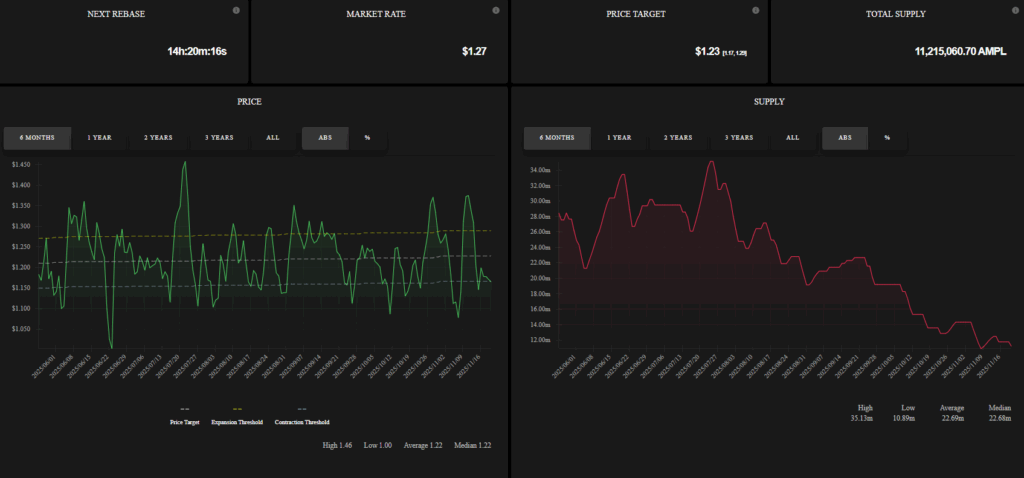

Ampleforth (AMPL) is an algorithmically adjusted digital asset running on Ethereum, designed to serve as a new form of base money for modern decentralized economies. Unlike traditional cryptocurrencies whose supply remains fixed, AMPL automatically expands or contracts its circulating supply once per day through a mechanism called rebasing.

The key innovation is that AMPL holders always own a percentage of the total supply, not a fixed number of tokens. When the price diverges from the target range near $1, the protocol adjusts supply proportionally across all wallets.

-

Price > $1.06 → Supply Expands (Positive Rebase)

-

Price < $0.96 → Supply Contracts (Negative Rebase)

This supply elasticity aims to help AMPL stabilize around its long-term price target of approximately $1, positioning it as a potential decentralized, non-dilutive unit of account.

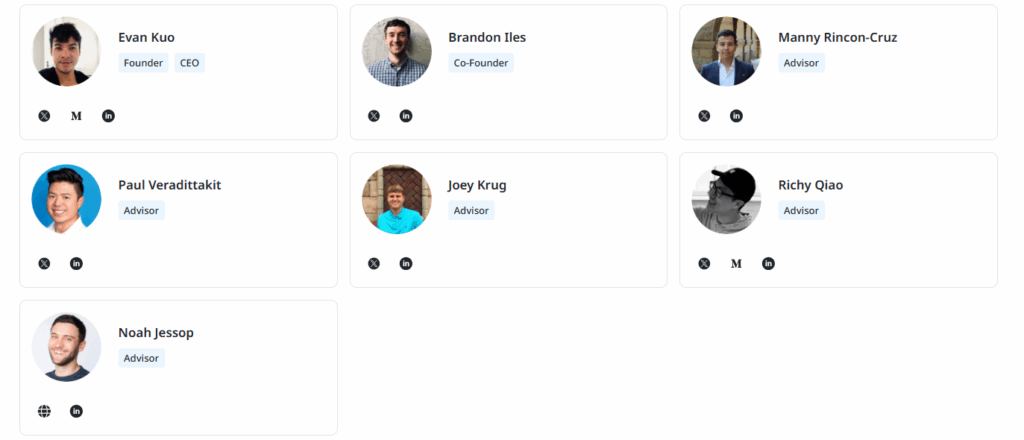

Founders and Team

Evan Kuo (Founder & CEO)

-

UC Berkeley graduate in mechatronics and robotics engineering

-

Background in mathematics, design, and creative systems

-

Former CEO of Pythagoras Pizza

-

Currently CEO of Ampleforth Foundation

Brandon Iles (Co-Founder)

-

Former senior software engineer at Google and Uber

-

Architect behind Ampleforth’s technical and economic design

Team

-

Primarily composed of engineers and researchers

-

Mostly based in the San Francisco Bay Area

-

Includes 10+ core developers, economists, and protocol researchers

Investors and Key Partnerships

Notable Investors

Ampleforth is backed by prominent early crypto venture firms and industry leaders, including:

-

Pantera Capital

-

True Ventures

-

Huobi Capital

-

FBG Capital

-

Brian Armstrong (Coinbase CEO – early individual supporter)

Integrations & Ecosystem Collaborations

-

Chainlink: Oracle integration for price feeds

-

AAVE, Synthetix, Uniswap: AMPL collateral pools and liquidity markets

-

Expansions into Avalanche, Polygon, Tron, and other multi-chain ecosystems

-

FORTH governance token enabling DAO-based upgrades and protocol decision-making

AMPL is widely used in DeFi as collateral, liquidity pool asset, and decentralized reserve component.

