During a period of heightened volatility in the crypto market, the latest wave of major inflows into spot ETFs indicates that institutional investors have re-entered a strong accumulation phase. The hundreds of millions of dollars flowing into Bitcoin, Ethereum, Solana, and XRP ETFs reveal significant demand in market bottoms and demonstrate that investor confidence remains strong.

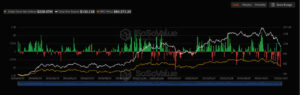

Massive Inflows into Bitcoin ETFs

Despite experiencing sharp price swings recently, Bitcoin has attracted notable institutional interest on the ETF side. A single-day inflow of $238.47 million into Bitcoin ETFs shows that investors prefer accumulating during market pullbacks.

Such a large influx not only highlights the strong support these ETFs receive from long-term strategic investors but also signals that institutions view Bitcoin as a secure, long-term asset. The fact that these inflows occurred during volatile periods reinforces the idea that market lows are being viewed as buying opportunities.

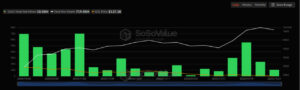

Strong Demand for Ethereum ETFs

Although Ethereum has seen short-term price declines, long-term expectations remain robust. The $55.71 million net inflow into Ethereum ETFs shows that institutional investors still regard Ethereum as a high-potential smart contract platform. The growth of the Layer-2 ecosystem, staking yields, and expanding enterprise use cases stand out as the primary drivers behind increased capital flowing into Ethereum.

Solana ETFs Signal Renewed Momentum

In recent weeks, Solana has experienced rising on-chain activity, a revival in memecoin and NFT markets, and a surge driven by the Tensor ecosystem—all of which have reignited institutional demand.

The $10.58 million inflow into Solana ETFs demonstrates the market’s strong belief in Solana’s long-term growth potential. Despite price volatility, SOL remains firmly on institutional radar and continues to be viewed as a “high-growth asset.”

Millions Flow Into XRP ETFs

As regulatory uncertainty fades and institutional interest in XRP rises again, XRP ETFs recorded $11.89 million in inflows. XRP’s potential in cross-border payments and its integrations with banking entities have contributed to its renewed presence in institutional portfolios. These inflows can be seen as one of the early signs of recovery for XRP investors.

Institutional Capital Is Returning to Crypto

The ETF inflows seen over the past 24 hours clearly show that institutional appetite for crypto is returning. The total inflows surpassing hundreds of millions of dollars indicate:

- Institutions are buying aggressively during downturns

- Spot ETFs have become one of the safest entry points into crypto

- Long-term accumulation continues in Bitcoin and major altcoins

The strong inflows into Bitcoin ETFs suggest that recent market declines are not driven by panic selling but rather by institutional accumulation. Meanwhile, Ethereum, Solana, and XRP ETFs show that the broader ecosystem continues to attract institutional attention.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.