The crypto market has experienced a sharp decline in recent days, leaving investors uneasy. The rapid drop seen in Bitcoin, Ethereum, and many major altcoins has fueled concerns that a renewed bear season may be forming. The increase in ETF outflows, weak liquidity, and negative macroeconomic signals created a chain reaction that caused prices to collapse in a short period of time.

What Triggered the Crypto Market Crash?

The main factor behind the latest downturn was the intense selling pressure directed at the crypto market this week. Liquidity providers reduced market depth, which led to the rapid liquidation of leveraged positions and caused a sharp pullback in major cryptocurrencies, especially Bitcoin.

A major catalyst for this decline was the significant outflow from Bitcoin ETFs. Institutional investors closing positions weakened spot demand and accelerated the downward price movement. These ETF outflows represent one of the largest drawdowns Bitcoin has seen throughout 2024. Market makers, who are the primary liquidity providers, also had to reduce their risk exposure under these conditions. Their withdrawal caused prices to fall even faster. This shrinking liquidity and the cascading effect of forced selling eventually caused the market to collapse under its own weight.

Fed and Macro Data Deepened the Crash

The decline was not caused solely by crypto-specific factors. Macroeconomic pressures also played a major role. Key developments include:

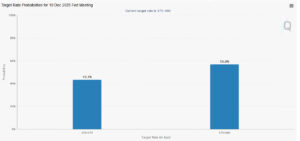

- No clear signal of interest rate cuts from the Fed: The market expected a definitive easing message, but it didn’t arrive.

- Weak economic data: Conflicting inflation and labor figures increased uncertainty.

- Global growth concerns: Weak data from the U.S. and Europe pressured global capital flows.

- Liquidity tightening: Stress in the bond market pushed institutional investors to reduce crypto exposure.

Combined, these macro pressures triggered the fragile structure that had been forming in the crypto market, accelerating the move downward.

Macro Pressures Further Exacerbated the Decline

Austin Arnold, co-founder of Altcoin Daily, noted that the crash was not just a technical breakdown but also the result of significant macroeconomic stress. Arnold argues that the overvaluation in the AI sector drew investor capital away from crypto and weakened liquidity across the digital asset space.

Additionally:

- Fears of a U.S. government shutdown also tightened capital flows.

- Widespread economic uncertainty pushed investors toward safer assets.

- Demand for risk assets sharply declined.

Despite all this, Arnold says Bitcoin’s fundamentals remain strong and describes the current drop as a “generational buying opportunity.”

Are We Entering a Bear Market?

Analysts note that Bitcoin trading between $70,000 and $100,000 resembles classic bear market behavior.

Typical signs of a bear market include:

- Prices stagnating or remaining low for extended periods

- Weak investor confidence

- Tightening liquidity

- A prolonged atmosphere of uncertainty

The most important technical level is the 200-week moving average, currently around $55K–$60K. As long as Bitcoin remains above this region, analysts believe the long-term structural bull trend is still intact.

When Will the Crypto Market Recover?

Experts identify several catalysts that could trigger the next major rally:

1. Upcoming Crypto Regulations

The U.S. Market Structure Bill could provide much-needed clarity and stability, encouraging institutional capital to return.

2. Stablecoin Adoption by Major Banks

JPMorgan, Citi, Mastercard, and Visa are all integrating stablecoins.

This boosts:

- On-chain liquidity

- Transaction efficiency

- Institutional participation

3. Government and Central Bank Bitcoin Purchases

Countries like Luxembourg and the Czech Republic have added Bitcoin to their reserves.

This indicates rising long-term confidence at the state level.

Combined, these factors could set the stage for the next major bull cycle.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.