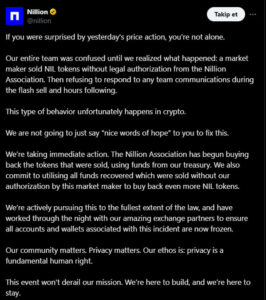

Binance-listed altcoins saw sharp volatility as NIL suffered a sudden and steep decline within the last 24 hours, drawing significant attention from investors. NIL the native token of the private computation network Nillion plunged after extreme price volatility, triggering an official statement from the project team. According to the announcement, the crash was caused by large, unauthorized sell-offs carried out by an unapproved market maker. The team confirmed that legal action has already been initiated.

How Did the NIL Token Crash Start?

NIL dropped more than 36% during the day, falling to $0.118. The sharp decline began with sudden liquidity spikes and large sell orders appearing on the order books. The Nillion team explained:

- An unauthorized market maker sold a large amount of NIL.

- The individual/entity did not respond to any communication from the team during or after the sale.

- This led to an uncontrolled collapse in price.

This highlights how vulnerable tokens can be to large, unexpected sell orders—especially during low-liquidity market conditions.

Nillion: “We Intervened Immediately and Started a Buyback”

The project announced that, upon detecting the incident, it used treasury funds to initiate an emergency buyback to:

- Stabilize the price

- Reduce the damage caused by the unauthorized sale

Nillion further stated that it is working directly with exchanges, has frozen accounts linked to the sale, and has launched legal proceedings.

Their statement reads:

“Unauthorized activity does occur in the crypto sector, but we will not remain passive. All funds recovered from the unauthorized token sales will be used for further buybacks. We have initiated all necessary legal steps to protect our ecosystem.”

This shows that the team views the incident not only as a technical breach, but also as a major violation of trust and operational discipline.

Current State of NIL

Following the sharp decline:

- NIL is down 3% in 24 hours

- Trading around $0.118

- Down 87% from its all-time high of $0.95

The large gap from its ATH indicates that NIL is facing a challenging period.

A Critical Moment for NIL

The NIL crash was driven by:

- Unauthorized token sales

- Weak market liquidity

- Cascade sell-offs

Nillion’s rapid response — launching buybacks, freezing accounts, and initiating legal action is aimed at restoring investor confidence. In the short term, volatility is likely to remain high, but the market will be watching closely to see whether the team’s actions stabilize the NIL ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.