As tensions rise in global markets, recent remarks by New York Fed President John Williams signal a new period of volatility for all risk assets, including the crypto markets. Williams stated that with cooling inflation and rising risks in the labor market, there is now “room for a short-term rate cut.” This message has reshaped expectations for the upcoming December FOMC meeting.

How Did Williams’ Remarks Impact the Markets?

Speaking in Santiago, John Williams said monetary policy remains “modestly restrictive” and indicated that loosening could be considered if needed. Signs of weakening in the labor market and easing inflation pressures strengthened expectations that the Fed may act more flexibly this time.

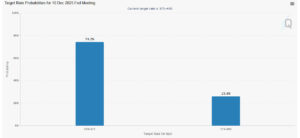

Williams’ phrase, “There is still room for further adjustments in the near term,” briefly created optimism in the markets, but the differing tone of other Fed officials has increased uncertainty. Chair Jerome Powell remains more cautious and emphasizes that nothing is certain for December. This divergence highlights the growing differences within the Fed and the increasing complexity of the decision-making process. According to CME FedWatch data, the probability of a December rate cut currently stands at 64.4%.

Morgan Stanley: “We Don’t Expect a Cut in December”

Managing $1.3 trillion, Morgan Stanley has dramatically revised its outlook. Citing the rebound in U.S. labor data, the bank announced that it does not expect a rate cut in December. The 119,000 increase in September payrolls indicates improvement in both goods and services sectors. Morgan Stanley notes that the rise in unemployment is due to increased labor-force participation rather than layoffs. Therefore, the bank does not expect the Fed to make a rushed move at the December meeting.

Based on new projections, Morgan Stanley anticipates rate cuts in January, April, and June 2026. This represents a much later easing scenario compared to forecasts made in the fall. Following Williams’ short-term rate-cut signal, Bitcoin saw a quick recovery. As risk appetite revived, Bitcoin mounted a strong rebound despite selling pressure.After the remarks, Bitcoin quickly climbed to $84,000. Despite macro uncertainty, this reaction showed that there is still a strong demand base in the market.

What Comes Next?

All eyes are now on the next statement from Fed Chair Jerome Powell. His upcoming messages will:

- Shape the December decision

- Define expectations for the final FOMC meeting of 2025

- Determine the direction of volatility in Bitcoin and altcoins

Additionally, U.S. inflation data, labor market reports, and further remarks from Fed officials will play a decisive role in the short-term direction of the markets.

December: A High-Risk Macro Turning Point for Crypto

Although John Williams’ remarks suggest the Fed may bring rate cuts back on the table in the short term, differing views have increased uncertainty. Morgan Stanley withdrawing its cut expectations and Powell’s cautious stance make the December FOMC meeting extremely critical. For the crypto markets, this meeting could become one of the biggest volatility catalysts of the year. Investors continue to follow Fed communications closely to determine the direction of liquidity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.