Project Vision & Mission

Ampleforth aims to create a fully decentralized, supply-elastic base money ideal for Web3 economies. Traditional fiat currencies rely on discretionary supply changes by central banks, while most cryptocurrencies maintain fixed supplies. AMPL introduces a third model—automated, rule-based monetary supply adjustments.

The project’s long-term vision includes:

-

A censorship-resistant, tamper-proof unit of account

-

A foundational monetary asset for decentralized banking systems

-

A building block for stable economies without centralized control

-

A reserve asset usable across DeFi protocols and algorithmic monetary experiments

AMPL positions itself as “the first adaptive digital currency”, engineered to maintain purchasing power while avoiding inflationary dilution.

How the Project Works (Rebase Mechanism)

What Is Rebase?

Rebase is the process in which the protocol adjusts the token supply—either increasing or decreasing it—to maintain the target price.

It occurs once per day and is applied proportionally to all wallets.

After a rebase, the total supply changes, but the percentage share of each holder remains the same.

Example:

- A user holds 1,000 AMPL and the total supply is 100,000 → Share = 1%

- After a rebase, if total supply becomes 200,000 → The user’s wallet balance becomes 2,000 AMPL

- Their share remains 1%.

Why Does It Work This Way?

-

Enables elastic supply

-

Creates a value model independent of demand shocks

-

Automatically stabilizes the price in the long term

-

Algorithmic market balancing makes it resistant to manipulation

Governance

The governance token of the Ampleforth ecosystem is FORTH.

FORTH holders can:

-

Vote on protocol parameter changes

-

Approve new features

-

Contribute to technical adjustments of the rebase mechanism

-

Participate in decisions about multichain expansion

AMPL itself does not provide governance rights; governance is handled entirely through FORTH.

Token Information

AMPL

-

Total Supply: 11.21M AMPL

-

Circulating Supply: 28.27M AMPL

-

Max Supply: Unlimited / Not specified

-

Due to the rebase mechanism, AMPL does not have a fixed maximum supply.

-

FORTH

-

Type: Governance token

-

Maximum Supply: 15 million

-

Standard: ERC-20

Token Distribution

AMPL Token Distribution

AMPL does not follow a traditional fixed distribution model because its supply continuously adjusts through the rebase mechanism.

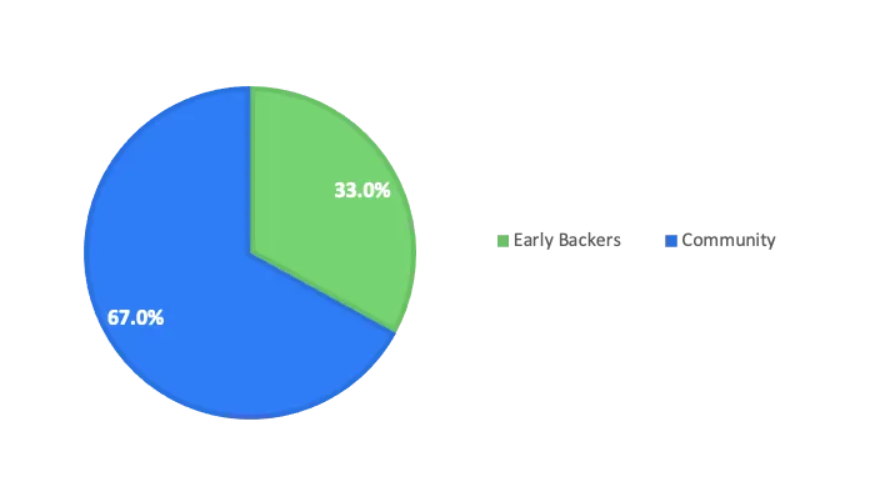

FORTH Token Distribution

-

67% — Community & Airdrop

-

33% — Team + Investors + Foundation

Roadmap

Completed

-

AMPL launch on Ethereum

-

Release of FORTH governance token

-

Multichain expansion (Avalanche, Polygon, Harmony, BSC, etc.)

-

DeFi integrations (AAVE, Uniswap, Sushiswap)

-

Oracle integration via Chainlink

Planned / Ongoing

-

Unified multichain rebase support

-

Positioning AMPL as a global reserve asset

-

Additional Layer-2 integrations

-

Expanded usage of AMPL as collateral in institutional and DeFi contexts

-

Strengthening the ecosystem’s DAO structure

Token Use Cases

The Ampleforth ecosystem includes two main tokens: AMPL and FORTH.

AMPL Use Cases

-

Elastic supply–based price stabilization

-

Collateral in DeFi protocols

-

Liquidity pool AMM pairs

-

A non-correlated asset for portfolio risk management

-

Reserve asset

-

Base asset for economic stability experiments

FORTH Use Cases

-

On-chain governance participation

-

Voting on protocol upgrades

-

Adjusting rebase parameters and system-level mechanics

-

Approving new integrations and ecosystem expansions

-

Shaping the long-term monetary policy of Ampleforth

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.