Ethereum’s price recently fell to $2,997, marking a four-month low in the crypto market. This dip created new buying opportunities for major investors. BitMine Immersion Technologies continued its buy-the-dip strategy, further strengthening its Ethereum reserves.

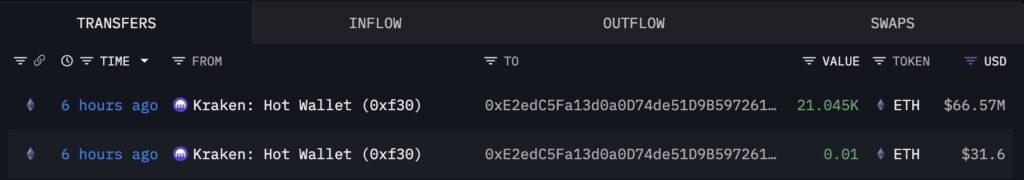

According to blockchain analytics platform Lookonchain, BitMine Immersion Technologies transferred 21,054 ETH to a new wallet via Kraken. The transaction occurred on November 18 at 19:22:59 UTC and was valued at approximately $66.57 million.

BitMine has not yet confirmed this new transfer, though the company’s previous announcement of a 54,000 ETH purchase last week indicates that it continues to strategically increase its Ethereum holdings.

BitMine’s Ethereum Strategy and Market Analysis

BitMine now holds a total of 3.6 million ETH, representing close to 3% of Ethereum’s circulating supply. The company also maintains positions in Bitcoin and holds ORBS (Eightco) shares in its portfolio.

Its cash reserves have risen from $398 million last week to $607 million. This increase demonstrates BitMine’s liquidity strength despite tightening market conditions.

Crypto analyst and BitMine Chairman Tom Lee links the current market weakness to liquidity stress. Lee noted that a major market maker pulled back following the October 10 crash, creating short-term market strain.

Despite ongoing volatility, Lee emphasized that the crypto market has not yet reached its cycle peak. In his November note to investors, he highlighted that asset tokenization on Ethereum could increase blockchain demand over the long term.

Ethereum Opportunities and Long-Term Trends

The recent ETH price drop is opening strategic buying opportunities for major investors. Institutional purchases and increased liquidity support the market’s medium-term recovery potential. Asset tokenization is also digitizing traditional assets such as stocks, bonds, and real estate on Ethereum. This trend encourages investors to engage with the Ethereum ecosystem and strengthens long-term market demand.

BitMine’s strategic purchases and strong cash reserves provide a current example of institutional behavior capitalizing on ETH price dips. These moves demonstrate how major investors leverage market downturns to expand their holdings.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.