Bitcoin is heading toward its worst monthly performance since 2022, with prominent investors signaling that the current downtrend may only be getting started. In November, Bitcoin lost nearly 23% of its value, dropping over 6% in a single day to $81,600. Since its all-time high in early October, the cryptocurrency has fallen more than 30%, highlighting ongoing volatility despite increasing institutional adoption and a pro-crypto stance from the White House.

Analysts Expect Deeper Declines Ahead

Chris Burniske, partner at Placeholder, emphasized that the selling phase is only beginning, noting that steep declines often mirror the pace of rapid upward moves. Similarly, Alliance DAO co-founder QwQiao suggested that prices may need to drop an additional 50% before a solid foundation can form in the market.

Institutional caution is amplifying market fragility. Major Bitcoin ETFs, such as IBIT, reportedly have a cost basis around $80,500, suggesting that significant outflows from funds could continue. Some experts caution that these levels may not yet represent the true bottom of the bear market, indicating further downside potential.

Institutional Withdrawals and Forced Selling Intensify

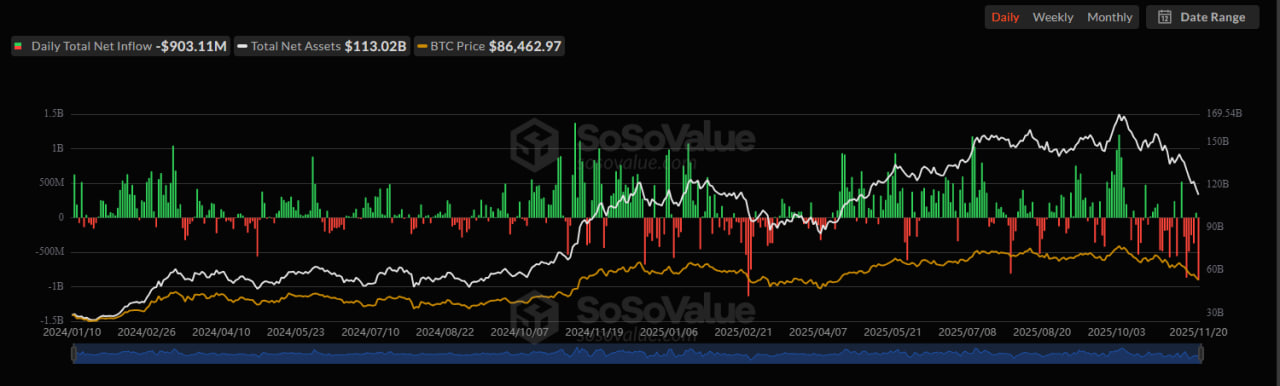

US-listed Bitcoin ETFs experienced a combined $903 million in outflows in a single day, marking the second-largest net redemption since their January 2024 debut. Open interest in perpetual futures has also declined by 35% from the October peak of $94 billion. Weak sentiment across the market is discouraging investors from buying the dip.

October 10 saw a massive liquidation wave that erased $19 billion in leveraged positions, removing roughly $1.5 trillion from the total crypto market capitalization. Ethereum also dropped below $2,700, with liquidations surpassing $1 billion across multiple timeframes, and a single-hour spike approaching $1 billion.

Market Structure Shows Cracks and Historical Patterns Resurface

Analysts point out that the market disruption in October is still evident, reflecting structural weaknesses. Observers note parallels to the cascading corporate failures from the TerraUSD collapse through the FTX collapse in 2022.

Benjamin Cowen, CEO of Into The Crypto, reminded investors that historically, Bitcoin tends to peak in Q4 of a post-halving year and reaches a bottom roughly one year later. He emphasized the importance of trading based on the market as it is, rather than on expectations.

Long-term models suggest that Bitcoin’s volatility is gradually narrowing, though its exact placement within projected ranges will depend on macroeconomic conditions and investor psychology. With no clear market floor in sight, the crypto sector faces sustained pressure as the bear market unfolds.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’ t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.