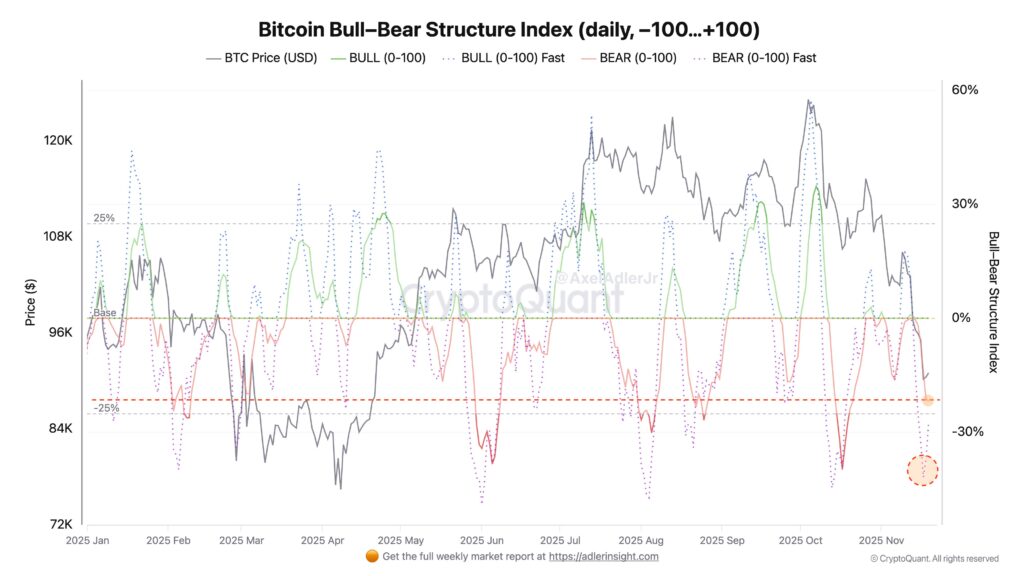

The crypto market is experiencing a volatile trend as Japan’s long-term government bond yields rise and key macroeconomic data approaches. Bitcoin, Ethereum, XRP, and other altcoins have given back some of their gains, while investors are focusing on Nvidia earnings, FOMC minutes, and the US Nonfarm Payroll (NFP) report. The Bull-Bear Structure Index indicates that short-term bearish pressure remains dominant.

Japan Bond Yields Reach Record Highs, Yen Carry Trade Concerns Rise

Japan’s long-term government bonds have surged to their highest levels in history amid economic uncertainty and potential interest rate hikes. The 40-year Japanese government bond yield reached 3.697%, marking an all-time high. This development signals tightening global liquidity and raises concerns about the unwinding of Japanese Yen carry trade positions.

Jeff Park, CIO of Bitwise Invest, stated, “Japan’s 30-year bond yield has never been this high in history. The global carry trade engine is now on critical support.” Bank of Japan Governor Kazuo Ueda also indicated that interest rate hikes are on the agenda to control inflation in line with the 2% target.

Analysts note that global Yen carry trade exposure is around $20 trillion, and further increases in bond yields could impact Bitcoin and other crypto assets. Historically, unwindings of carry trades have triggered sharp short-term price movements in crypto markets.

Bitcoin and Altcoins Fluctuate Ahead of Nvidia Earnings and FOMC

Following a rise in US jobless claims, Bitcoin and altcoins experienced a brief recovery. The weakening labor market has increased expectations of a Fed rate cut in December. However, Bitcoin prices fell below $90,000 after rebounding above $93,000, signaling heightened uncertainty ahead of Nvidia’s earnings report and the FOMC minutes release.

Nvidia is set to report its Q3 earnings after market close on Wednesday. Investors will assess the sustainability of the company’s AI-driven investments. NDVA shares closed at $181.36 last week, down 7.26%.

Ahead of the FOMC minutes, markets remain cautious about a potential December rate cut. CME FedWatch data shows the odds of a 25 basis point cut below 49%, with Fed officials divided in their outlook.

Meanwhile, US President Donald Trump’s plans to replace Fed Chair Jerome Powell by year-end, despite Powell’s hawkish stance, may increase short-term volatility in global markets.

Key Jobs Data and Altcoin Analysis

This week, the most critical data will be the US Nonfarm Payroll and unemployment rate, marking the first jobs report following the government shutdown. The White House confirmed that October CPI and employment data will not be released.

ETH is trading above $3,000 following a major decline, with 24-hour trading volume down 30%. XRP is holding near $2.15. However, whale distributions during this early bear market could trigger further price drops. The Bull-Bear Structure Index shows that negative taker flows, persistent derivatives pressure, and ongoing ETF outflows continue to favor bearish momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.