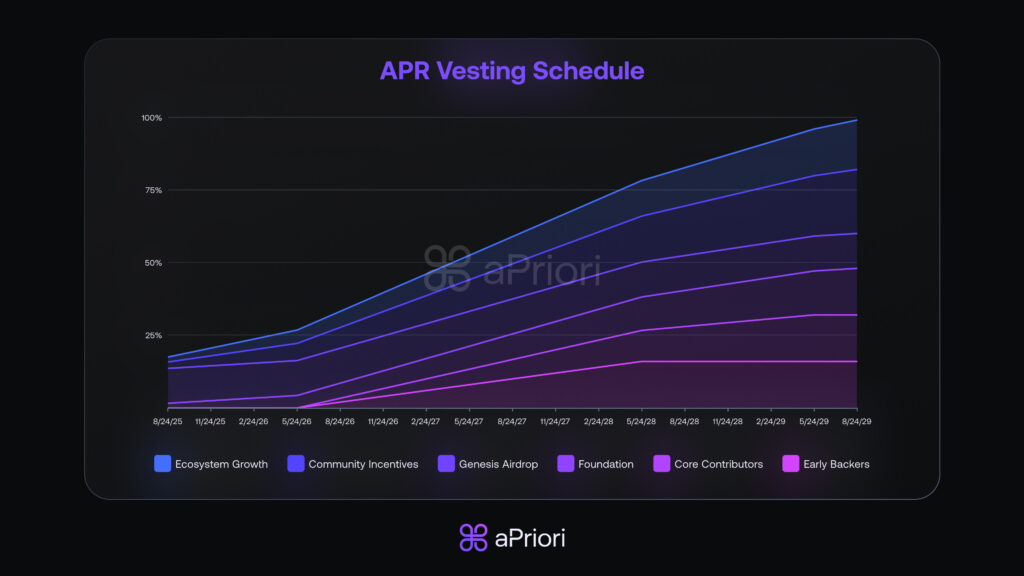

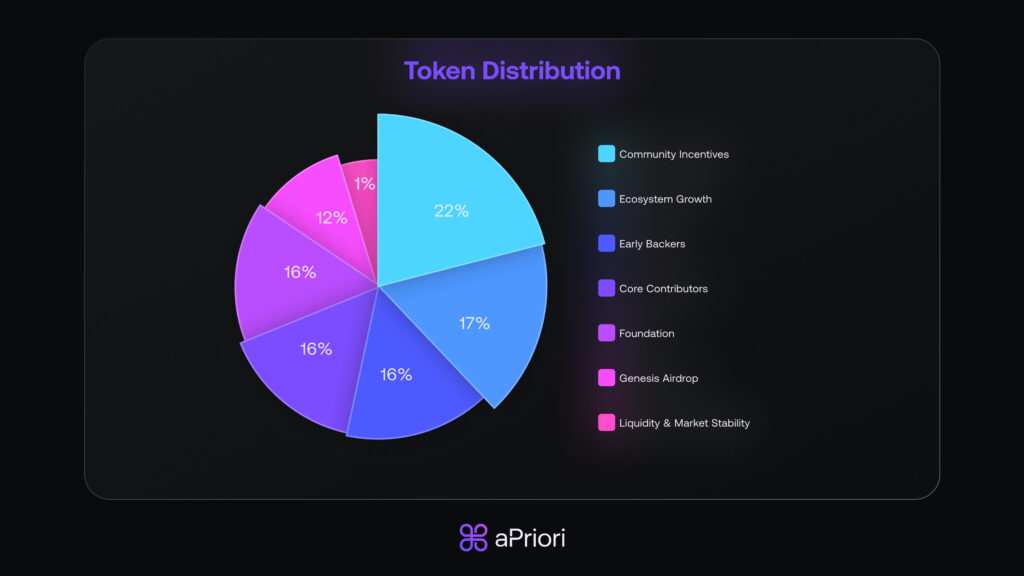

Token Distribution

-

Early Backers: 16%

-

Core Contributors: 16%

-

Foundation: 16%

-

Genesis Airdrop: 12%

-

Community Incentives: 22%

-

Ecosystem Growth: 17%

-

Liquidity & Market Stability: 1%

Ecosystem

aPriori’s ecosystem is primarily built around high-performance blockchains and MEV-sensitive DeFi protocols.

-

Monad Ecosystem: aPriori is a liquid staking project planned on Monad, directly tied to the ecosystem’s growth.

-

Validators and Traders: Core users of the ecosystem that enhance transaction execution efficiency.

-

Stakers: Community members providing liquidity and staking $APR tokens to earn rewards.

Features

-

MEV-Aware Infrastructure: Designed to minimize MEV exploitation in transaction ordering and execution.

-

Liquid Staking: Optimizes returns while maintaining liquidity for users.

-

Intelligent Coordination: Provides seamless coordination among validators, traders, and data systems.

-

Reward Redistribution: MEV revenue is fairly distributed to stakers and validators.

-

High Performance: Focused on efficiency for high-throughput blockchains like Monad.

aPriori strengthens coordination among validators, traders, and DeFi users, creating a sustainable and efficient ecosystem on high-performance blockchains.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.