Bitcoin November gains have long been seen as a reliable historical trend, yet this year’s performance has raised serious questions. The cryptocurrency slipped sharply over the past week and briefly dipped below the 90,000-dollar mark, weakening confidence in the idea that November is traditionally Bitcoin’s strongest month. Although the price recovered slightly, overall sentiment remains cautious as volatility continues to increase.

Why Past November Gains May Not Reflect Today’s Market

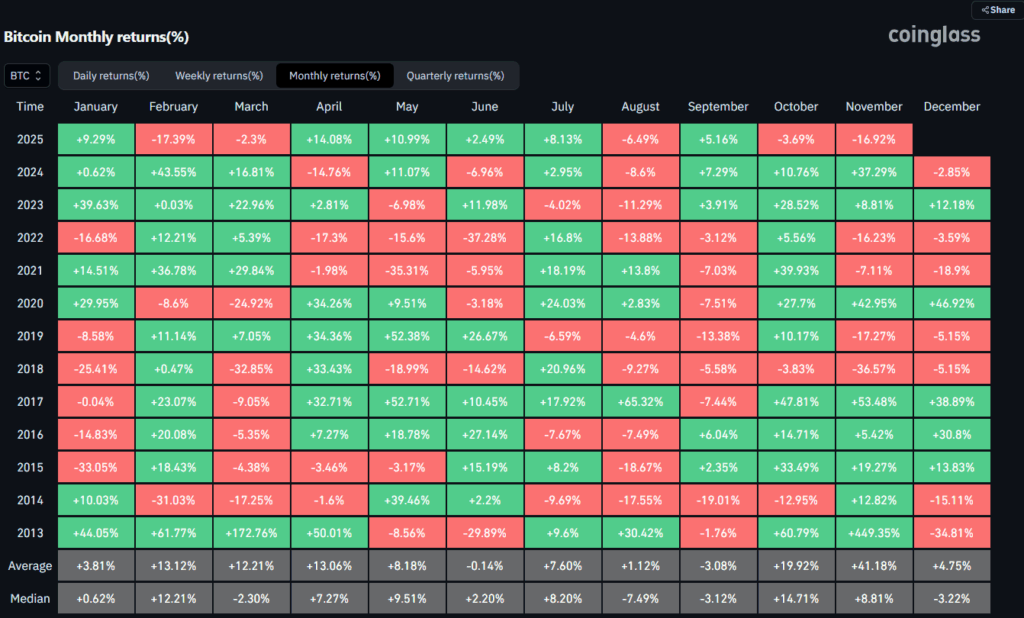

For years, Bitcoin’s November averages appeared unusually strong due to several extreme outlier months that pushed the historical data higher. Analysts now argue that these inflated averages no longer provide an accurate benchmark. This season’s market conditions are shaped by delayed macroeconomic data, shifting inflation expectations and renewed uncertainty around rate cuts. As a result, comparing previous cycles with the current backdrop offers little practical guidance.

Confidence in a near-term monetary policy shift has also weakened, which limits the impact of traditional seasonal patterns. With expectations for a December rate cut falling, risk appetite across crypto markets has cooled. This environment makes it harder for Bitcoin to repeat the aggressive November rallies seen in earlier years.

Analysts See Early Signs of a Potential Stabilization

Despite the broader pullback, several analysts believe BTC may be approaching a short-term floor. Selling pressure appears to be easing and market behavior suggests that a local bottom could form if weaker hands continue to exit. Some analysts also note that the seasonal momentum typically associated with November could shift into December instead.

For Bitcoin to reclaim a stronger bullish tone, experts highlight the 97,000 to 100,000-dollar band as the first meaningful resistance zone. Sentiment is expected to stay defensive until this range is retested. Even so, analysts maintain that recoveries in crypto markets can form quickly once broader macro conditions stabilize.

Key Points

• Historical November averages are inflated by extreme outlier years

• Macro uncertainty lowers the reliability of seasonal Bitcoin trends

• Selling pressure is easing and a potential bottom may be near

• The 97k–100k region remains the next major resistance level

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.