Grayscale has taken another major step in the U.S. crypto ETF market, securing listing approval for its spot ETF products for Dogecoin and XRP. NYSE Arca, a subsidiary of the New York Stock Exchange, has approved both ETFs’ registration and listing certificates.

With this approval, the Grayscale XRP Trust ETF (GXRP) and Grayscale Dogecoin Trust ETF (GDOG) will officially begin trading on Monday. This development shows that the large-scale ETF wave, which began with the conversion of spot Bitcoin and Ethereum ETFs, is continuing to gain strength on the altcoin side as well.

NYSE Arca Approves the Listings

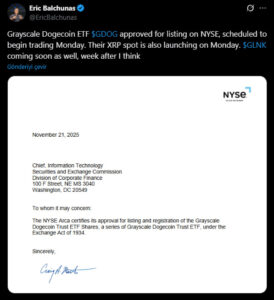

According to certification letters dated November 21, NYSE Arca confirmed that both the XRP and Dogecoin ETFs meet all listing requirements. With this approval, both funds will now be accessible to U.S. investors.

Bloomberg ETF analyst Eric Balchunas confirmed on social media that the two funds will begin trading on Monday. The approval highlights the accelerating integration of crypto assets into traditional financial markets.

XRP and DOGE Are Now Official ETF Products

Grayscale, one of the largest crypto asset managers overseeing more than $35 billion in client assets, has drawn attention in recent years with its aggressive ETF expansion. After converting its Bitcoin and Ethereum trusts into ETFs, the company has now shifted focus to altcoins. The XRP and Dogecoin ETFs will join Grayscale’s existing product lineup, which includes:

- Bitcoin ETF

- Ethereum ETF

- Solana ETF

- Dogecoin Trust (in closed-end format)

- Litecoin, HBAR, and other altcoin products

This expansion signals rising institutional interest in altcoin-focused ETF products in the United States.

XRP and Dogecoin ETFs Come With a 0.35% Management Fee

Both ETFs are offered with a management fee of just 0.35%. This rate is relatively low compared to many traditional and crypto ETF products and may provide an additional advantage in attracting institutional capital.

Grayscale’s XRP Trust was first launched last year as a closed-end product. After successful Bitcoin and Ethereum ETF conversions, the company applied to the SEC to convert the XRP Trust into an ETF as well. Following NYSE Arca’s approval, the product will now operate fully as an exchange-traded fund.

On the Dogecoin side, this product becomes the second DOGE ETF to be listed in the U.S. The first was introduced in September by REX Shares and Osprey Funds. Grayscale’s entry into this space is seen as a significant move validating Dogecoin’s growing popularity.

A New Era Begins for Altcoin ETFs

The listing of Grayscale’s Dogecoin and XRP ETFs on NYSE Arca marks a critical milestone for both the expansion of the existing ETF ecosystem and the increase in institutional interest in altcoins.

This development:

- Opens the door for institutional investment into XRP and Dogecoin

- Accelerates mainstream adoption of ETFs

- Contributes to the growth of altcoin-based investment instruments in the U.S.

The ETF trading set to begin on Monday may create new market activity and bring significant liquidity inflows—particularly for XRP and DOGE.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.