The sharp decline in the cryptocurrency market has unsettled many investors, yet some major players have chosen to treat the downturn as a buying opportunity. Among them is El Salvador, a country that has long positioned Bitcoin as a core strategic reserve asset. During the recent sell-off, as BTC slipped below the $90,000 mark, the nation moved swiftly and executed the largest single-day Bitcoin acquisition in its history.

Fear Dominates as Bitcoin Breaks Below $90,000

Bitcoin’s retreat to levels not seen in months triggered a significant shift in market sentiment. The Crypto Fear and Greed Index reflected this dynamic clearly, plunging to a reading of 11 and entering the “extreme fear” zone. While this atmosphere fueled further anxieties among retail investors, it simultaneously opened a door for those willing to take advantage of discounted prices.

Large holders, often referred to as whales, began accumulating Bitcoin aggressively throughout the downturn—an indication that some market participants viewed the correction as a favorable entry point rather than a threat.

El Salvador Executes Its Largest Daily BTC Acquisition

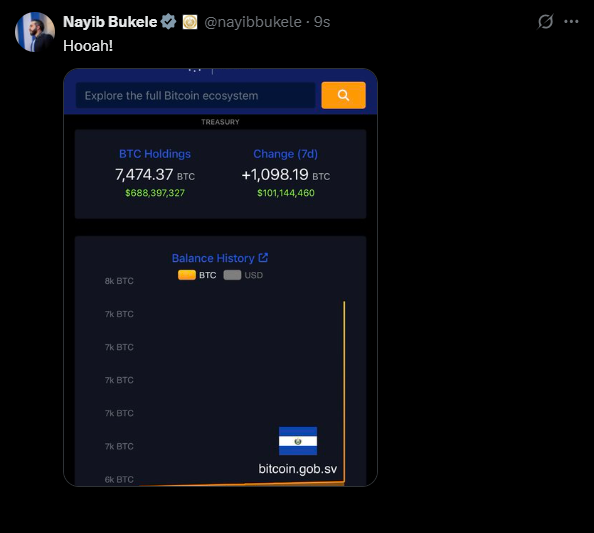

El Salvador, known for its pro-Bitcoin stance, has been steadily expanding its reserves through a long-running strategy of daily BTC purchases. Since November 2022, the country has been buying 1 BTC per day as part of its accumulation plan. With the latest market slide, this strategy intensified significantly. On Monday evening, the government purchased 1,090 BTC in a single action, marking the country’s biggest one-day Bitcoin acquisition to date.

The purchase—valued at roughly $100 million—pushed El Salvador’s total holdings to 7,474 BTC. Based on current prices, this represents approximately $676 million in Bitcoin reserves. The move reaffirmed the government’s commitment to its Bitcoin strategy despite ongoing volatility in global markets.

A Long-Term Strategic Move

Economists interpret this substantial purchase as part of El Salvador’s long-term financial strategy rather than a reactive decision. Although the drop in price created short-term uncertainty, President Nayib Bukele’s administration continues to emphasize Bitcoin as a crucial component of the nation’s reserve structure.

This record-setting acquisition underscores El Salvador’s conviction in Bitcoin’s future and highlights how periods of widespread market fear can create strategic opportunities for nations and institutional investors prepared to act decisively.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.