The sharp downturn in the crypto market this week has heightened investor anxiety. Bitcoin has retreated to the critical support area around $80,000, while the total crypto market capitalization has fallen to approximately $2.90 trillion. Major altcoins such as Ethereum, Ripple, BNB, and Cardano have all declined more than 12% over the past seven days. Despite the bearish sentiment, several historical indicators that often appear near market bottoms are beginning to surface again. These developments suggest that the ongoing correction may be nearing its final phase.

Fear & Greed Index Hits Lows: A Classic Reversal Signal

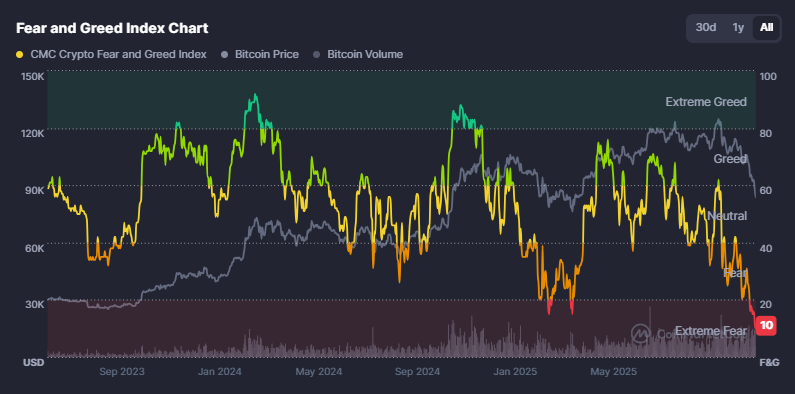

One of the most notable signs is the sharp drop in the Fear & Greed Index, which recently plunged to a year-to-date low of 10. This decline coincides with fading momentum across the crypto landscape, heightened market volatility, and increasingly negative sentiment on social platforms.

Historically, many major crypto rallies have started from periods dominated by extreme fear. Earlier this year, for instance, Bitcoin reached a new all-time high just weeks after the index entered deeply fearful territory. Conversely, bear markets often begin when the index signals excessive greed. With November nearing its close, this shift in sentiment raises the possibility that December could deliver a more favorable environment for digital assets.

Market Cap RSI Signals Oversold Conditions

Another important indicator pointing toward a potential rebound comes from the broader market’s Relative Strength Index. Data shows that the RSI for the total crypto market cap has slid to 24, a level that traditionally reflects oversold conditions. Analysts note that the negative divergence pattern seen since July appears to be weakening, hinting that selling pressure may be close to exhaustion.

Such a setup increases the likelihood of a recovery in Bitcoin and altcoins in the coming weeks. Any rebound, however, is unlikely to be completely linear, and some analysts suggest a possible double-bottom formation before a sustained rally begins.

Leverage Flush-Out Points Toward a Healthier Market

A further factor supporting a potential market turnaround is the ongoing reduction in leveraged positions. According to CoinGlass data, futures open interest has dropped from over $320 billion earlier in the year to around $123 billion today. Since October 10, total liquidations have surpassed $40 billion.

This aggressive unwinding of leverage indicates that excessive risk-taking is being cleared from the system, a process that often leads to a more stable market structure.

Additionally, improving macro conditions—such as rising expectations of Federal Reserve rate cuts, expanding global money supply, and continued progress on altcoin ETF approvals—could provide further fuel for the next major upswing in the crypto market.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.